Definder 2024: A Year of Transformation and Strategic Resilience

As we bid farewell to 2024, it’s important to reflect on a year that was pivotal for Definder. This year marked a significant transformation within our platform and operations, steering us through challenges and leading us toward a future ripe with potential. As your CEO,Maxim Kolyada, I am deeply proud of what we’ve accomplished and grateful for the community’s robust support throughout these changes.

Strategic Realignment

The year kicked off with a comprehensive audit of our entire system, a process that led us to critically reevaluate our approach and ultimately redefine our business model. We have concluded that while tokenization had its merits, the regulatory and cost implications made it unsustainable as a core business model. The process of legally attaching real-world assets to tokens, including audits, share issuance, and on-chain sales, proved prohibitively expensive—costing up to $50,000 per project. Additionally, marketing expenses further increased the financial burden, making it clear that under the evolving global regulatory landscape, tokenization was becoming increasingly impractical.

In response to these challenges, we shifted our focus towards developing a robust peer-to-peer lending platform underpinned by smart contracts. This strategic pivot is not just about compliance; it’s about optimizing our platform for scalability and user empowerment without the hefty costs associated with tokenization. We’ve introduced a comprehensive suite of features including DAO voting, automatic refunds, repayment systems, and a dynamic marketplace. This new framework is designed to facilitate direct lending interactions within the regulatory confines, ensuring that Definder stays at the forefront of the decentralized finance industry.

Launching a Revamped Platform

The culmination of our efforts was the launch of a fully functional system, complete with a newly designed whitepaper that outlines our revamped system architecture. This document serves as a blueprint for the operational logic of the Definder Network, offering clarity and insight into the sophisticated mechanisms driving our platform. By May 2024, we successfully rolled out the new platform, marking a significant milestone in our journey towards creating a more accessible, efficient, and compliant financial ecosystem for peer-to-peer lending.

These strategic decisions and technological advancements underscore our commitment to adapting to market needs and regulatory requirements. We are setting new standards for the industry, ensuring that our platform not only meets current demands but also anticipates future trends.

First project listing and financing

In parallel with the development process we have been focusing on the partnerships and listing of the financing projects for the platform. From over 40 different projects Yaskrava has emerged not only as our pilot project but as a high interest fully collateralized investment opportunity for our users. Following a short public round an investment of $75,000 was raised for the project by 3 whales, and with the raised funds Yaskrava undertook the acquisition of five vehicles. Providing a real-world application of our financing model and serving as a comprehensive case study for the vehicle investment and performance strategy. Yaskrava’s business model harnesses the potential of strategically utilized financed assets, offering insights that are instrumental in refining our approach for future projects. The success of this venture demonstrates Definder’s capability to facilitate significant transactions in the real-world assets space, effectively bridging the gap between crypto financing and tangible asset utilization.

Yaskrava specializes in acquiring and leasing vehicles to Uber drivers, in combination with their Driver Retention bonus program they are able to achieve a return of 20-55% annually on their investments.

- New Cars from OEMs: Yaskrava purchases new cars directly from manufacturers at a discount of 25-30%, ensuring a lower initial investment and higher potential for profit upon resale.

- Leasing Auction Cars: Cars from leasing auctions typically have lower acquisition costs and are still in good condition, allowing Yaskrava to offer them at competitive leasing rates.

- Restored Post-Accident Cars: These vehicles are bought at significantly reduced prices, restored, and leased out, offering a high return on investment due to the minimal initial cost.

Profits based on the vehicle types:

New cars: Up to $1,200/month.

Auction cars: Approximately $600/month.

Restored post-accident cars: Around $350/month.

These rates are structured to cover the investment in the vehicle over time, while also providing a steady income stream from the leasing operations.

Sale and ROI:

At the end of the lease term, the cars are sold, often at a higher value than the depreciated book value, thanks to the strategic purchase prices. A new car bought for $30,000 can be sold for $30,000-40 ‘000 after one year due to the discount Yaskrava has on new vehicle acquisition. The depreciation allows for attractive exit strategies, plus it generates monthly lease payments, significantly boosting the total return.

Token relaunch and BSC

The year 2024 brought significant challenges, especially with the decision to relaunch our token.During the preparation to list on larger exchanges one factor stood out is the large unvested token distribution on the open market, After the analysis it was apparent that the sell pressure with the current market positioning would be too much for the token to grow sustainably. A change was needed. Moving from DNT to DFIND presented an opportunity to evaluate switching chains:

- Solana

- Avalanche

- Cosmo

- Ethereum

- Tron

- Ton

- Fantom

- Polygon

Ultimately after reviewing all of them we chose to stay on the Binance Smart Chain (BSC) first the cost structure was very similar on most chains BSC being one of the cheapest and secure. The switch cost however to a different chain could have been an issue especially when we are considering the cross chain distribution. That would have been the toughest challenge and possibly would have created some issues on the distribution side. Therefore to maintain the system and to continue to scale as soon as possible we have decided to simply change the token contract on Chain. This choice helped preserve stability on our platform, allowing us to maintain the core structure as it was developed and simply change the token contract. This transformation was necessary to make successful token exchange and to prepare for further development and our long-term goals.

