By 2030 Millenials Will Control $20 Trillion in Assets Globally, Banks, Investing Platforms Are Struggling to Catch Up

Smartlands has been betting on the millennials from the company’s humble beginnings, and it appears that the strategy is about to pay off big time. According to a report by tech market intelligence firm CB Insights, the market for investing is changing rapidly and incumbents are struggling to satisfy the needs and expectations of younger generations of investors.

By 2030, Millennials are expected to hold five times as much wealth as they do today, controlling as much as US$20 trillion of assets globally. Their parents, the baby boomers, are set to pass down another US$30 trillion by 2050 in North America alone.

However, the legacy financial institutions still appear utterly unable to appeal to the millenials with new products and services. When it comes to investing, the generational gap is wider than it’s ever been.

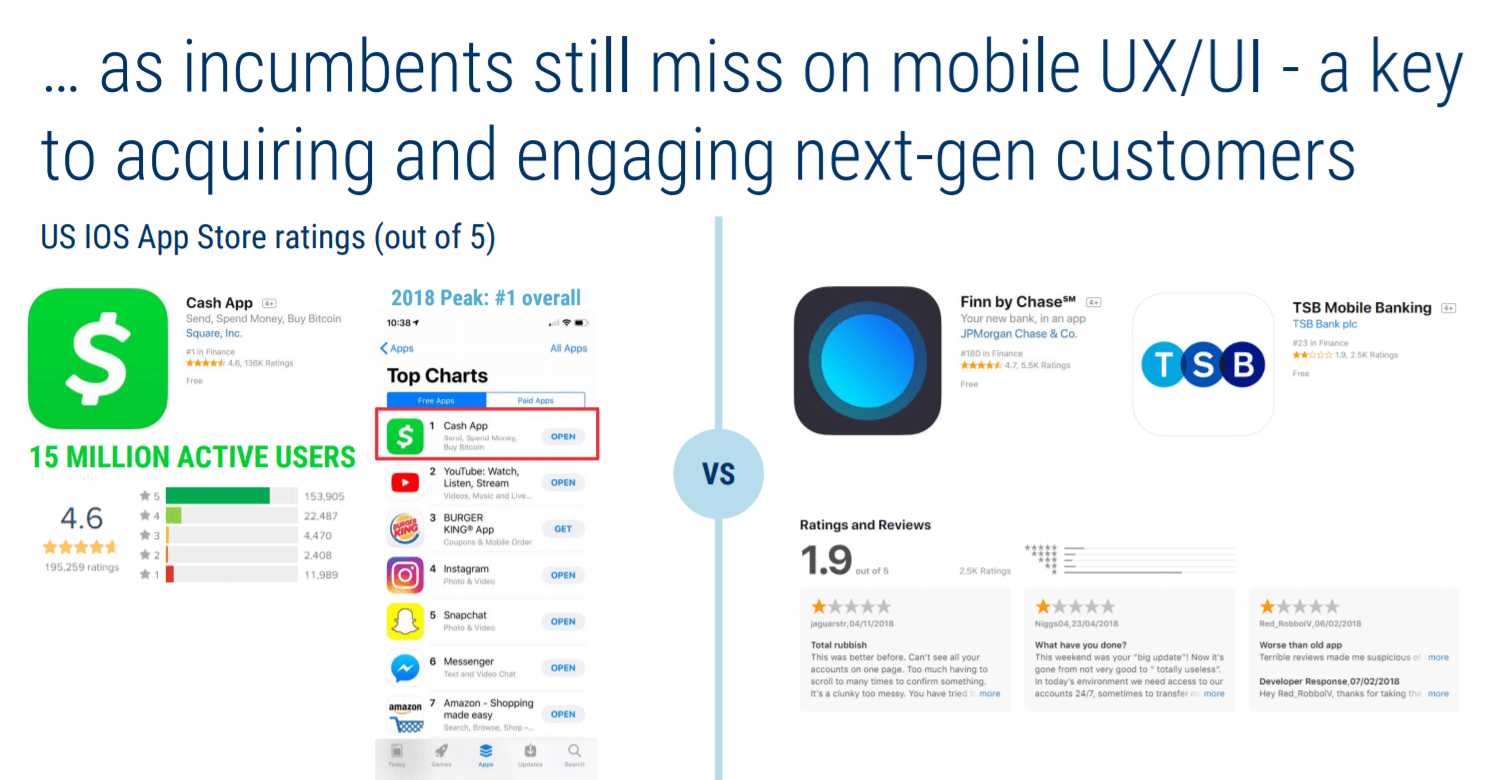

UI/UX is Key to Engaging the Millennials

One of the most striking circumstances sited in the report is that most incumbents aren’t meeting the expectations of the younger generation of investors who make a huge emphasis on user experience (UX). The success of mobile apps like Robinhood, Stash, Square, Cash App and others apparently lies in the ability to engage the end-user on a cerebral level; the Cash App has been praised for being “geniusly simple” and “perfect for any occasion” and currently ranks first in the Apple App Store and counts some 15 million active users.

Source: CBInsights

Throwing money at the problem is clearly not a remedy. For instance, the TSB Mobile Banking app, by TSB Bank, ranks poorly in the App Store with reviews that qualifies it as “clucky” and “too messy.” And JP “Moneybags” Morgan, which launched its digital bank, Finn, in 2018, scrapped the experiment in less than a year.

Don’t have Asset Classes for the Millennials? Create One!

Gen Z may not be as good at investing as the baby boomers were, but younger folks are always ready to play, and some fintechs have been experimenting with creating a new playground for the twenty-somethings.

