E-Commerce Making Investing in UK Logistics Market Excitingly Attractive

The Brexit uncertainty puts pressure on the price of real estate in the UK in general and London in particular. However, the meteoric rise of online shopping acts as a counterweight for the Brexit scare giving investors in commercial real estate a chance to seize the right opportunity at an attractive valuation.

2018 was the second-strongest year in terms of industrial real estate investment volumes since the data series started in 2000. Among the largest deals on record, Royal London Asset Management’s acquisition of a distribution warehouse in Maidenhead for £32m (4.5% IY) in November, followed by the St James’s Place PF’s bid of £28m (no IY reported) on an eight-unit industrial estate in Dunstable (deal closed right before Christmas).

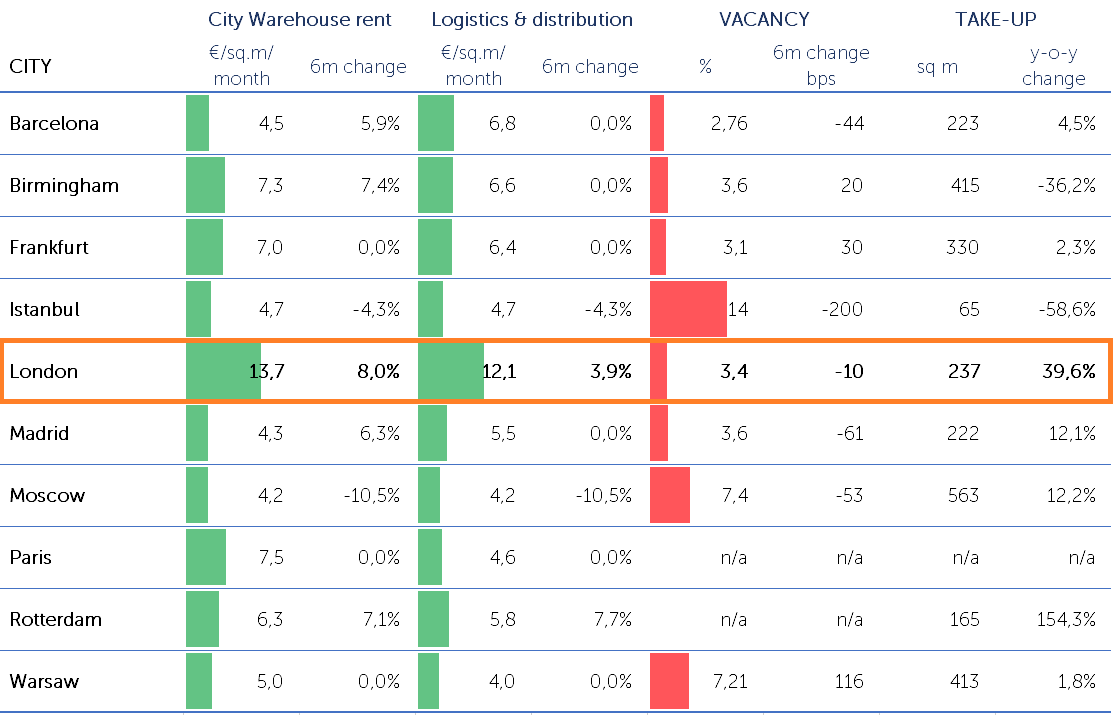

Looking across all commercial property sectors, London has retained its crown as the world’s most popular destination for cross-border investment in real estate with inward volumes more than 50% higher than Manhattan. What makes the local industrial/logistics real estate stand out from other types of commercial real estate is the surge in take-up that coincided with a fallen supply and plummeting vacancy rates, which in turn have driven up the growth of rental revenues.

