Smartlands Сooperates with London Strategic Consulting to Assess Digital Securities Space in the UK

As a part of corporate social responsibility program, Smartlands cooperated with a student-run non-profit consultancy London Strategic Consulting to assess the digital securities space in the UK and provide a fresh perspective on the place Smartlands is destined to take in it.

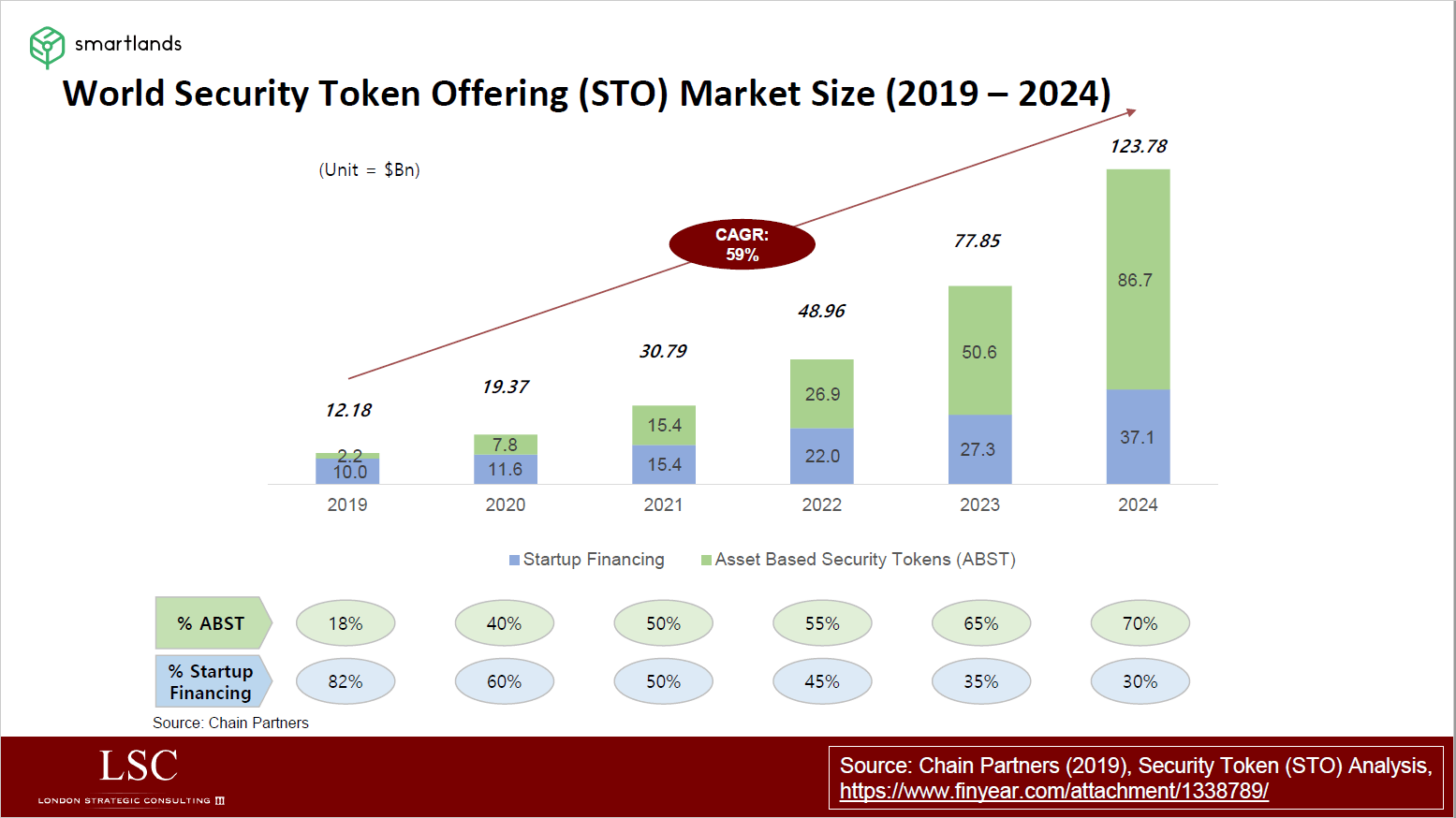

