Smartlands Cooperates with London Strategic Consulting to Analyse Smartee Market Situation

As a part of a corporate social responsibility program, Smartlands continued cooperation with a student-run non-profit consultancy London Strategic Consulting, which earlier this year conducted research to assess the digital securities space in the UK. Spring term project was dedicated to the analysis of Smartee market situation as well as online and mobile banking systems, and payment habits of potential Smartee users which would help us build a well-thought-out product in evergrowing demand.

There were three primary objectives identified for the project. First, to pinpoint customer behaviour patterns in the UK, Germany, Netherlands, and Austria. Second, develop an understanding of Smartee’s required product features. Third, suggest the optimal communication strategy that should be applied to target Smartee’s potential user base.

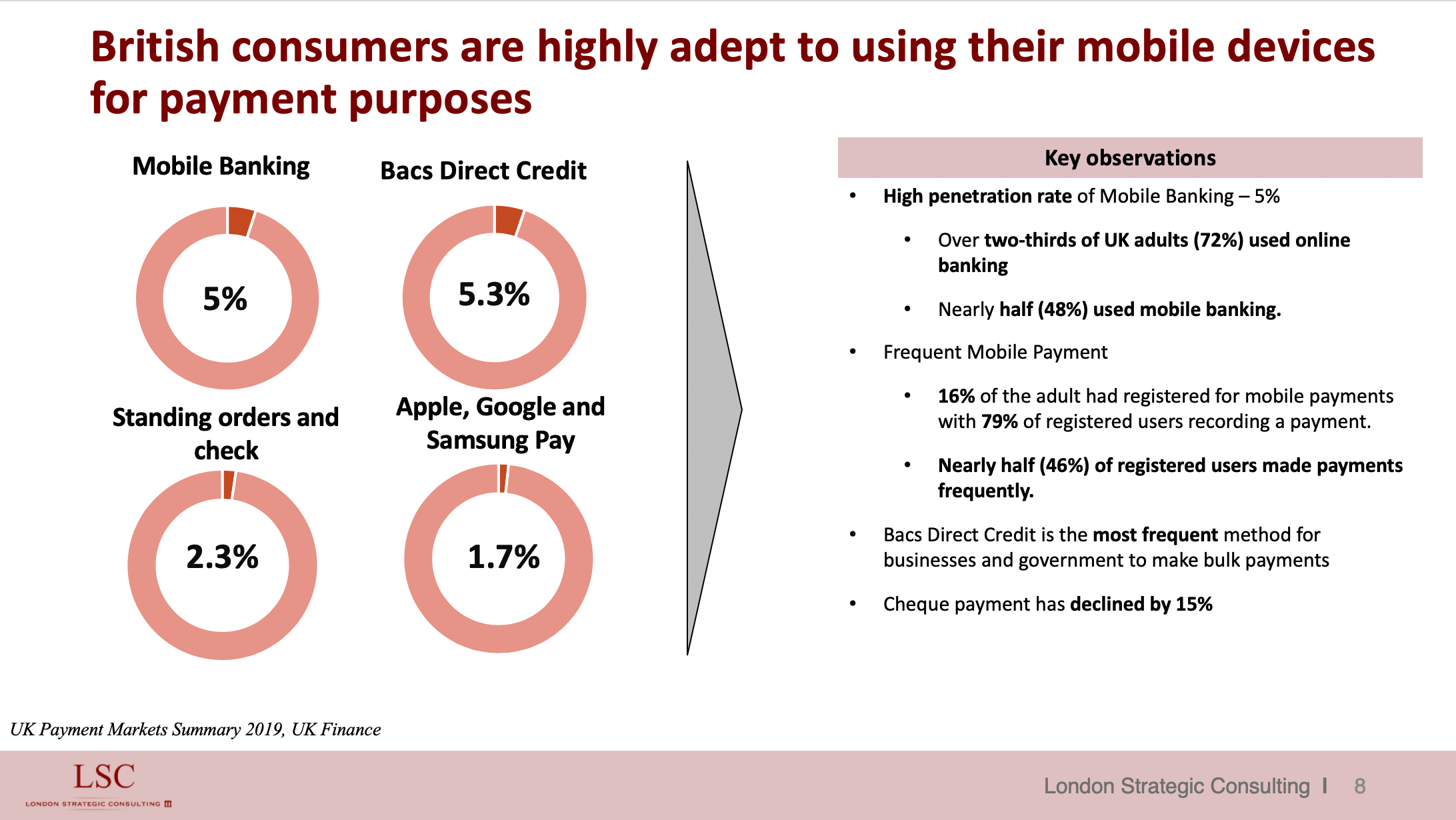

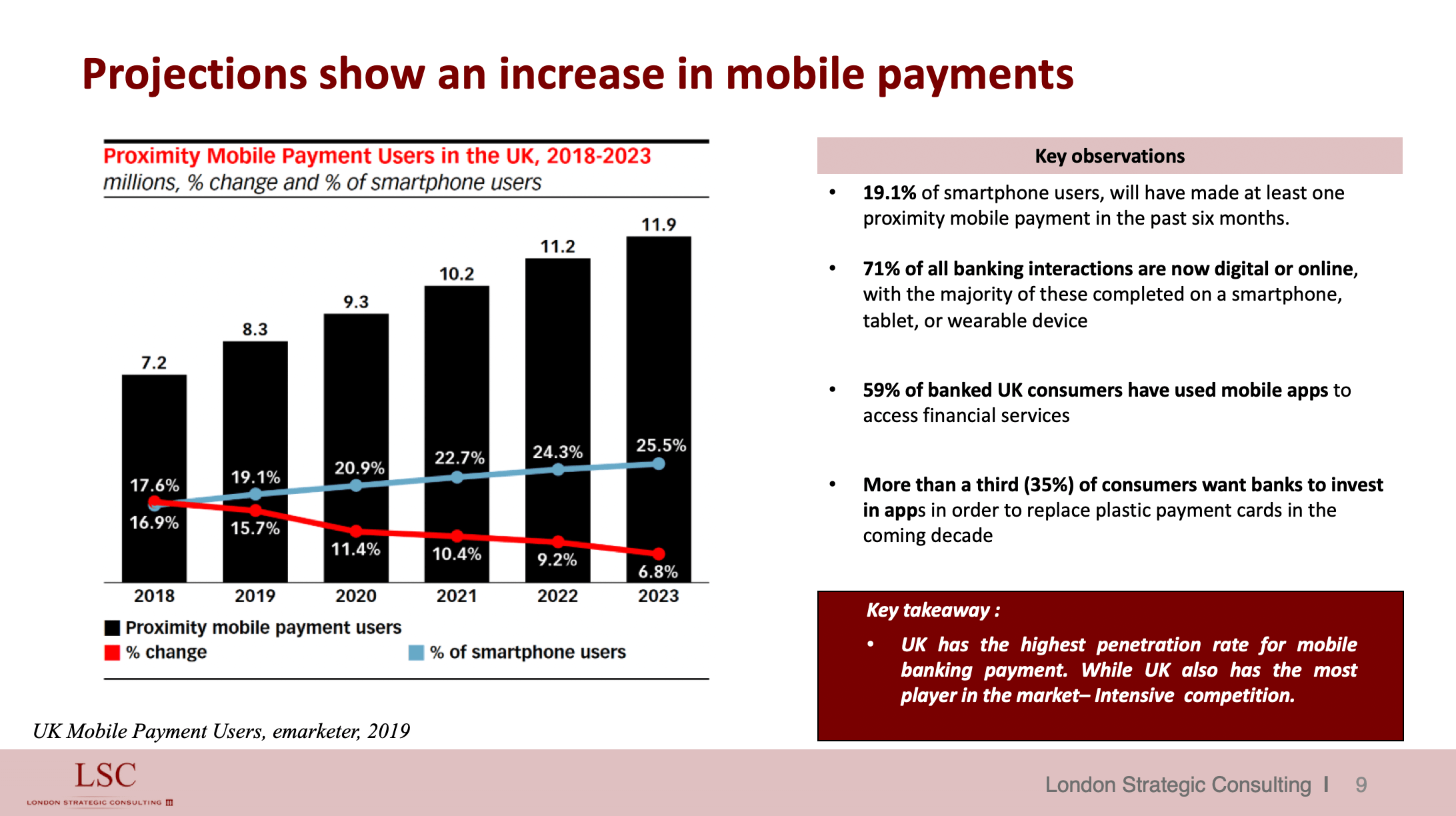

LSC took a rigorous approach to investigating an already existing online and mobile market, its competitor landscape and user needs across the aforementioned countries. According to LSC, the majority of European countries under scrutiny in this research tend to manage their finances online, not abandoning traditional payment methods though. The overall growth is slow for online and mobile payments in Germany but the prognoses reassure that it is to be amended by 2025. It seems that only the British and Dutch population have been extremely caught on by the prospects of online banking as the projections are showing a significant rise in mobile payments. With online banking, people can save their time by not waiting long queues and perform daily tasks in the comfort of their own homes just by securely logging in to the right app.

