Finding Real Estate Gems

In the previous section, we have provided a breakdown of how one could evaluate good locations for real estate investments. In this part, we would like to highlight using examples how one could identify good properties and exact investment opportunities in a given market. The goal for this part is for you to be able to see the logic on how real estate investors can identify good-value properties and find which assets could be worth acquiring for rental and asset flipping strategies.

First, is reviewing the available properties in the growing districts of the city. Previously we have identified that in the case of Lisbon, Chiado, Parque das Nações, and Marvila emerged as top investment districts due to their strong job growth, high demand, and excellent infrastructure.

Browse Listings on Local Platforms:

- Use trusted real estate websites like Idealista, Imovirtual, or Remax Portugal to search for properties in the target districts. You could simply find those with a simple Google search (Real estate Location) top websites would normally be the most reliable.

Analyze Property Types That Perform Well in the Market

Before narrowing down specific properties, it’s important to understand which property types (e.g., apartments, villas, commercial spaces) are most in demand in Lisbon’s market, particularly in the identified districts (Chiado, Parque das Nações, and Marvila). This ensures your investment aligns with market preferences and maximizes rental income and appreciation potential.

To analyse real estate options one needs to understand the property types. Property types could be segmented in 10 different ways, but the approach that seems the most common is based on the target demographic:

– Budget

– Apartments

– Family homes

– Luxury

For this case, the focus would be on apartments to keep things a bit more straightforward. Apartments are normally sorted based on the number of bedrooms. Then the investors normally consider whether the apartment is newly built or traditional—lastly, the style, Modern, Classical, Luxury, budget etc.

| Property Type Comparison Lisbon Appreciation Estimate 2018-2024 | ||||

| Property type | Initial Investment (2018) | Current Value (2024) | Total Appreciation | Annual Rate |

| Traditional 1-Bedroom | €150,000 | €180,000 – €200,000 | 20% – 33% | 3-5% |

| Modern 1-Bedroom | €200,000 | €250,000 – €300,000 | 25% – 50% | 4-7% |

| Traditional 2-Bedroom | €250,000 | €300,000 – €350,000 | 20% – 40% | 4-6% |

| Modern 2-Bedroom | €350,000 | €450,000 – €550,000 | 29% – 57% | 5-8% |

| High-end Luxury | €750,000 | €1,000,000 – €1,250,000 | 33% – 67% | 6-10% |

Modern 1-Bedroom Apartments could be considered the most reasonable investment assets. 1-bedroom apartments offer a good balance of size, affordability, and rental demand. High demand from both short-term and long-term renters, strong potential for both rental income and capital appreciation. These properties cater to a broad range of renters, from tourists and young professionals to expats. Lisbon boasts a robust tourism industry, ensuring consistent demand for short-term rentals. Prime locations in Lisbon have consistently shown strong price appreciation, making it a good long-term investment. To further verify this theory lets take a look at the maket offering with the Parque Das Nações