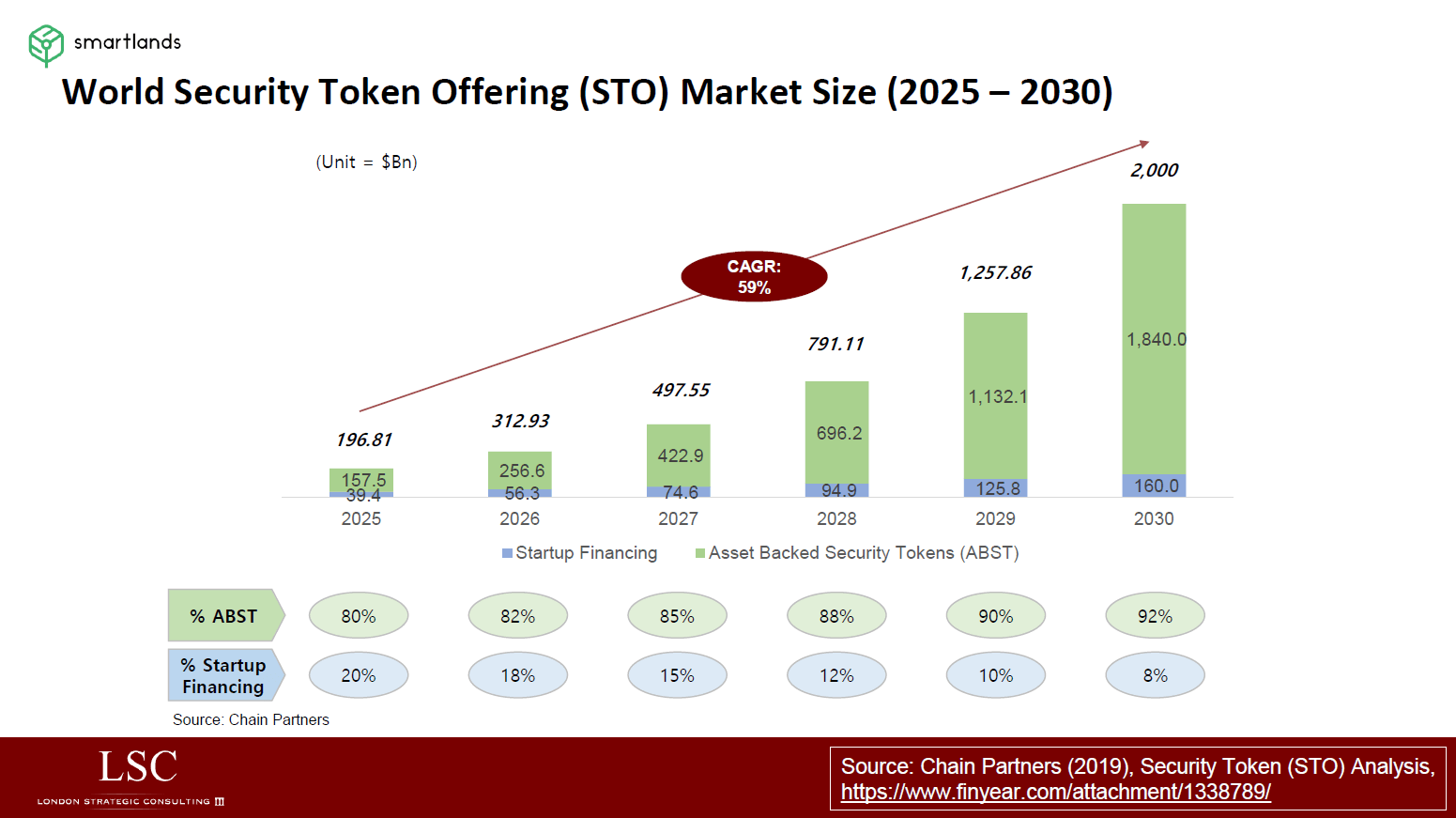

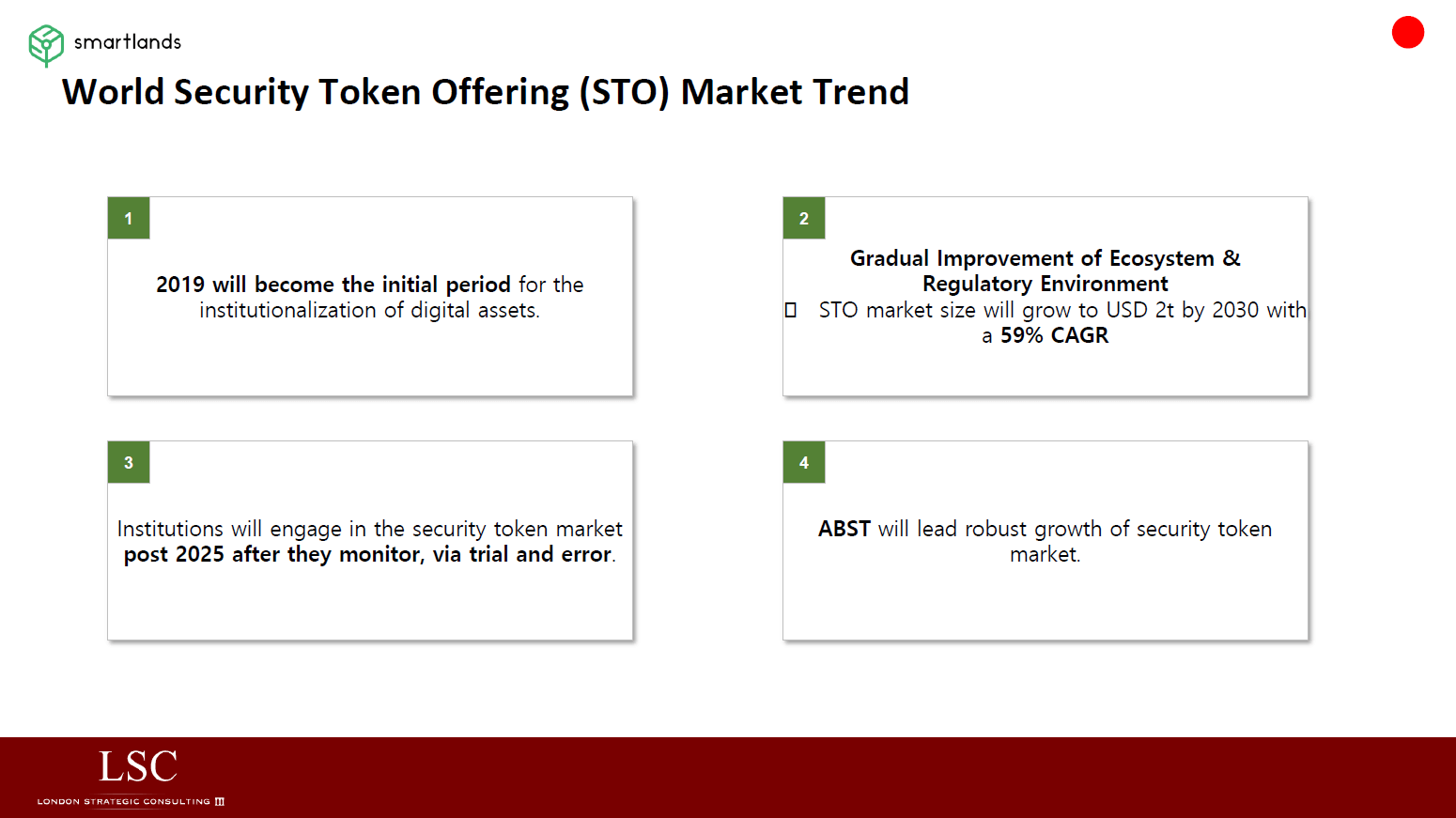

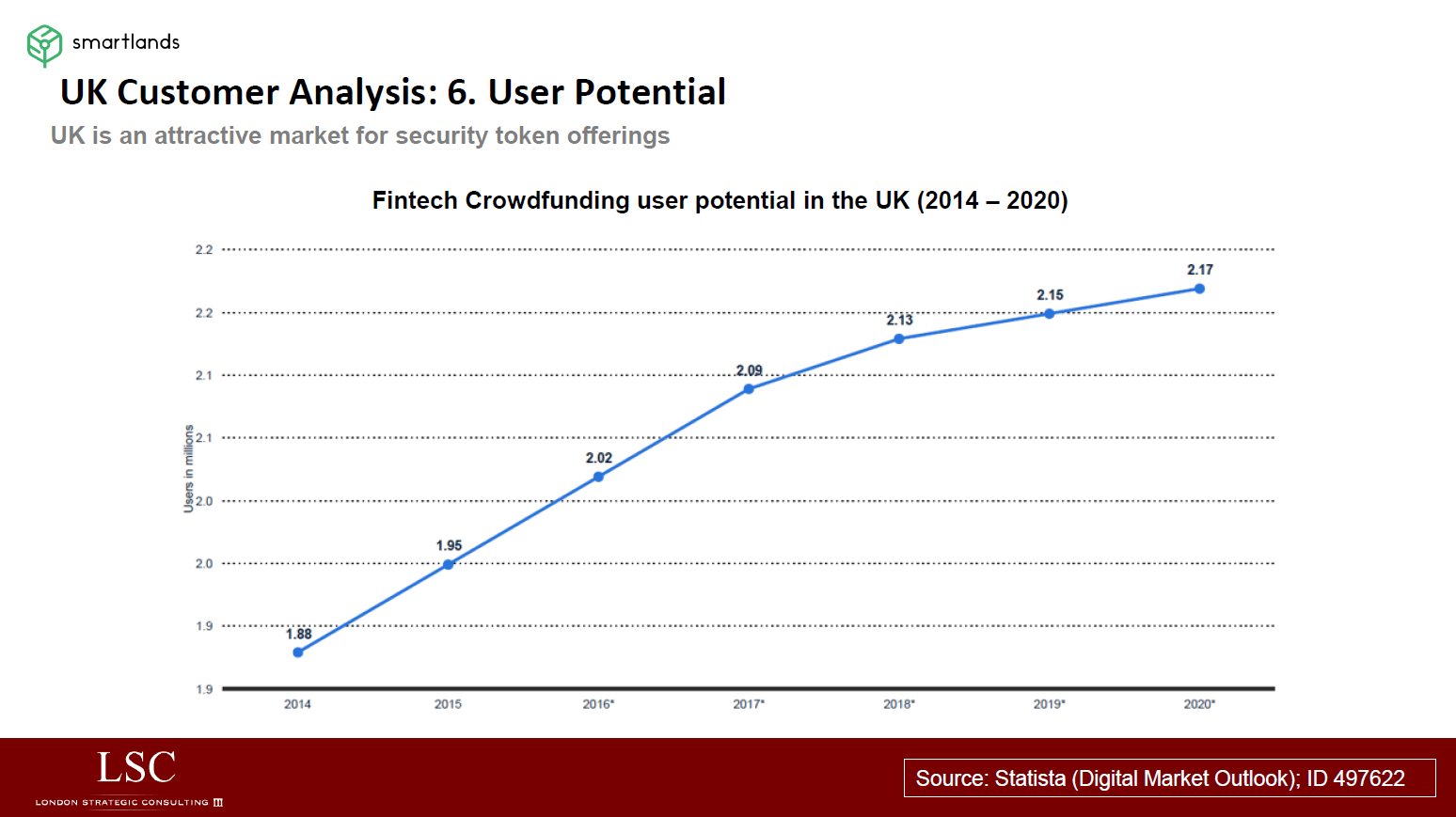

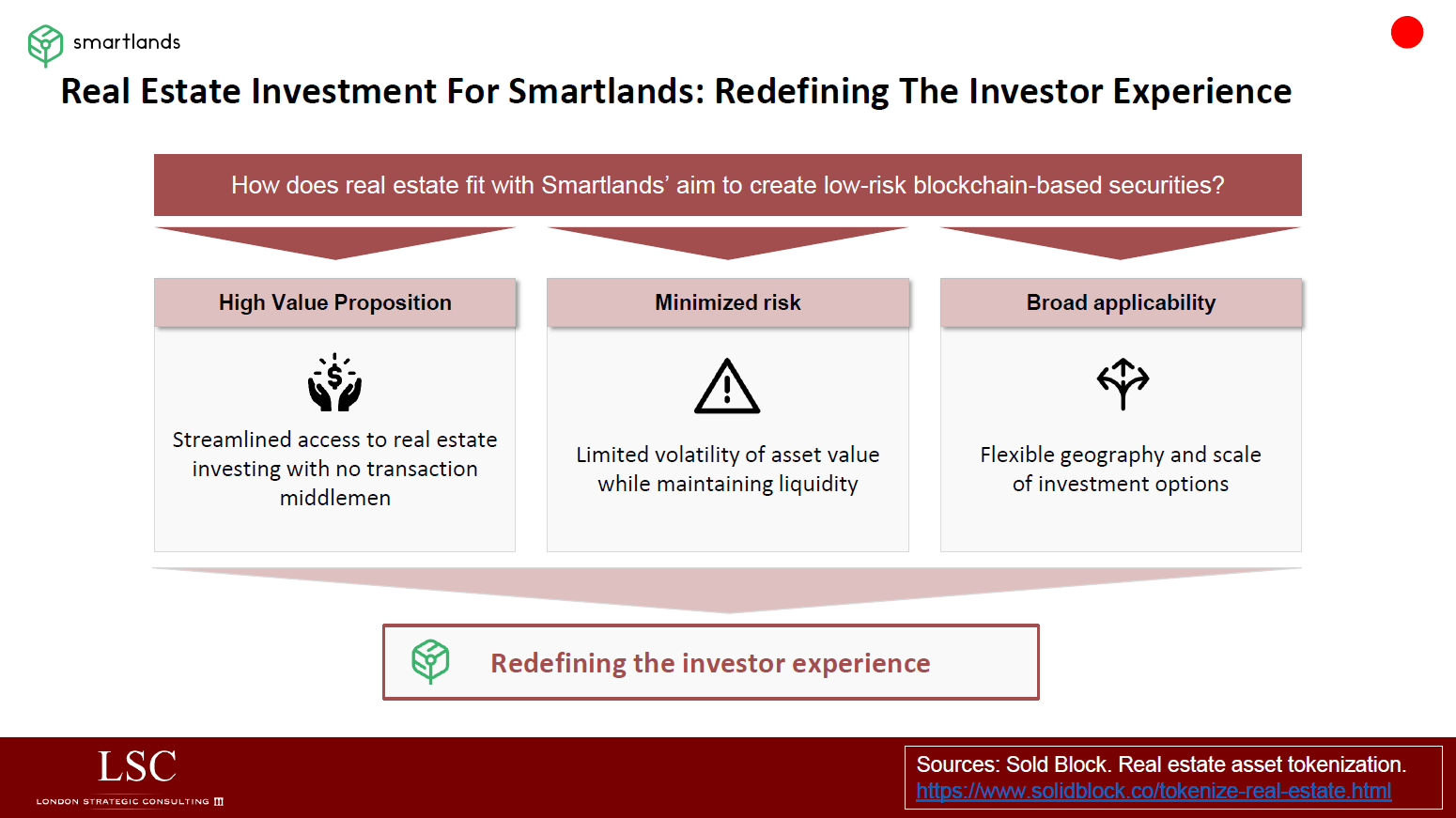

LSC showed keen interest in the Smartlands business model, displaying an impressive familiarity with the subject matter. According to LSC, tokenised securities are the next big megatrend of the blockchain revolution and will disrupt the UK financial sector decisively. LSC deals head-on with the issues of mass adoption by both issuers and investors citing a number of benefits blockchain-based digital securities bring into our lifestyle, creating an innovative new financing and capital raising model that delivers new efficiencies, scalability, transparency, while providing the level of liquidity evolutionary to traditional investments.