When talking about low adoption rates, LSC mentions Germany and Austria where cash payments still prevail. Generally, young researchers relate this to high concerns about data protection. Having indisputable security and increasing popularity, blockchain appears to be an attractive solution. Smartee online banking service is a complex of fundamental features to satisfy consumer needs and grant a stress-free experience with your money. Smartee will accept multiple fiat and digital currencies, allows transfer, currency exchange, and cash withdrawal. What’s more, also you will be able to utilise a cashback function and earn by saving 10% or more from your monthly income.

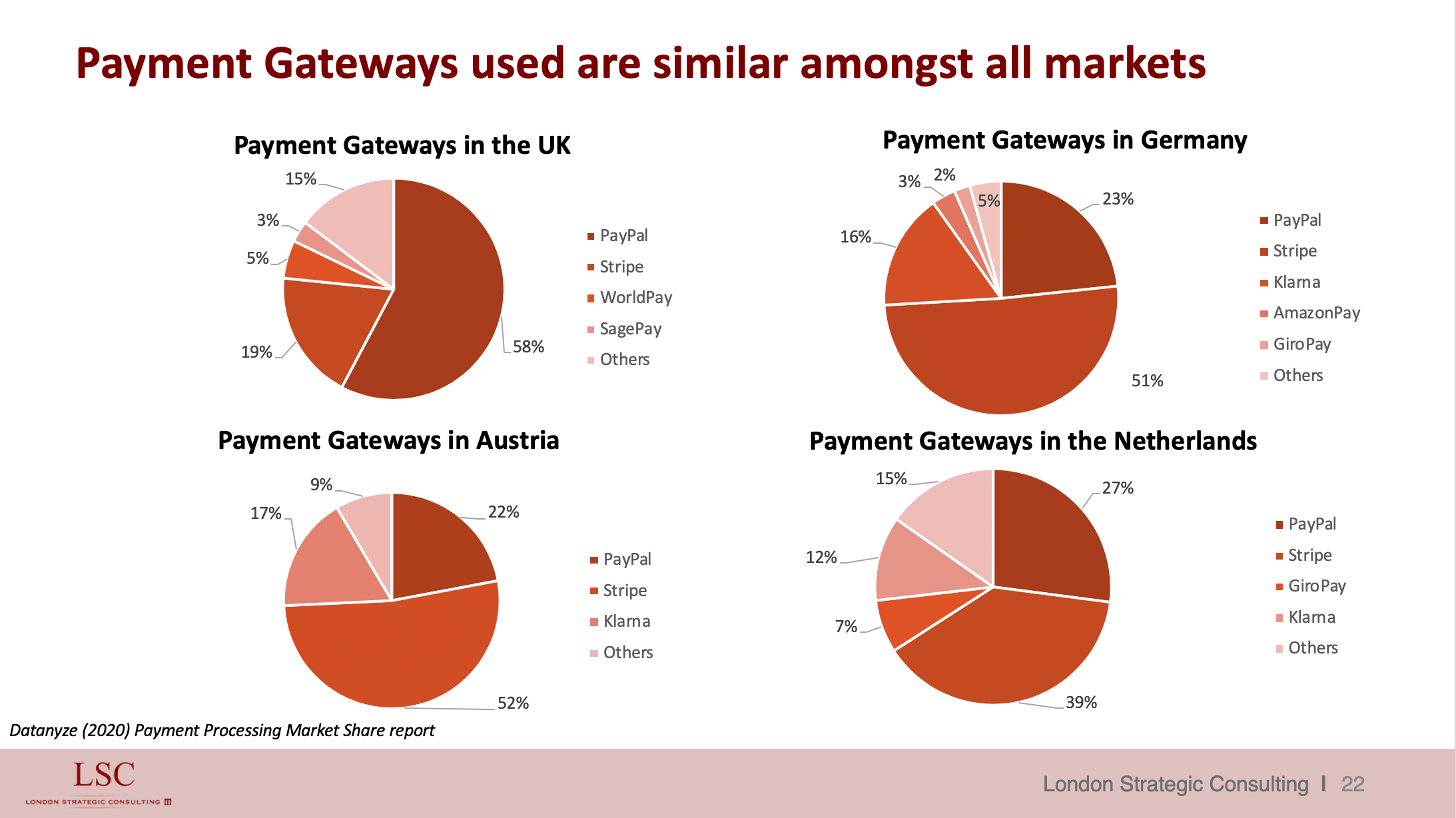

We asked LSC to scrutinise the traditional payment gateways used presently, and they did a fantastic job. Having compared market leaders in Europe, PayPal, Stripe, and Klarna tend to be the leaders. To add, multiple currencies and universality are the pillars of PayPal popularity. The space of digital payments has got numerous payment gateways with relatively similar features exposed to a consumer. Thus, the research has proven a well-structured product with ample features that facilitate one’s time-saving habits, ease transaction workflow and integration to merchants’ platforms, provide multiple currencies and statistics, with no or minimum fees, is becoming increasingly popular, especially at current pandemic times and during a worldwide lockdown.