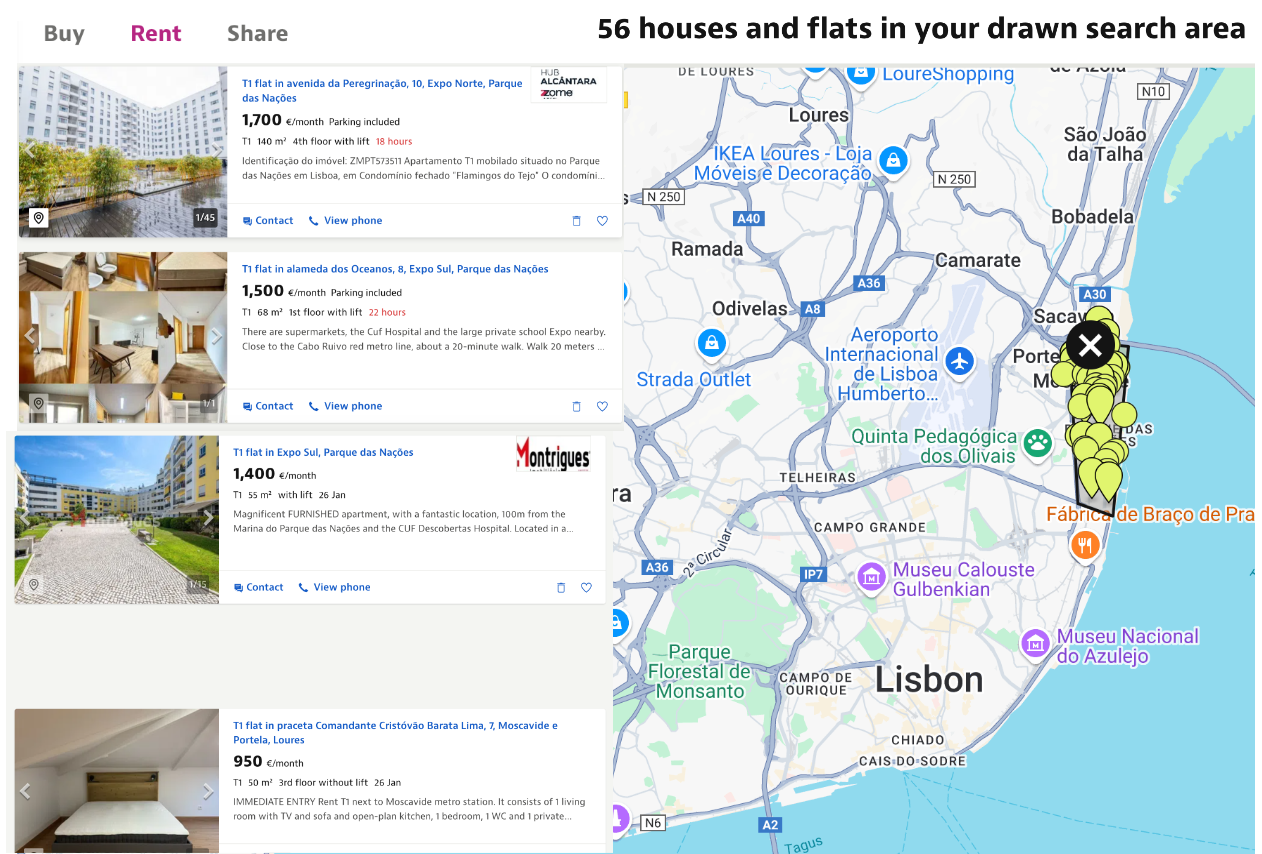

By researching the properties in any specific region of Lisbon on the Local Real Estate websites you could the available properties which could easily allow you to see the lowest and the highest property rent prices and the available units in the area.

By analysing the demand and putting the date in the table we could see that Modern 1 bedroom apartments indeed offer the most stable rental yield with the highest demand for this apartment located in that area with the lowest available supply. Therefore lets focus on checking the listings and identifying the best properties in the area that are available.

| Rental Performance Lisbon Parque das Nações | |||

| Property Type | Rental Rate | Rental Yield | Number of listings |

| Traditional 1-Bedroom | €700 – 1’500/month | 3-7% | 40 |

| Modern 1-Bedroom | €1’300- 1’800/month | 5-6% | 15 |

| Traditional 2-Bedroom | €1’100 – 2’500/month | 3-7% | 42 |

| Modern 2-Bedroom | €1’800 – 2’900/month | 4-6% | 35 |

| High-end Luxury | €3’000 – 7’000/month | 3-7% | 20 |

When prior we were using the properties that are available for rent to research on the local real estate websites now we need to switch to the Buy property to see which properties are available for sale in the Parque das Nações district. To narrow down the search check the properties only with 1 bedroom and with recent listing within the past 2-4 months. Another filer that could be useful is to check the lowest price per square meter if the website allow you to do so – this would allow you to see the best value assets. Following find the properties which seem good for you.

