Lending Market Outlook and DeFi: Navigating Through $300 Trillion in Global Debt

The lending market is undergoing a profound transformation, driven by the emergence of Decentralized Finance (DeFi) and crowdlending amid stagnation in traditional banking. This article delves into the evolving dynamics of the lending market and the disruptive influence of alternative financing methods, particularly DeFi, on its future trajectory.

This year, global debt escalated to an unprecedented $300 trillion1. How did we arrive here? The answer lies in the vast array of debt issuers and sources of capital. With the world’s Gross Domestic Product at $21 trillion in 2024 The World Counts. Undoubtedly, debt dominates the financial landscape. Debt financing’s allure stems from its ability to preserve ownership, offer tax benefits through deductible interest payments, and provide predictable repayment schedules, fostering a disciplined financial management culture.

Market Composition:

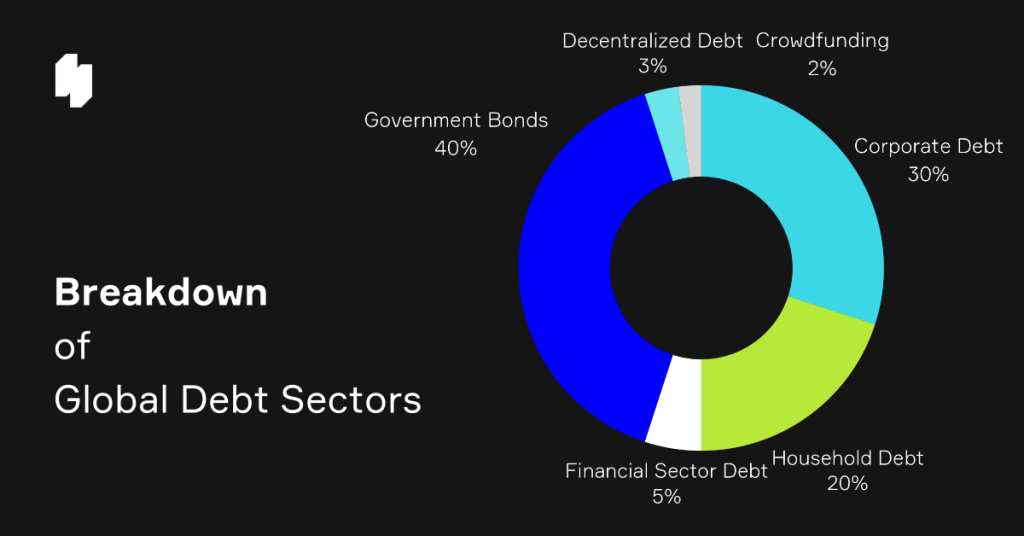

The $300 trillion encompasses various sectors: government bonds, corporate debt, household debt, private debt, crowdfunding, and decentralised debt. A significant chunk, approximately 70%, comprises government and corporate bonds. Government bonds, instrumental in funding beyond tax revenues, account for about 40% of global debt, reflecting the uptick in government spending on crisis’s response and social programs. Corporate debt, fueled by low-interest rates to spur growth, makes up another 30%, indicating corporate expansion and the rising appeal of debt financing.

Financial sector debt, including interbank lending and non-bank financial institution loans, while pivotal, often results in double-counting and is estimated at 5% of global debt. Household debt emerges as a vibrant segment for investors and tech integration, representing 20% of the market with interest rates between 7-15%. This variability is due to diverse lending products, from mortgages to personal loans.

Despite banks maintaining a substantial market share, their conservative lending models struggle against the fast-paced, technology-driven market. Here, DeFi platforms offer a solution, filling gaps with innovative financing that aligns with the modern real estate market’s needs. This leaves a 5% market opportunity that Private Debt, Crowdlending, and DeFi companies are quickly capturing. Following the 2008 crisis: private debt funds have shown remarkable growth, projected to hit $2.8 trillion by 2028 2, underscoring the gaps left by traditional banking.

The Rise of DeFi:

Today’s rapidly evolving economic landscape, marked by globalization and tech advancements, highlights banks’ hesitancy to fund new tech-driven ventures. In contrast, DeFi platforms provide a more adaptable and inclusive financing model. By facilitating direct lender-borrower transactions, DeFi platforms, offering USDT staking opportunities, promise competitive returns and crucial funding for underserved sectors.

The discrepancy between traditional bank lending rates and DeFi platforms’ returns underscores the inefficiencies in traditional banking and the potential for DeFi to offer lucrative opportunities while nurturing innovative projects.

DeFi not only replaces traditional banking but also complements it by addressing areas where conventional approaches are lacking. By directing funds to niche ventures, DeFi platforms not only offer more accessible capital but also promise higher returns for crypto holders, diversifying the global economy and enhancing its resilience. As DeFi platforms continue to grow, they are set to claim a larger market share from traditional finance, signalling a significant shift towards private debt institutions’ expansion.

About Definder

Definder emerges as a beacon of opportunity, revolutionizing access to real estate investment. By harnessing the power of blockchain technology and decentralized platforms, Definder offers a transparent and inclusive avenue for individuals to participate in real estate financing. Through its innovative Decentralized Autonomous Organization (DAO) model, Definder empowers users to contribute to decision-making processes, ensuring that only the most promising projects receive funding. With a steadfast commitment to legitimacy and meticulous due diligence, Definder sets a new standard in the DeFi space, providing investors with unparalleled opportunities for growth and diversification. For more information, visit www.definder.global.