Farming in a blockchain-enabled world

The farmer is the only man in our economy who buys everything at retail, sells everything as wholesale, and pays the freight both ways. – John F. Kennedy

In my article, “Where have all the horses gone?” published in November 2020, I drew the readers’ attention to the fact that Smartlands was in negotiation with a major agricultural produce trading platform with a view to finalizing a joint venture to apply the Smartlands blockchain system to their platform.

Last week Smartlands and the trading platform signed an agreement setting out the basis for the joint venture. With this article, I intend to give the reader a bit more background on the basis of the JV and introduce Agroxy, our new partner in the agricultural space.

But first, some background.

Although agriculture is a global business providing food for all, it is, by nature, a local business too in that local framers supply their product, which is then moved up the value chain, processed, and ultimately ends up on the shelves of supermarkets across the world.

While there are a small number of huge farming groups operating vertically integrated businesses with hundreds of thousands of hectares in cultivation worldwide, it is fair to say that the majority of farming operations are generally much smaller than this. For example, the average farm size in the USA in 2019 when all categories are taken into account was 180 Ha as recorded by the US Department of Agriculture. A similar picture emerges worldwide, with smaller farms operating the majority of the farmland.

This ultimately leads to an inherent disadvantage for the smaller farms as they do not possess the resources or capital to maximize their product’s output price. Accordingly, many large trading houses have come to dominate the agricultural supply infrastructure. These enormous global trading companies are able to leverage their huge balance sheets and ownership of infrastructure such as grain terminals and storage silos to pay as low a price as possible to the farmers while charging as high a price as possible to the end buyer taking a large spread between their buy and sell price for their trouble. In many cases, farmers simply have to accept the price offered as the trading house buys up the farmer’s entire harvest.

In this somewhat uneven playing field, Agroxy has set out its stall with a mission to put the smaller farmers back in control of the marketplace and put them in direct contact with produce buyers so removing the trading houses from the equation.

The Agroxy Solution

Agroxy describes itself as follows:

The Agroxy trading system allows sellers and buyers to enter into legally binding agreements online and directly with counterparties for products stored in silos. At the same time, one can access the trading system’s mechanisms for checking counterparties, warehouse receipts, and the solvency of counterparties. For each trade, the Agroxy platform automatically generates all the necessary documentation for trade closure, thus saving time and hassle for the counterparties and reducing the chances of human error.

To date, Agroxy has more than 15,000 farmers registered in the system and actively using the Agroxy marketplace to benefit their bottom-line. Agroxy generates its income by charging both sellers and buyers a commission for using the platform; the commission is only charged on completed trades. In the agricultural powerhouse of Ukraine, Agroxy is fully functional, producing benefits for farmers in higher output prices and for buyers in lower prices than those historically demanded by the big trading houses.

In addition to Ukraine, where testing and development is carried out, Agroxy is developing itself as a major service provider in East Africa and is meeting a great deal of success in getting its message out to farmers in that region, for example, a business development plan is currently underway in Tanzania.

Agroxy not only assists farmers in getting the best possible price for their produce but also helps farmers to reduce input prices by applying economies of scale to seed and fertilizer purchases. The wholesale suppliers of such inputs pay a usage fee to Agroxy to access the entire platform across a whole geographical region.

The Agroxy system automatically generates all of the post-trade document flow to ensure a smooth settlement of each transaction, which has the effect of saving the farmer a great deal of time. In effect, Agroxy becomes the farmer’s back office.

The main features of the Agroxy platform can be summarized as follows:

- Tenders exhibit goods with warehouse receipts (documents)

- The contract (lot size) of the traded commodity is 10-300 tons (in increments of 10 tons)

- The quality of the goods is standardized and proven by the warehouse receipt

- Bidding always starts at the same time every working day (for example, wheat 11: 00-11: 30, corn 12: 00-12: 30)

- The seller sets the starting price for himself

- The seller can set a backup price below which the product will not be sold. The backup price is known to the seller only

- The seller can choose who is invited and participates in the bidding

- An unsold lot may be automatically redeployed on the next business day

- No speculative trading, but there is a mechanism for maximizing profits

- The first buyer to agree on the price buys the lot and closes the bidding, and gets the whole package of documents