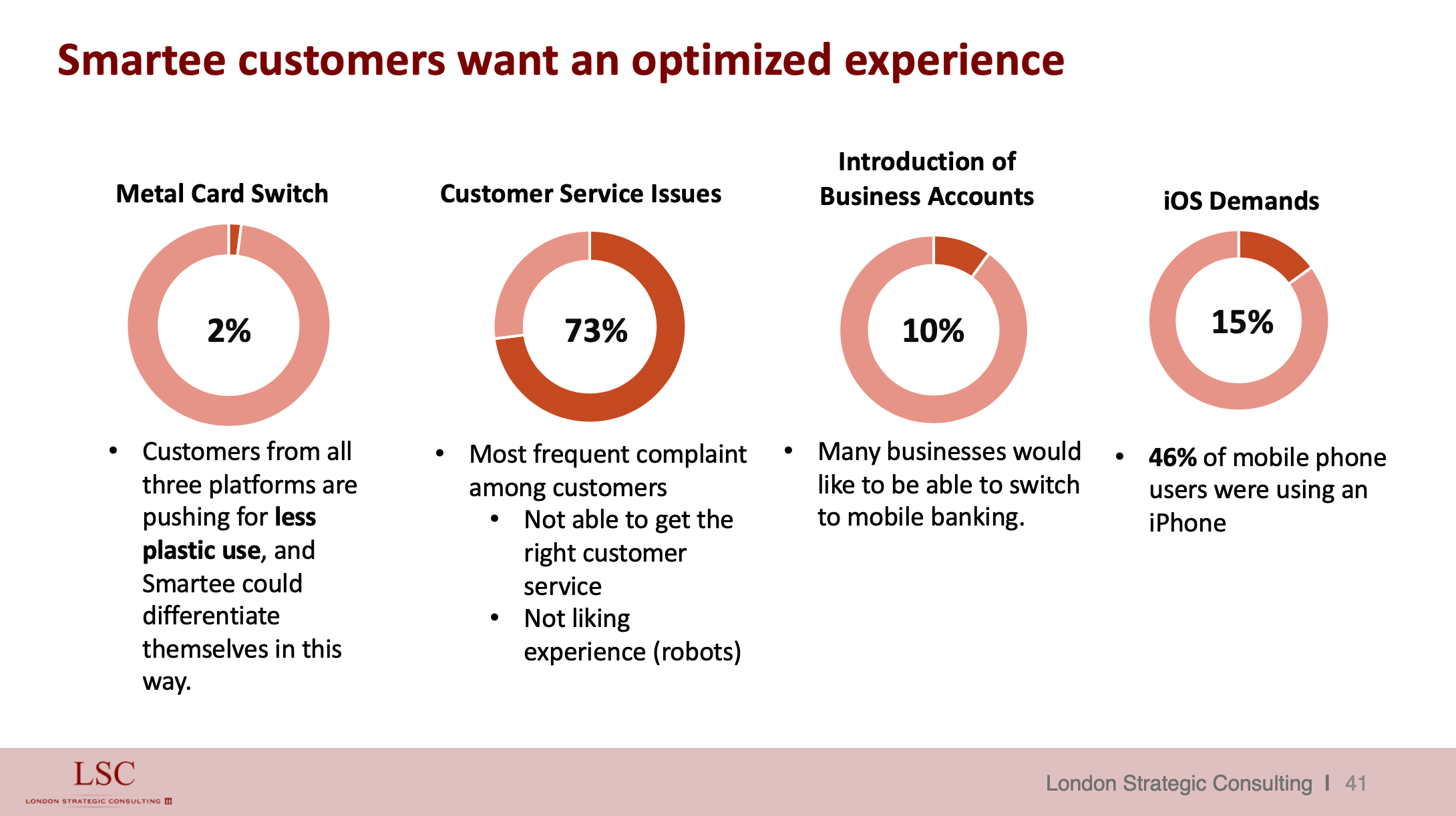

Further, the team has developed and presented product features that could meet the demand of the Smartee target audience. Interestingly, some of the proposed features like issuance of metal cards and p2p loans, have already been added to the Smartee development backlog. One more proof that we are on the right track! During the presentation, the team stressed on the necessity of developing a strong customer support platform to effectively manage inbound requests, as this might be one key differentiation point for Smartee.

Finally, as a result of the conducted market and competition analysis, LSC proposed three milestones communication should be based on. Namely, they suggest that Smartee:

- Continue building community-based communication

- Highlight the security aspect of the product

- Underline sustainable and responsible company image

Below we present some extracts from the presentation made by LSC.