Real Estate Investments in the age of Decentralized Finance (DeFi)

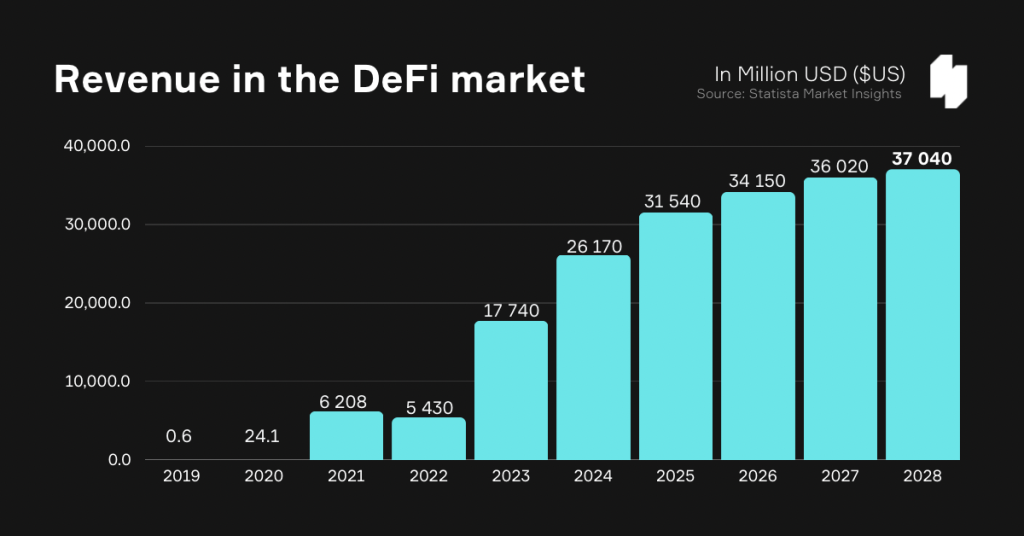

In the digital age, real estate investment has embraced the innovative wave of cryptocurrencies and decentralized platforms, fundamentally altering its traditional confines. As of 2024, the decentralized finance (DeFi) market has surged to $26 billion and is projected to exceed $37 billion by 20281, representing a significant compound annual growth rate.

This growth is powered by the wide adoption of decentralized financing, addressing numerous market gaps and introducing a plethora of use cases. Such innovation has revolutionized the investment process, making it more inclusive, efficient, and transparent. Here’s an exploration of the vital steps and considerations for engaging in DeFi real estate investments.

1. Understanding Real Estate Tokenization and Decentralized Debt

DeFi real estate investments can be approached through two primary avenues: debt and equity (Fractional Ownership). Tokenization has emerged as a popular concept during the NFT boom, offering fractional ownership of assets. It enables investors to buy into the real estate market with as little as $100, democratizing access to property investment. However, tokenization presents several challenges, including legal recognition of NFTs as property ownership, operational hurdles in tokenizing assets, and the risk of scams.

The process begins with an asset’s valuation and its conversion into a separate legal entity, followed by the issuance of shares or tokens representing ownership. Yet, the lack of legal recognition for NFT-based ownership in many jurisdictions complicates asset control and rights enforcement for token holders. Furthermore, the prerequisite of owning the property before tokenization and the high cost and duration required to tokenize assets raise barriers to entry and risk.

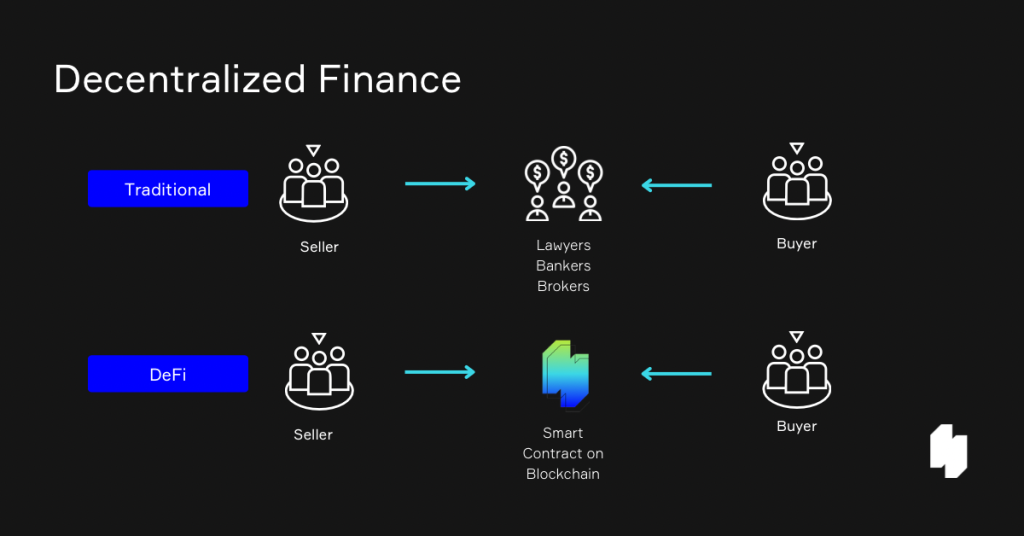

In contrast, decentralized debt offers a simpler, legally recognized investment model through smart contracts. This mechanism facilitates lending and borrowing without the need for direct asset ownership, reducing operational complexities and legal ambiguities associated with tokenization.