Shilling Programm

While we were dealing with an unfortunate circumstances of CMO, Tatiana, leaving her role the team has put together a shilling program to engage the community in the promotional efforts Participants can earn points by interacting with Definder’s social media posts, joining Telegram groups, registering on the platform, and investing in the presale or other platform opportunities. More creative contributions like sharing personal stories, creating memes or art, and making videos about Definder also earn significant points. Rewards are structured to encourage both initial actions, like following on Twitter, and ongoing interactions, such as tweeting about Definder regularly. This multi-tiered approach aims to boost visibility and active participation within the community.

Presale

Following the successful relaunch of DFIND and launch of the shilling program, we initiated the presale phase, attracting significant investment and setting the stage for expanded market presence. This phase raised $72,000, crucial for enhancing liquidity and establishing a stable trading environment. Despite initial challenges in gaining marketing momentum, our strategies laid a stronger foundation for future campaigns. Listings on WhiteBit and PancakeSwap marked key milestones, improving DFIND’s liquidity and accessibility. Notably, 20% of funds were allocated towards liquidity on exchanges, with the remainder used for targeting strategic partnerships, positioning us for continued growth and market integration.

During this period, we also strengthened our team with the addition of two exceptional advisors who bring invaluable expertise to Definder:

Talgat Takiyev – A seasoned asset management and investment banking professional with extensive experience in scaling startups and managing diverse portfolios.

Eric Kadyrov – A renowned technologist and investment banker with a track record of supporting pre-IPO tech giants and driving innovation in fintech and blockchain.

Their combined expertise bolstered our efforts during the presale, adding strategic insight to our capital-raising efforts and positioning us for long-term growth.

Key Achievements

- Platform Development:

We successfully developed and deployed the core components of our ecosystem, including smart contracts, a user-friendly DApp, and back-office infrastructure. - First Project Launched:

Our pilot project, Yaskrava, focused on vehicle acquisitions and raised $75,000 USDT through partnerships. This enabled us to acquire 5 vehicles, which served as both a proof of concept and a system stress test for our platform. - Token Relaunch:

Following the identification of distribution imbalances in the original DNT token, we executed a successful relaunch with DFIND. The process required evaluating multiple tokenomics models, migration strategies, and blockchain alternatives.- Our decision to remain on Binance Smart Chain (BSC) was driven by operational efficiency and existing system dependencies, with plans to integrate cross-chain functionality in 2025.

- The new tokenomics were carefully designed to ensure growth potential while respecting the interests of existing holders.

- Presale and Marketing:

We launched the DFIND token presale, supported by influencer outreach and media collaborations. Early rounds attracted significant participation, and partnerships like Radom enabled cross-chain investment into the presale. While later rounds faced challenges in traction, they provided valuable lessons for future campaigns. - Token Listings:

DFIND successfully listed on WhiteBit and PancakeSwap, stabilizing prices and ensuring liquidity.

Challenges and Insights for the Future

While 2024 marked critical milestones, it was not without its challenges:

- Token Transition: The migration to DFIND was resource-intensive and required balancing competing priorities.

- Marketing Adjustments: Despite strong early traction, some marketing strategies underperformed, highlighting areas for refinement in targeting and messaging.

- Team Changes: The departure of key personnel mid-year required operational restructuring and temporary adjustments to our plans.

These challenges delayed the rollout of certain features, such as staking, liquidity pools, and multi-wallet integration, which are now priorities for Q1 2025.

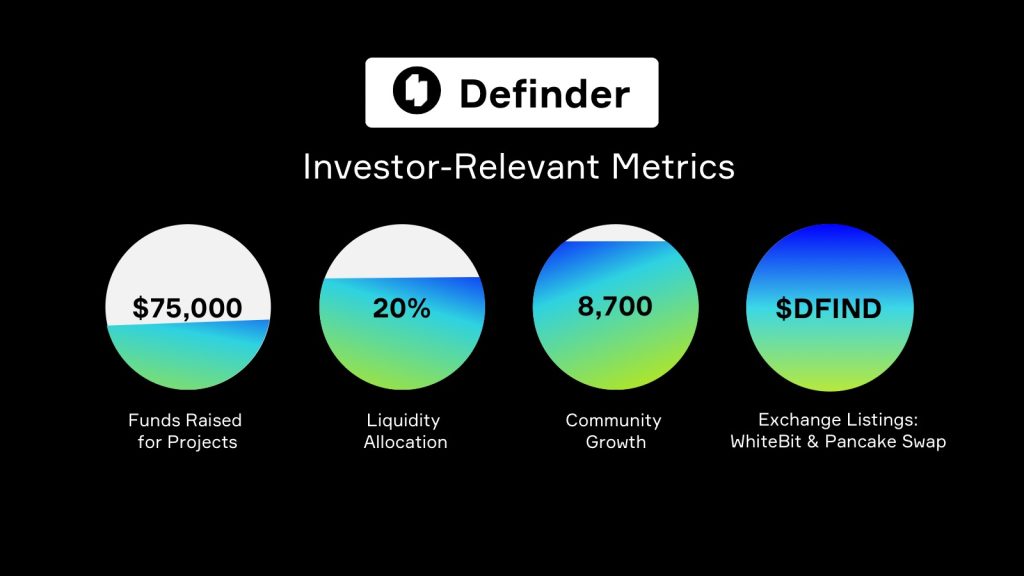

Investor-Relevant Metrics

Funds Raised for Projects:

To date, we have facilitated $75,000 USDT in project financing, including the successful pilot of the Yaskrava project.

