Staking Economy: Implication of PoS Assets in Decentralised Finance

Probably, one of the most exciting parts for our community with regards to transition to Smartlands Network is associated with the validators and staking. Staking is quite a new concept in general and there is still no clear consensus on the most effective structure in terms of liquidity for token holders, network resilience, etc. Ability to earn network rewards (including and mainly inflation) through participation in consensus creates a strong stimulus to stake tokens, though it comes at cost of network restrictions (unbonding period) that forces holders to jeopardize liquidity that is crucial for basically any blockchain asset. Such situation leads to the appearance of many different solutions to get liquidity despite technical restrictions of blockchain networks ranging from just holding your tokens on an exchange (that runs a node and distributes network rewards), to sophisticated investment strategies with the use of token derivates. Seemingly useless inflation becomes a driver to the appearance of the whole new segment of DeFi.

Chorus One, an operator of validating nodes and staking services on Proof-of-Stake networks, has recently released a dedicated report – the Liquid Staking Research Report – that perfectly addresses the issue. We encourage everybody from our community to find some time and look through the report. And here is why.

In the previous blog post, we have already delved into the question of securing decentralised networks. A quick reminder for those who skipped our previous blog posts, in Proof-of-Stake networks virtual assets are used as collateral to determine participants (“validators”) in the consensus process (“staking”). Given these assets are designed to incentivise and enforce appropriate behaviour of validators, protocols may need to be able to confiscate or destroy them in case of misbehaviour.

In the report by Chorus One, the authors discuss the implications of common restrictions used by current PoS protocols. If you are looking for a good source with systematization on desired characteristics for liquid staking, analysis on the solutions that centralised custodial entities can provide, and contrast-comparison of those with non-custodial approaches, we do encourage you to check the paper.

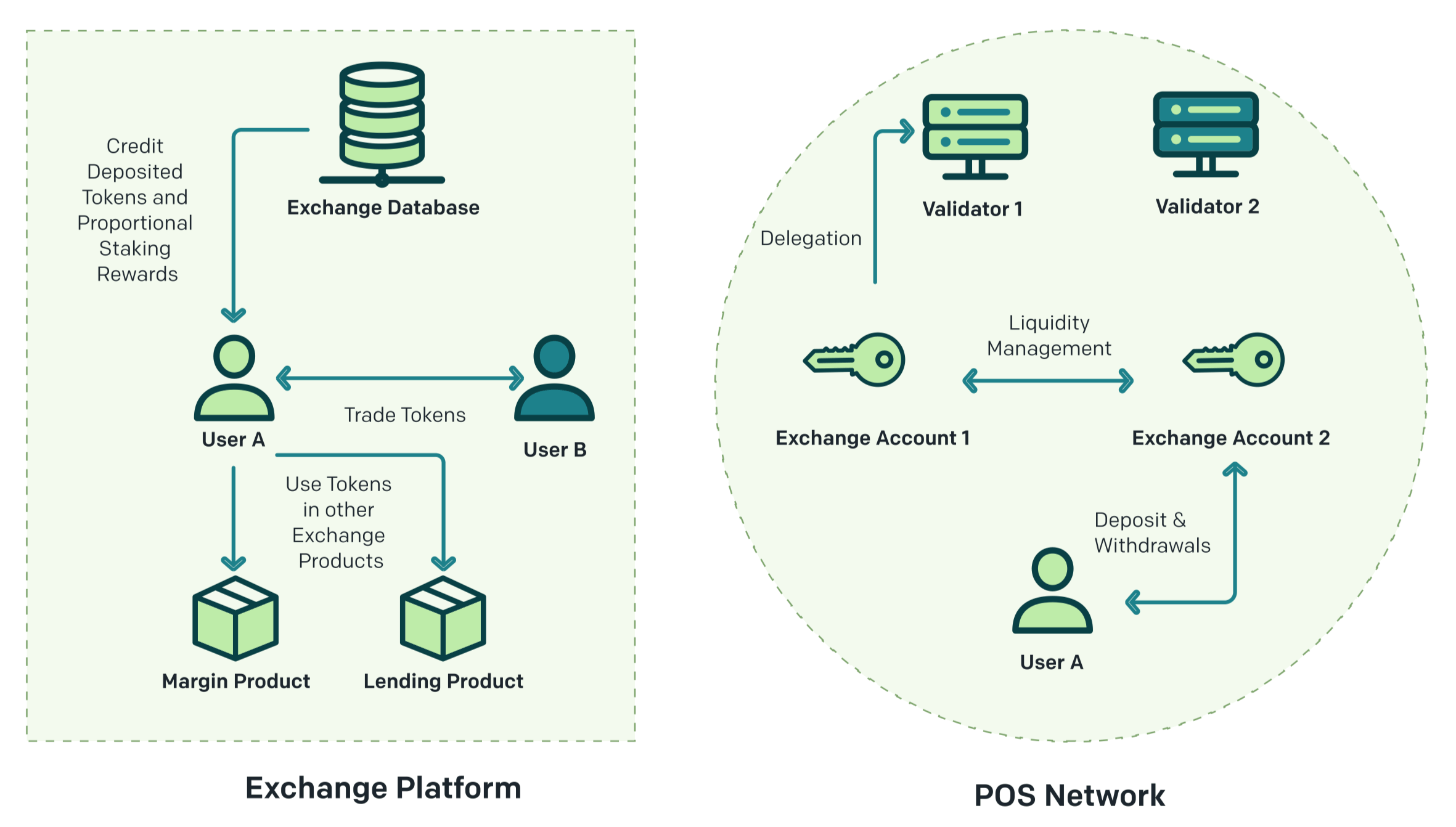

Exchange Staking Illustration, p.16

Speaking about the pros and cons, the authors believe that the most crucial risk associated with PoS networks is exchange staking. This due to exchanges have rapidly gained market share and accumulated staking assets on their platforms. If this continues, the outcome is expected to be negative. They range from defunding community validators to decreasing network resilience to potential corruption of the governance process.

On the other hand, the technology can unleash a wave of rapid staking innovation.” Liquid staking offers composability, permissionless innovation, and an endless playground for experimentation”, – the authors claim. Further, it is getting clear that liquid staking is rapidly developing and is inevitable. PoS protocols should see liquid staking not as a threat, but rather as a tremendous opportunity that is able to accelerate innovation, encourage the development of new business models and provide a decentralised alternative to the ever-growing power of centralised exchanges.