2. Choosing a Platform

Selecting the right platform is critical, with considerations spanning the platform’s nature (decentralized vs. geographically tied) and the type of investments offered (equity vs. debt). Despite the allure of tokenization, it’s crucial to ensure that the chosen platform and jurisdiction recognize digital ownership rights to mitigate risks. Decentralized platforms offer global investment opportunities and are typically divided into geographically limited or fully decentralized categories, each with its unique regulatory and operational framework. Investors should scrutinize the platform’s governance, decision-making processes, and how it ensures transaction security and transparency.

3. Choosing the Right Projects

Investment success in the DeFi real estate sector heavily relies on selecting legitimate and promising projects. With the real estate market’s inherent risks and the prevalence of scams, investors must conduct thorough due diligence. This includes verifying property details, comparing expected returns with market standards, and assessing the project’s feasibility and legal standing. Preference should be given to projects in well-regulated markets with transparent property registries.

Investors should also consider the type of real estate (commercial vs. residential) and its expected revenue patterns, aligning selections with their risk tolerance and investment goals. Highlighting the potential, innovative real estate opportunities such as staffless gyms, ghost kitchens, fulfillment centers, and non-fixture hotels present high Internal Rate of Return (IRR) prospects, illustrating the diverse and lucrative avenues available within DeFi real estate investments.

4. Recognize Market Opportunities

The real estate market continually evolves, presenting a myriad of opportunities shaped by geographical, demographical, and technological trends. The increasing globalization and changes in work culture, especially post-COVID-19, have unlocked new investment landscapes and business models, promising lucrative returns for those ready to explore beyond traditional boundaries. Let’s delve into these trends to identify where these emerging real estate opportunities lie.

Geographical Trends

Globalization has rendered the world more interconnected, making previously overlooked regions like Vietnam, Indonesia, Africa, and the Middle East more attractive for real estate investment2 3. The allure of beautiful landscapes combined with improving infrastructure and easing language barriers has opened these markets to foreign investors and residents. The rise of remote work and digital nomadism further accentuates this trend, as individuals seek out destinations with favorable climates and living conditions, thereby driving up real estate development and values in these areas.

Demographical Shifts

The global landscape is also shaped by demographic shifts, including migrations driven by conflicts, tax incentives, or the search for better living conditions. Such movements create high-demand real estate markets as people relocate, bringing investment and development opportunities. Regions that offer peace, tax breaks, or refuge from oppressive regimes are witnessing substantial real estate growth, outpacing traditional markets in terms of investment returns.

Innovative Real Estate Opportunities

The post-COVID era has accelerated several trends, creating unique investment opportunities within the real estate sector. The pivot towards technology and automation has redefined what’s possible, offering returns that were once deemed unattainable. Here are some of the innovative and high-return business opportunities within this landscape:

- Staffless Gyms: Fully automated gyms eliminate the need for on-site staff, allowing for unlimited membership models and lower operational costs.

- Ghost Kitchens: Focused solely on food delivery, these kitchens cater to the booming online food service demand without the overhead of traditional restaurant spaces.

- Fulfillment Centers: These facilities cater to the ‘last mile’ delivery need, pivotal in e-commerce, offering strategic investment opportunities in logistics and distribution.

- Staffless Retail: Automated retail solutions, including self-checkout systems and vending machines, reduce staffing needs while meeting consumer demands for convenience.

- Cosmetology and Dental Clinics: Niche clinics focusing on frequent, lower-cost procedures offer high returns due to their demand and scalability.

- Student Housin : High-occupancy, affordable housing for students promises stable returns, given the perennial demand.

- Non-Fixture Hotels: Innovative lodging solutions like glamping and remote luxury resorts with minimal infrastructure investment open up new avenues for high-yield investments.

Final Thoughts

In the rapidly evolving digital era, real estate investment landscapes are undergoing transformative changes, propelled by cryptocurrencies and decentralized platforms. This shift, moving away from traditional frameworks, is largely driven by the burgeoning DeFi market, poised to exceed $37 billion by 2028. Such a leap underscores a shift towards investment methods that prioritize accessibility, efficiency, and transparency. This transition is further bolstered by global trends, technological leaps, and demographic shifts post-COVID-19, opening up previously uncharted or undervalued territories for investment. Regions like Vietnam, Indonesia, Africa, and the Middle East are emerging as vibrant real estate development hubs, thanks to a worldwide adoption of remote work and digital nomadism. Furthermore, demographic shifts are steering investment towards locales offering tranquility, tax benefits, or a haven from restrictive regimes.

The introduction of innovative business models such as staffless gyms, ghost kitchens, and non-fixture hotels is revolutionizing investment return expectations. In this nuanced and opportunity-rich environment, the importance of meticulous due diligence, strategic platform selection, and commitment to legitimate projects cannot be overstated.

At Definder, we leverage DeFi to democratize real estate investment. leverage DeFi to democratize real estate investment. With its pioneering DAO approach to debt and a focus on tech-driven investments, Definder empowers users to explore new frontiers in real estate. It offers an innovative, transparent, and community-led platform where investment decisions are made collaboratively. This ensures that only the most viable and promising projects receive funding, aligning with the collective wisdom and interests of its users.

As we venture into new opportunities in real estate investment, marked by borderless growth, diversification, and gains. We make sure that the strategies risks and opportunities are balanced out to secure investors interests while maximizing the returns. Join Definder’s chat or other social media channels if you would like to learn more or ask questions about DeFi in Real Estate.

DF Platform | White Paper | Website | Telegram | Twitter | Facebook | Medium | Reddit