Presale Success:

The DFIND token presale brought in early adopters and secured key partnerships, laying the groundwork for broader market penetration.

Community Engagement:

Our Telegram community grew to 8,700 members, with over 400 active participants contributing to platform discussions and promotions.

Token Listings and Liquidity:

Listing DFIND on WhiteBit and PancakeSwap provided the liquidity necessary for stable trading, despite initial selling pressure.

Why Definder is Poised for Growth

Definder’s focus on debt financing for real-world assets (RWAs) uniquely positions us in the DeFi space. Unlike competitors who focus on expensive tokenization models, our approach is cost-effective and scalable.

- Security and Transparency: Smart contracts ensure that investor funds are securely managed and repayments are automated.

- Risk Management: Investments are collateralized, reducing risks associated with default. Insurance pools are in place to further protect creditors.

- Market Demand: With over $1 trillion in private debt and crowdfunding markets in 2023, and DeFi projected to reach $16 trillion, our model capitalizes on growing demand for secure, transparent investment opportunities.

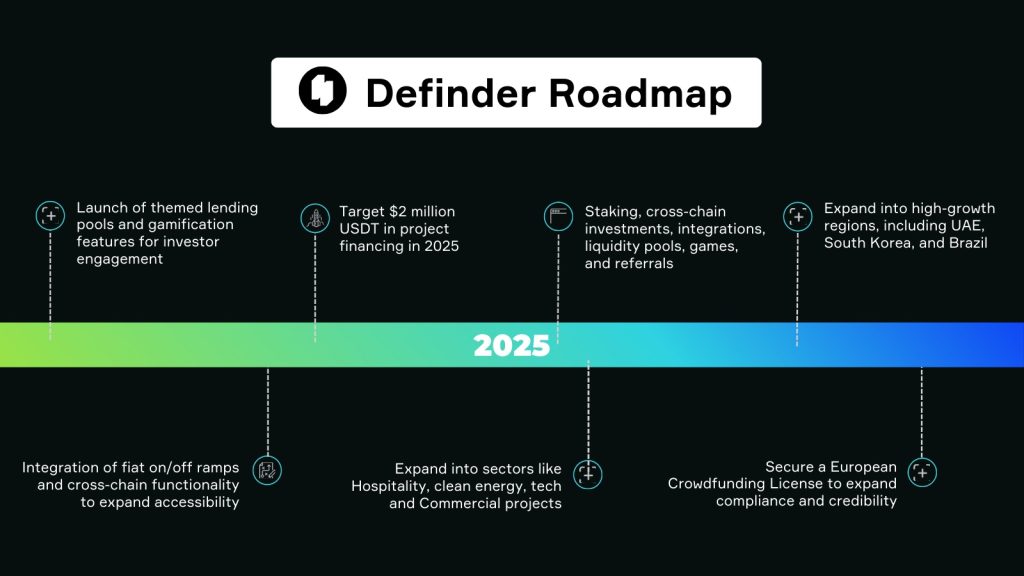

2025 Roadmap

- Platform Features:

- Launch of themed lending pools and gamification features for investor engagement.

- Integration of fiat on/off ramps and cross-chain functionality to expand accessibility.

- Project Listings:

- Target $2 million USDT in project financing in 2025.

- Expand into sectors like Hospitality, clean energy, tech and Commercial projects.

- Token Ecosystem:

- Introduce staking functionality, Cross chain investments, Wallet and Exchange integrations, liquidity pools, games, and referral system.

- Licensing and Expansion:

- Secure a European Crowdfunding License to expand compliance and credibility.

- Expand into high-growth regions, including UAE, South Korea, and Brazil.

Conclusion: A Transformative Year, A Bright Future Ahead

2024 was a year that tested our resilience and sharpened our focus. Through challenges, we redefined our approach, prioritized sustainability, and laid the groundwork for a scalable, impactful platform. From launching Yaskrava as a proof of concept to engaging our community through innovative programs like shilling, Definder has evolved into a more robust and future-ready ecosystem.

As we enter 2025, we carry forward the lessons of the past year with renewed optimism. With an ambitious roadmap, enhanced token utility, and a commitment to real-world impact, we’re poised to deliver meaningful value to our community and investors. Thank you for your unwavering support—together, we’re building a decentralized finance future that truly makes a difference. The best is yet to come!

Kind regards,

CEO of Definder