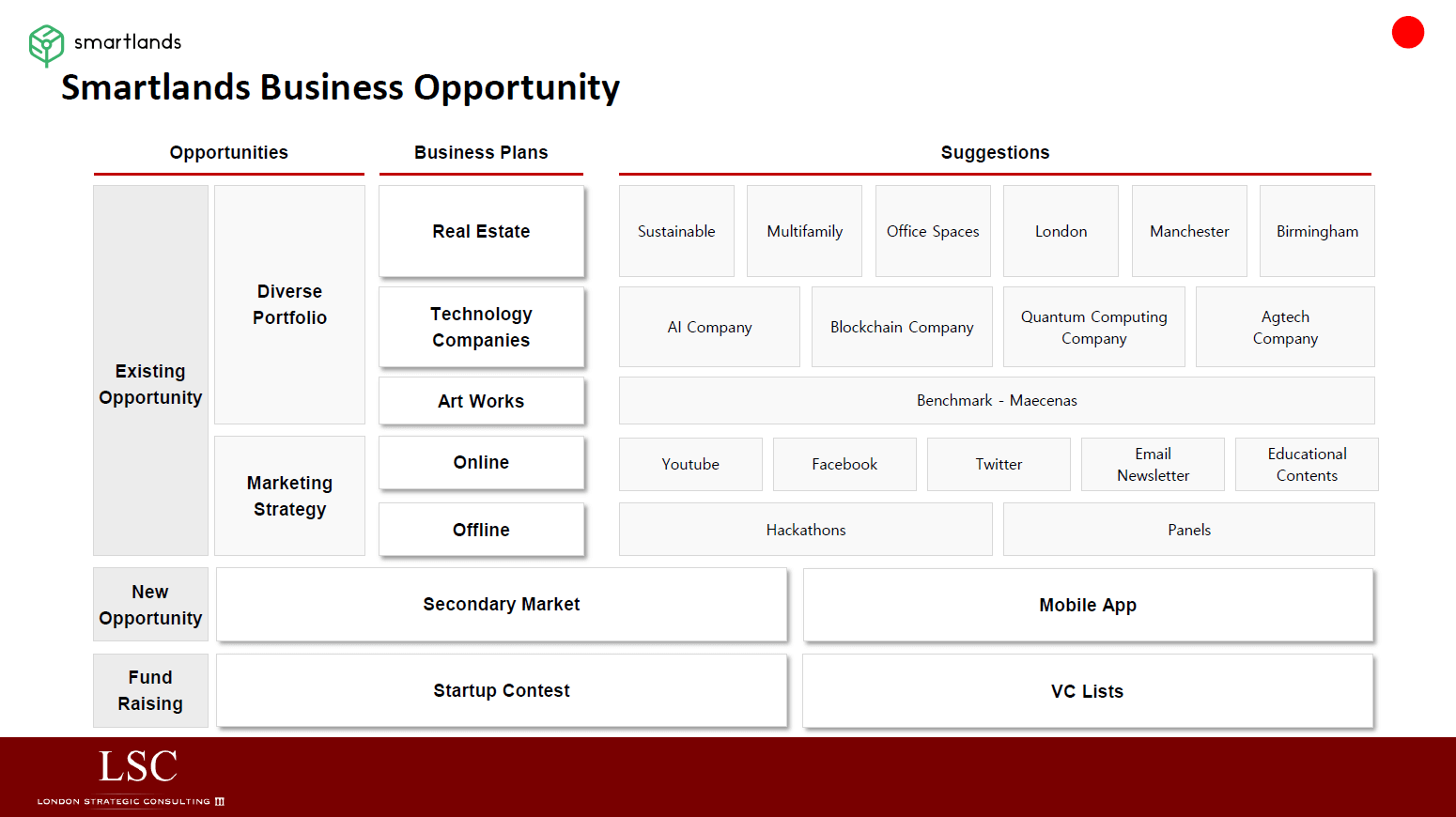

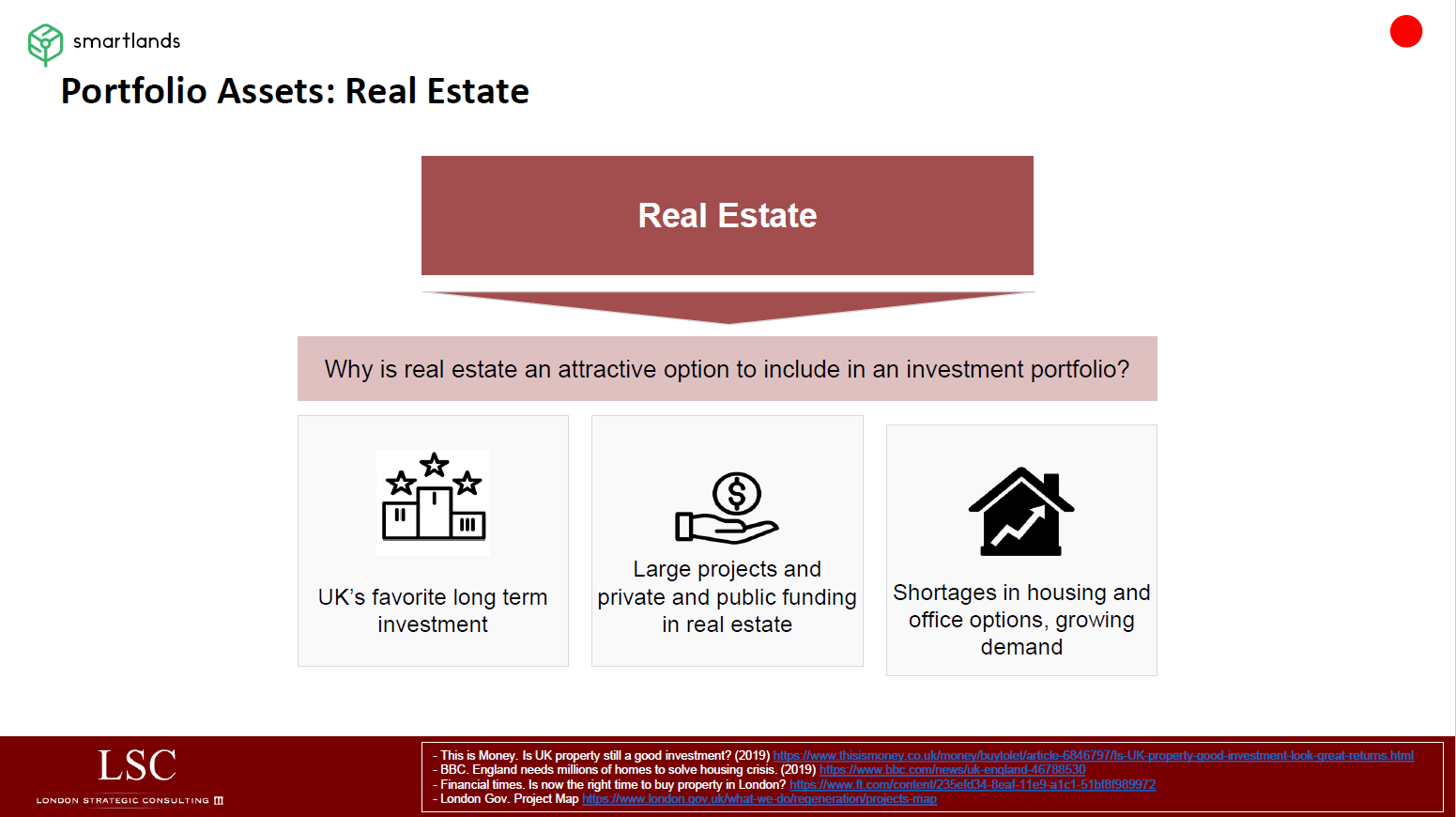

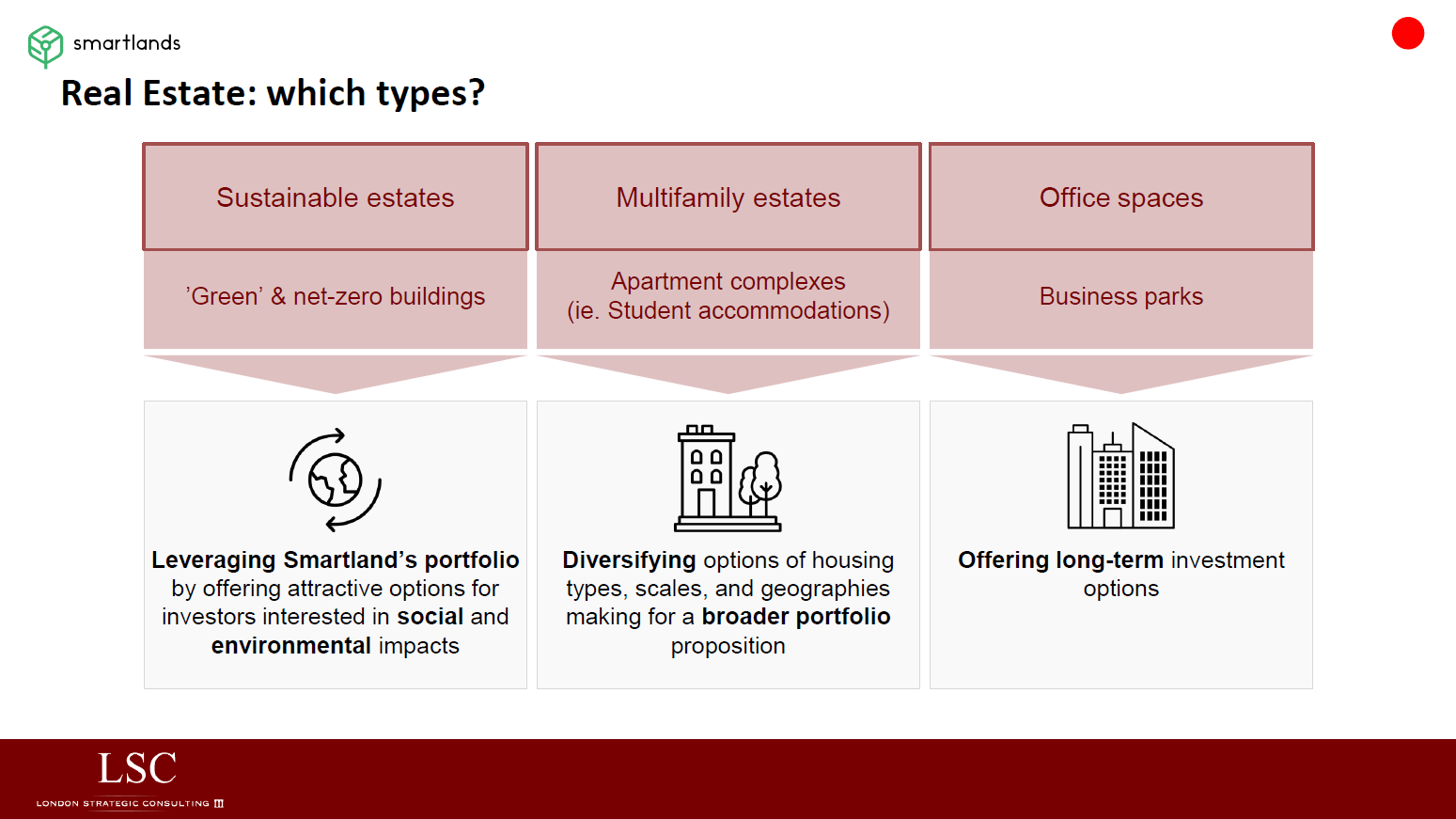

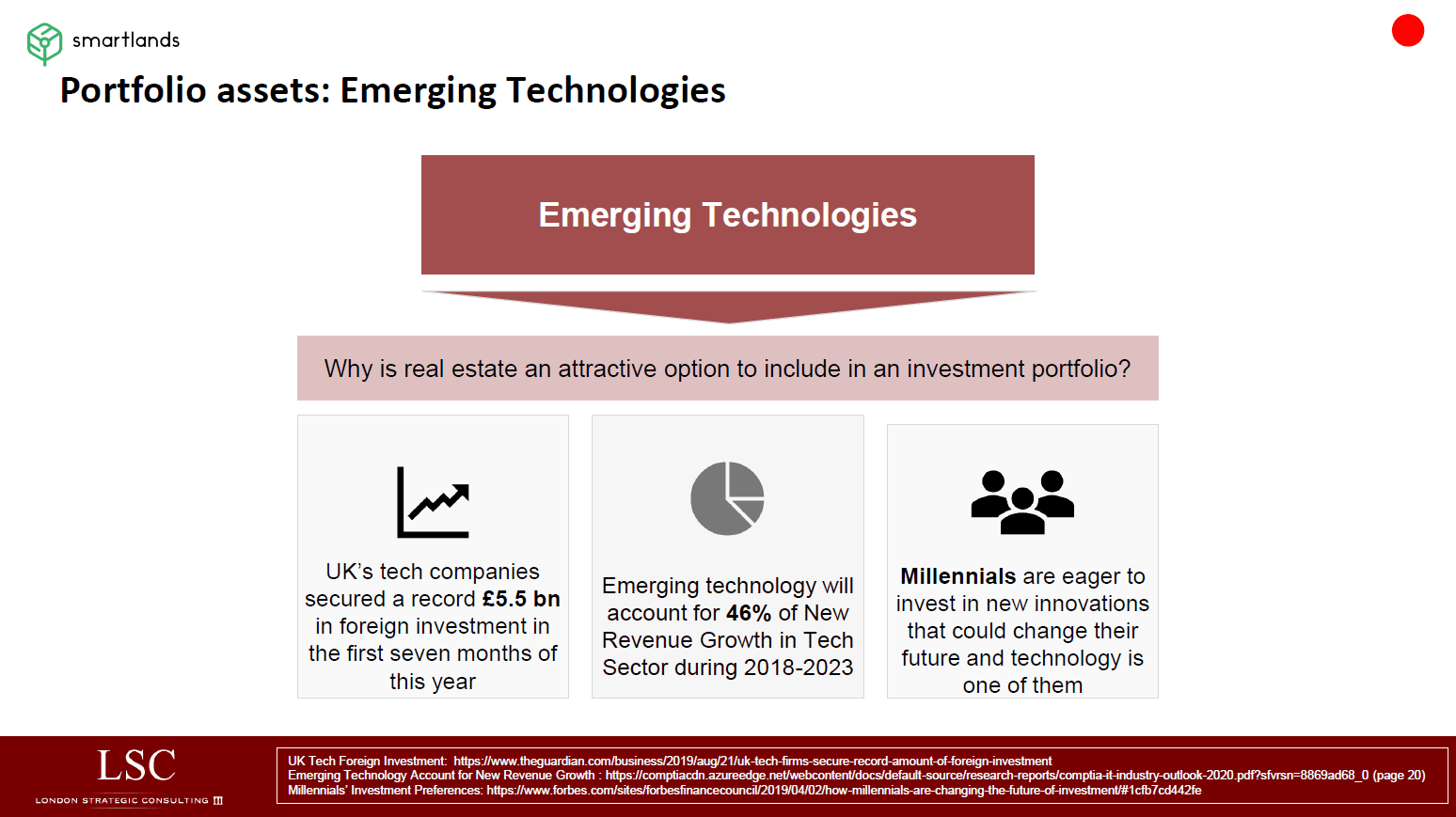

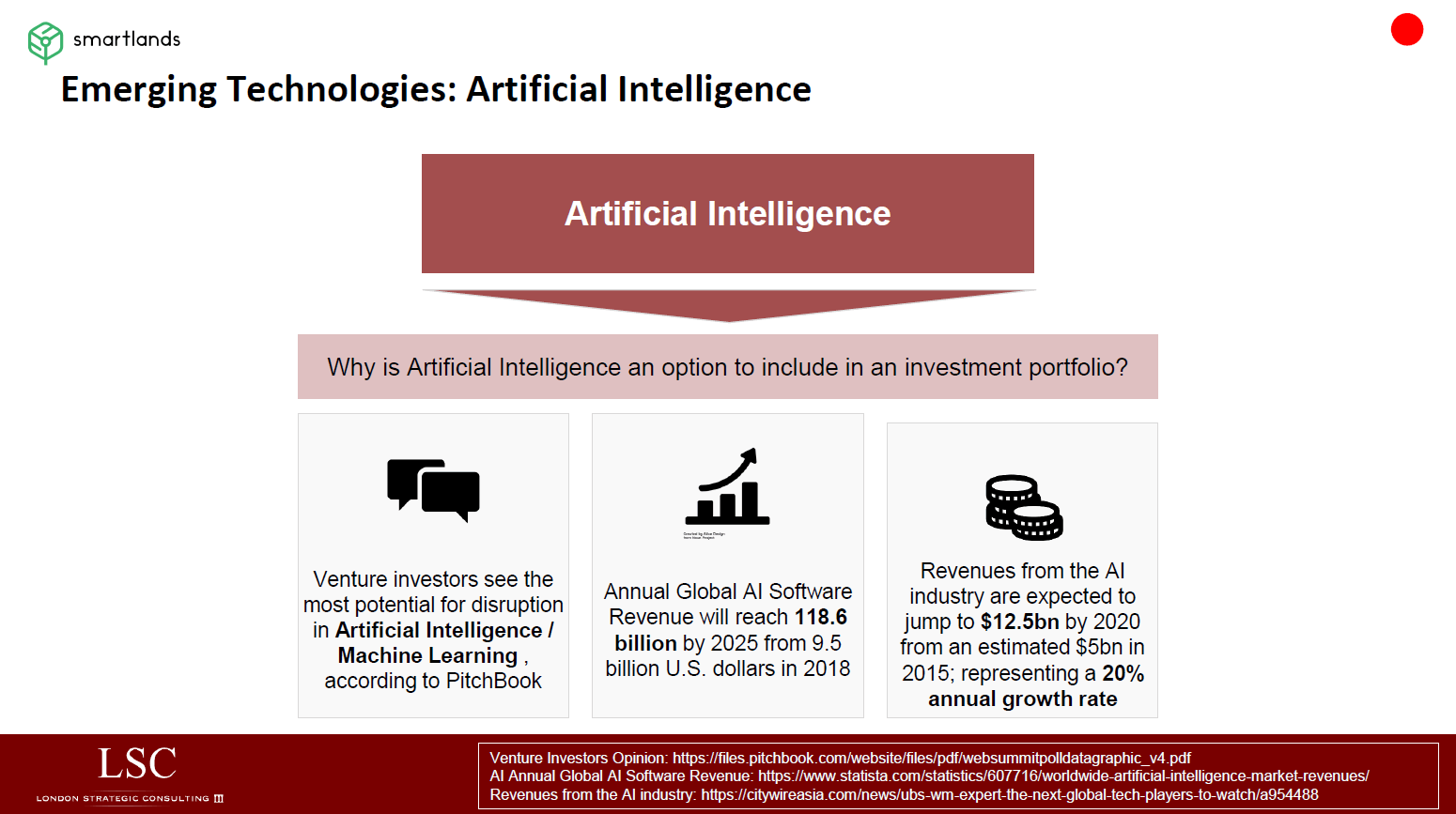

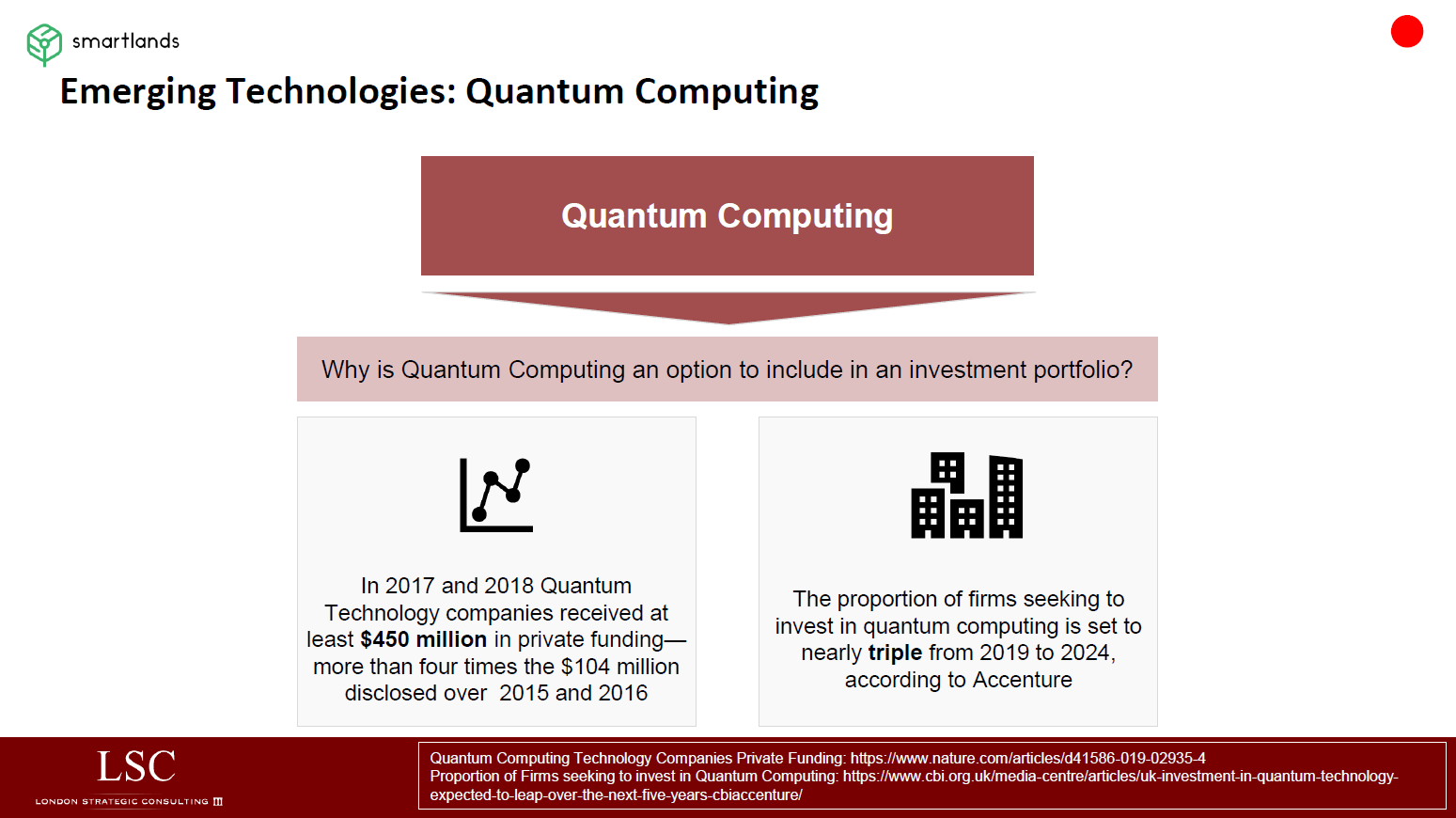

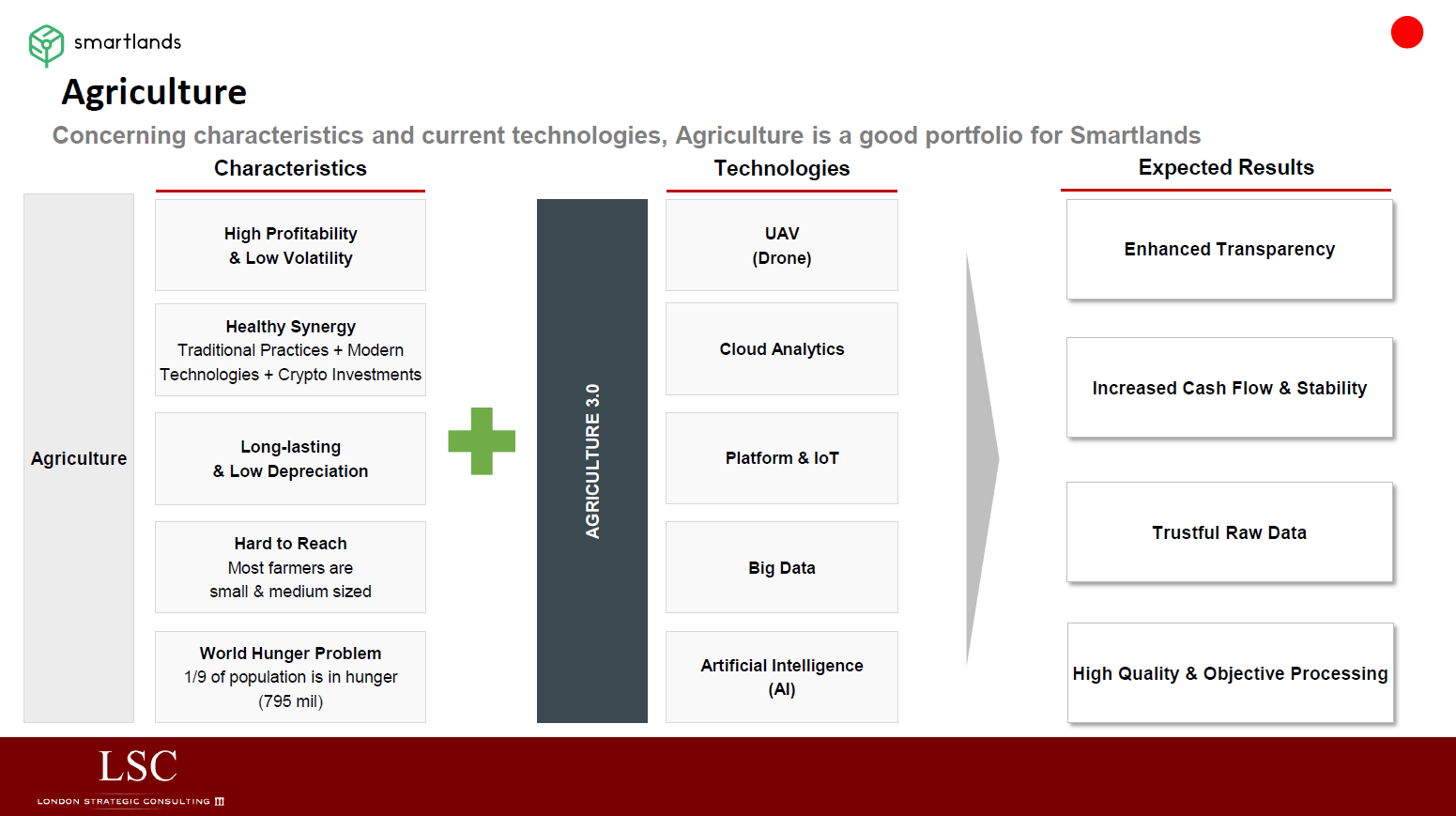

While it is at an early stage and the extent and timing of future adoption is still uncertain, the data gathered by LSC clearly supports the Smartlands belief that tokenised securities will impact traditional finance and act as a bridge between legacy finance and the new digital world, taking benefits from each. The research points out the sectors of the real economy Smartlands should focus on, explains why Smartlands as a market participant needs to be aware of some of the developments and key aspects of the end-to-end tokenised security lifecycle (i.e. structuring, issuance, distribution, primary listing, secondary trading, custody, portfolio management, advisory and market making) and how this compares to traditional securities.

The young sages at LSC show how some of the asset tokenisation trends could impact Smartlands and outline marketing practices we need to consider in the various stages of digital securities offerings. “To ensure a focused approach, the research primarily concentrates on UK, but tokenised securities that are intended to constitute traditional regulated securities such as shares and bonds are, clearly, a global trend,” says Yaroslava Tkalich, Smartlands CMO. “We’ve asked LSC to consider some of the factors relevant to tokenised securities that represent other types of securities such as interests in collective investment schemes (funds) and structured products, and the LSC analysts did a marvelous job at that.”

Below are some extracts from the final presentation provided by LSC.