- Transaction details are confidential after the closure

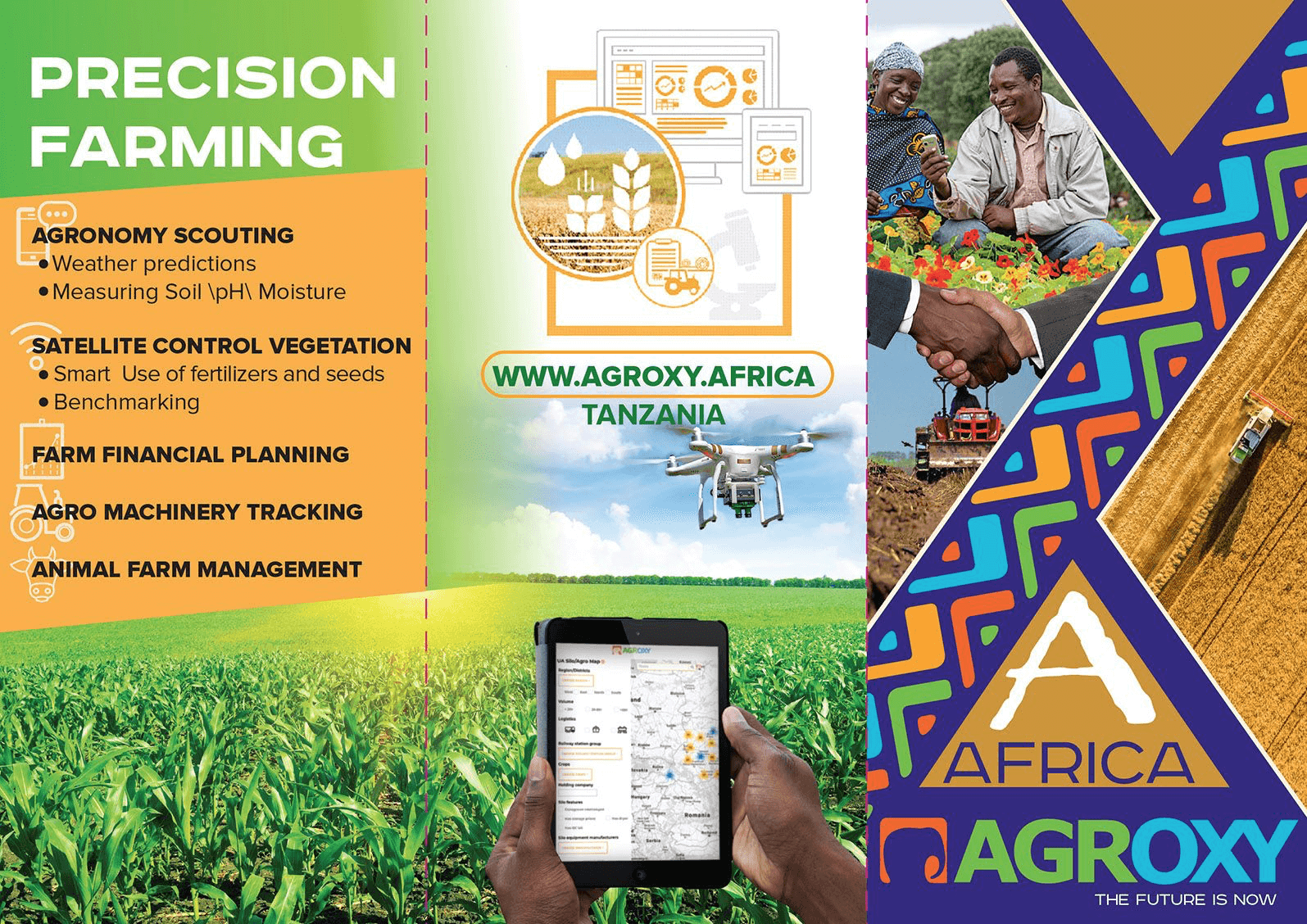

In addition to the market platform, Agroxy is also developing a collection of ancillary services to add value to its farming clients further to ensure that Agroxy becomes integrated into the local farming community’s daily life, as the advertisement from Tanzania shows below.

The Agroxy / Smartlands Joint Venture

Agroxy and Smartlands have entered into a Joint Venture where the blockchain solution developed by Smartlands will be merged with Agroxy’s backend, making Smartlands’ IP the backbone of the Agroxy system.

The Smartlands input to the JV is currently complete, with just some fine-tuning required to facilitate the technology merger. At the time of writing, the technical team at Agroxy is hard at work preparing their side, which will involve several hundred hours of technical development and coding; consequently, it is expected that the full system will go live during Q1 of 2021.

Once the Smartlands blockchain solution goes live within Agroxy, users of the system will be able to pay fees and commissions and indeed carry out complete trades using the Smartlands Token (SLT) as the primary method of exchange, facilitating fast transfers of value between the trade participants. This will be especially useful in rural areas of West Africa, for example, where full-service banks are expensive, slow, and not to be found on every street corner.

The Smartlands blockchain will also allow full traceability of each product consignment through its blockchain history, making it easier for buyers to apply social considerations to their purchasing policy.

We expect that once the Smartlands / Agroxy joint venture goes live that it will herald a massive increase in demand for the Smartlands Token as it becomes a method of exchange within the fast-growing Agroxy marketplace.

Agroxy will continue to open up new geographical markets for the platform moving forward, and each new market will result in more transactions being undertaken in part or completely with the Smartlands Token, which will further underpin demand.

As mentioned in my previous article, interested parties should add the Smartlands Token (SLT) to their crypto watchlist as the Agroxy partnership is just one example of steps being taken to increase the application and use of the SLT in a blockchain-enabled world.

Martin Birch

Kyiv December 2020

About the Author, Martin serves as the Non-Executive Chairman of the Smartlands Group and is the Managing Partner of Ukrainian investment bank Empire State Capital Partners.