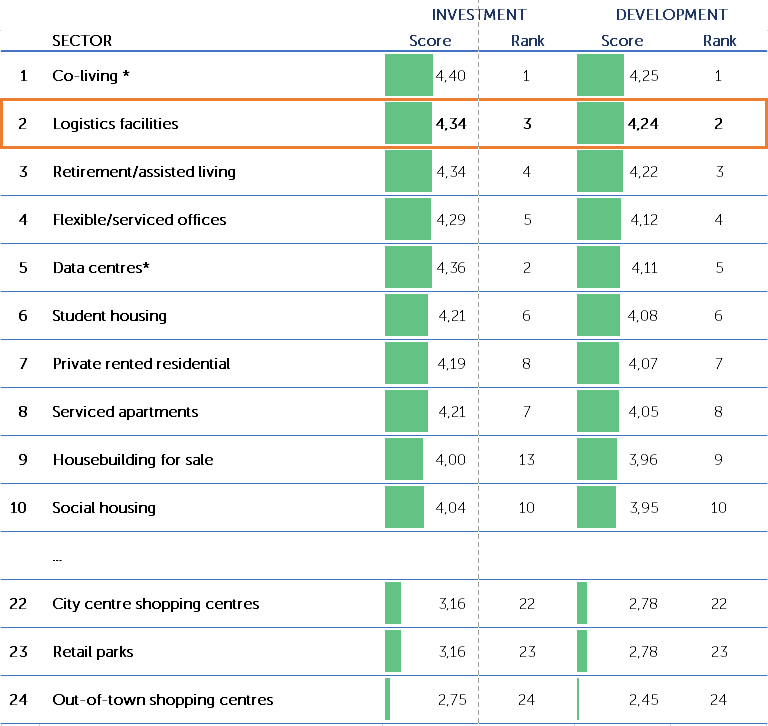

On the other hand, logistics itself is considered as one of the most attractive investment opportunities in real estate in Europe. According to Emerging Trends in Real Estate® Europe 2019 report by PwC, logistics has ranked second and third as the most attractive development and investment opportunity. A significantly lower number of respondents scored Co-living (rank #1 in both categories) and Data centers (ranked #2 in Investments) making Logistics #1 in both categories among major sectors.

Source: PwC, Emerging Trends in Real Estate® 2019

Demand for logistics grows stronger

Online shopping is a major driver of demand for logistics capacities in the UK, the country being a global leader by the share of e-commerce in GDP. According to research undertaken by Prologis, an extra €1 billion spent online leads to an additional 770,000 sq ft requirement for warehouse space, which indicates that the appetite for industrial accommodation will only continue to increase. A study by property consultants Gerald Eve suggests an even bigger demand for additional 1 mln sq ft per £1bn increase in online sales.

In addition to massive logistical hubs, the demand for the same-day and overnight delivery requires the availability of the “last mile” warehouses located close to conurbations. The surge in the number of such smaller “spokes” in a larger wheel is driving a significant part of the demand for logistics facilities from the online shopping companies.

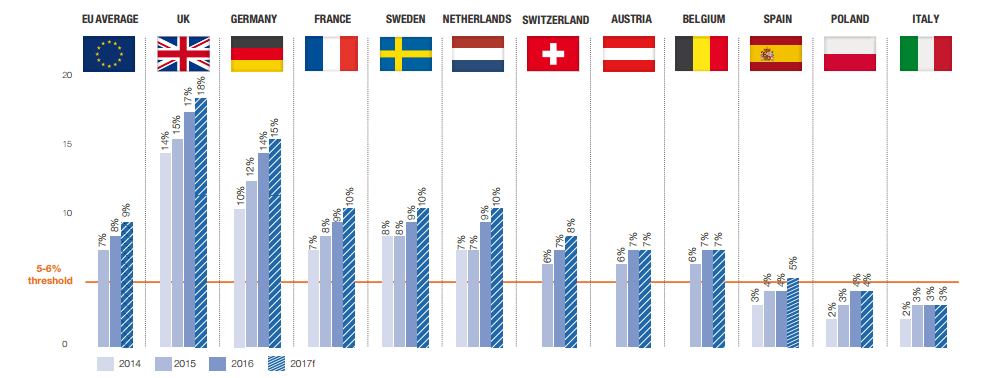

Source: Savills Investment Management, European Logistics: Warehousing the Future

Recent data from the Office for National Statistics show that online sales rose by 15.3% over the past year and now have reached a record high of 18.2% of all retail sales (for comparison, the total volume of online sales in the EU averages only 8.8%). In the not-so-distant past, online shopping was mostly the domain of tech-savvy younger consumers. Today, Amazon and other online retailers have turned Internet shopping into something so convenient and simple, the amount of older online shoppers had tripled over the past decade going from 16% to 48%, according to the Office for National Statistics.

Further increase in demand for local warehouses comes from new shopping habits in the UK. Britons move away from a big weekly shop to several “top-up shops” in convenience stores that require much more frequent replenishment due to scarce storage capacities.

Source: Colliers International, EMEA Industrial & Logistics Hubs

This Land is Not Your Land

Urbanization means steady demand for land. Ironically, the more expensive land prevents developers from building service units on it. Local authorities see that the most profit-generating plots are reserved for high-value residential properties, upscale office buildings, and posh leisure projects that include modern amenities. The existing aging warehousing infrastructure is not mended but either demolished or converted into residential units as well. AECOM reports that in London, for example, roughly 1,300 hectares of former industrial land was converted for other uses between 2001 and 2015. According to an article by Financial times, land used for industrial and warehousing needs in the Greater London area had shrunk by 50% over the past 30 years. The Greater London Authority predicts it will be reduced by another 25% over the next 15 years.

In Conclusion

The demand for locally-sourced quality logistics accommodations is nowhere near the finish line. In 2018, the UK market has outdone itself in speculative development announcements yet supply remains static with a vacancy rate of only 3-6%. The shortage for logistics space is so catastrophic, some established retail chains managed to use surplus store space on existing high streets to satisfy the increasing demand form online shoppers. Effectively, this reads conversion of retail space to warehouses, and still, the retailers’ limitations are glaringly obvious and, alas, barely addressable at this time. Stores have very limited storage capacities and even a substantial (albeit hypothetical at this point) boost in supply is unlikely to completely satisfy soaring demand.