| Property | Price (€) | Size (m²) | €/m² | Rent Comparable | Yearly yield | % Yield |

| Flat 1: | 430’000 | 91 | 4’725 | 1’700 | 20’400 | 4.74% |

| Flat 2: | 490’000 | 100 | 4’900 | 1’850 | 21’000 | 4.53% |

| Flat 3: | 450’000 | 68 | 6’716 | 1’600 | 19’200 | 4.27% |

| Flat 4: | 675’000 | 96 | 7’031 | 1’900 | 21’600 | 3.20% |

| Flat 5: | 675’000 | 89 | 7’584 | 2’000 | 21’600 | 3.20% |

By analysing the properties available on the market we were quickly able to find 5 properties that fit the Modern 1-bedroom apartment style. After analysing the apartment sizes and styles we could find comparable rent prices from similar properties on the market and could estimate the average price that these apartments could fetch on a monthly rent basis. Further, we could quickly conduct calculations to compare what kind of yield one could expect from these apartments. Considering that the average price per square meter in the area is around 5400€ per square meter anything below could be considered a good deal. Here we see that Flat 1and Flat 2 are the ones that carry the highest annual rental yield and the lowest price for SQM. Therefore we can consider that there are two good properties that we could consider as potential investments.

Now the focus is to further analyse the properties from a financial gain perspective. Lets consider the usual 5 year time frame and calculate return on investment we could expect from these properties. The return on investment should include property rent Yield, property appreciation and discounting property expenses over the 5 year period. Then to underline the possible return on investment.

| Property | Price (€) | Appreciation % per year | Total appreciation | Total Rent Yield | Expenses 2% per year | Sales tax Lisbon 28% | Profit | ROI |

| Flat 1: | 430’000 | 5.2% | 4’725 | 1’700 | 20’400 | 31300 | 172300 | 40.07% |

| Flat 2: | 490’000 | 5.2% | 4’900 | 1’850 | 21’000 | 35600 | 191700 | 39.12% |

Its important to consider costs when conducting ROI calculations. In this case we can benchmark that the property if rented out for 5 years should generate 2% from its original value in costs per year. This includes insurance 0.5% per year, Property Tax 1% per year, Maintenance costs 0.5%. In addition when the asset is sold in Lisbon they apply a 28% charge on the property Appreciation – meaning only on the amount of how much the property has increased in value since it was purchased. After deducting costs and taxes from the rental income over the 5 year period and the property appreciation we could conclude that on the €430’000 investment in Flat 1 we could be able to make a €172’300 profit or a 40% return on investment.

Conclusion:

Through a structured approach to property analysis, we have demonstrated how to identify high-potential real estate investments in Lisbon, specifically focusing on Modern 1-Bedroom Apartments in the Parque das Nações district. By following a data-driven methodology, investors can systematically evaluate properties based on location, demand, rental yield, and long-term appreciation potential.

Key Takeaways from the Analysis:

- Start with Market Research:

- Identifying high-growth districts with strong job markets, infrastructure, and rental demand is essential.

- Lisbon’s Chiado, Parque das Nações, and Marvila emerged as top investment zones.

- Analyze Property Types that Perform Well:

- Modern 1-Bedroom Apartments showed high rental demand and strong appreciation potential.

- The segment balances affordability, liquidity, and consistent rental income.

- Use Data to Compare Properties:

- Listings were analyzed based on price per square meter, rental yield, and supply-demand trends.

- Flat 1 (€4,725/m²) and Flat 2 (€4,900/m²) stood out as offering the best balance of affordability and returns.

- Calculate True ROI (Return on Investment):

- Beyond rental yield, appreciation and all expenses (maintenance, insurance, property tax, and sales tax) were factored into the final ROI calculation.

- After deducting sales taxes (28% on appreciation) and property expenses (2% per year), the 5-year ROI for Flat 1 and Flat 2 stood at 40.07% and 39.12%, respectively.

Final Thoughts: Finding Investment Gems

Investing in real estate is more than just identifying properties with high rental demand, strong appreciation potential, and a favorable price per square meter -it requires a strategic approach to purchasing, financing, and optimizing returns. Here we have showcased how anyone could use publicly available tools to real estate opportunities, compare rental yields, and calculate ROI while considering property expenses and taxation.

However, the next step is to explore how different purchasing strategies – especially using financing (Credit) – can impact returns. Most investors do not purchase real estate fully in cash, and leveraging debt effectively can significantly increase ROI, cash flow efficiency, and portfolio scalability.