The Rally Rd. investment app, for example, allows small investors to invest in rare collectibles and luxury cars. YieldStreet provides a platform for making alternative investments in areas like real estate, marine/shipping, legal finance and commercial loans. And StockX is a platform for buying and selling sneakers and other apparel that works similar to a stock market where buyers place bids and sellers place asks.

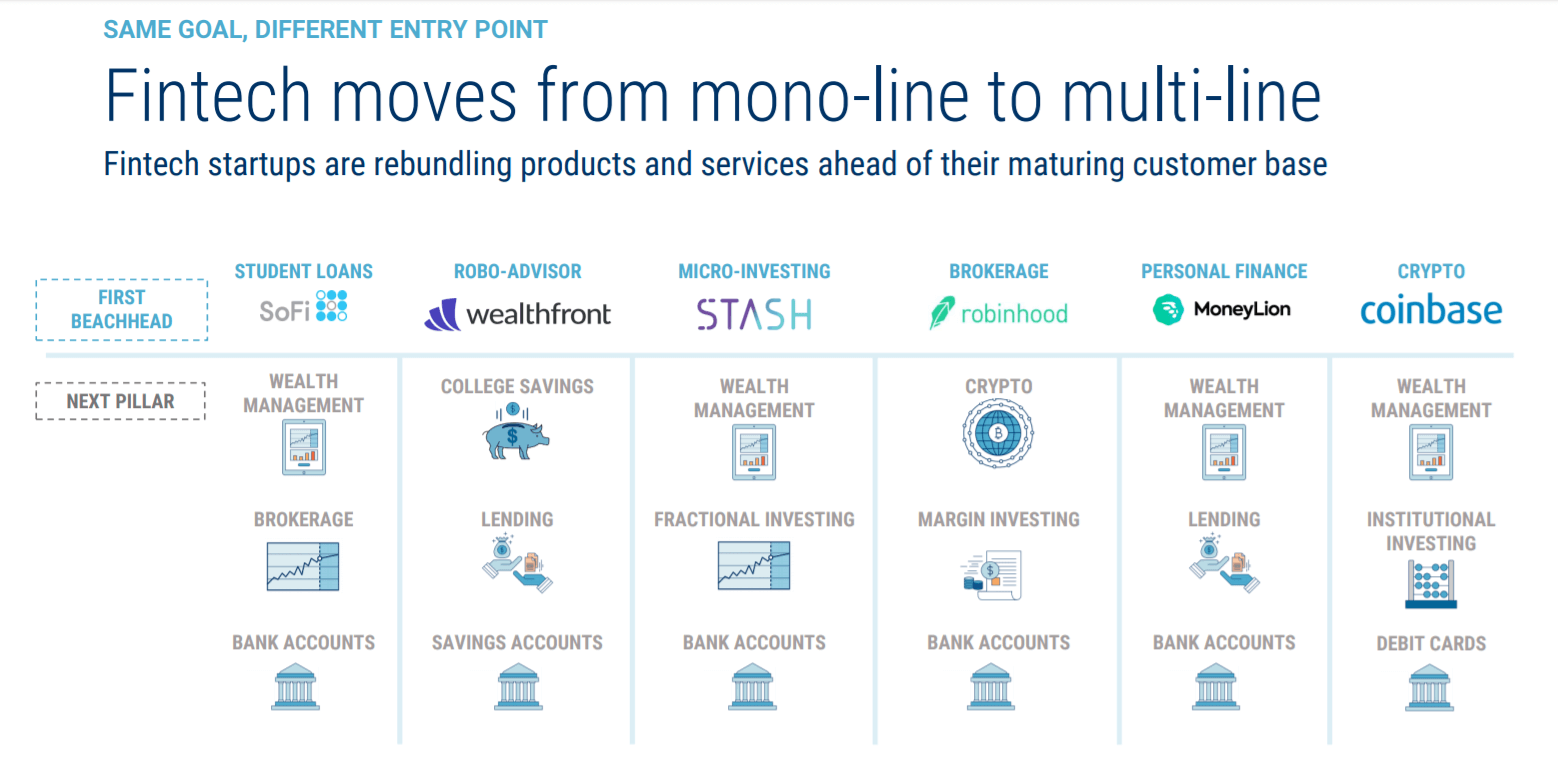

Multi-line of products and services is the way of the future

Another key wealthtech trend we observe (and uphold) is the rapid expansion of products and services from a single-shelve good to a multi-line provider.

Source: CBInsights

Social Finance (SoFi) for example started as a platform for student loan refinancing before moving toward full-scale banking. Coinbase began as a cryptocurrency exchange for retail customers and later expand into institutional investment house. Smartlands is quickly transitioning from an investment platform to a global investment and digital banking ecosystem of wealth management for both traditional investors and crypto enthusiasts.

We could go on, but the pattern is clear. Since growth is still the main goal in a capitalist society, growth opportunities are what businesses are going to be after in the observed future. Attracting new investors is a major avenue for achieving that goal.

As investors, the millennials are still “growing” in a manner of speaking, but hey are more tech savvy and are more inclined to generate enough disposable income to enter financial markets. They are all about their future – three quarters of the US millennials have been saving for retirement since their early 20s.

To really grab their attention the current system has to create certain appeal through reducing its complexity and making things, well, more fun. The generation, for which the dot-com crash is a legend, wants things to be fast, smooth, easy, and entertaining. To paraphrase Freddie Mercury, it wants it all, and it wants it now, and the legacy financial system will just have to provide the cost-effective means for this evolution lest be replaced immediately and mercilessly.