Smartlands Platform Architecture: High-Level Review

London, Aug 21 ‒ Smartlands, a global platform for crowdfunding investments via the issuance of compliant digital securities, has reached the level of scalability that allows for simultaneous launching of multiple STOs at lightning speeds. This is made possible by the sophisticated project architecture consisting of 3 parts: Platform Core, SDK, and frontend applications. Let’s have a deeper look at the Smartlands Platform components and the way these elements interact.

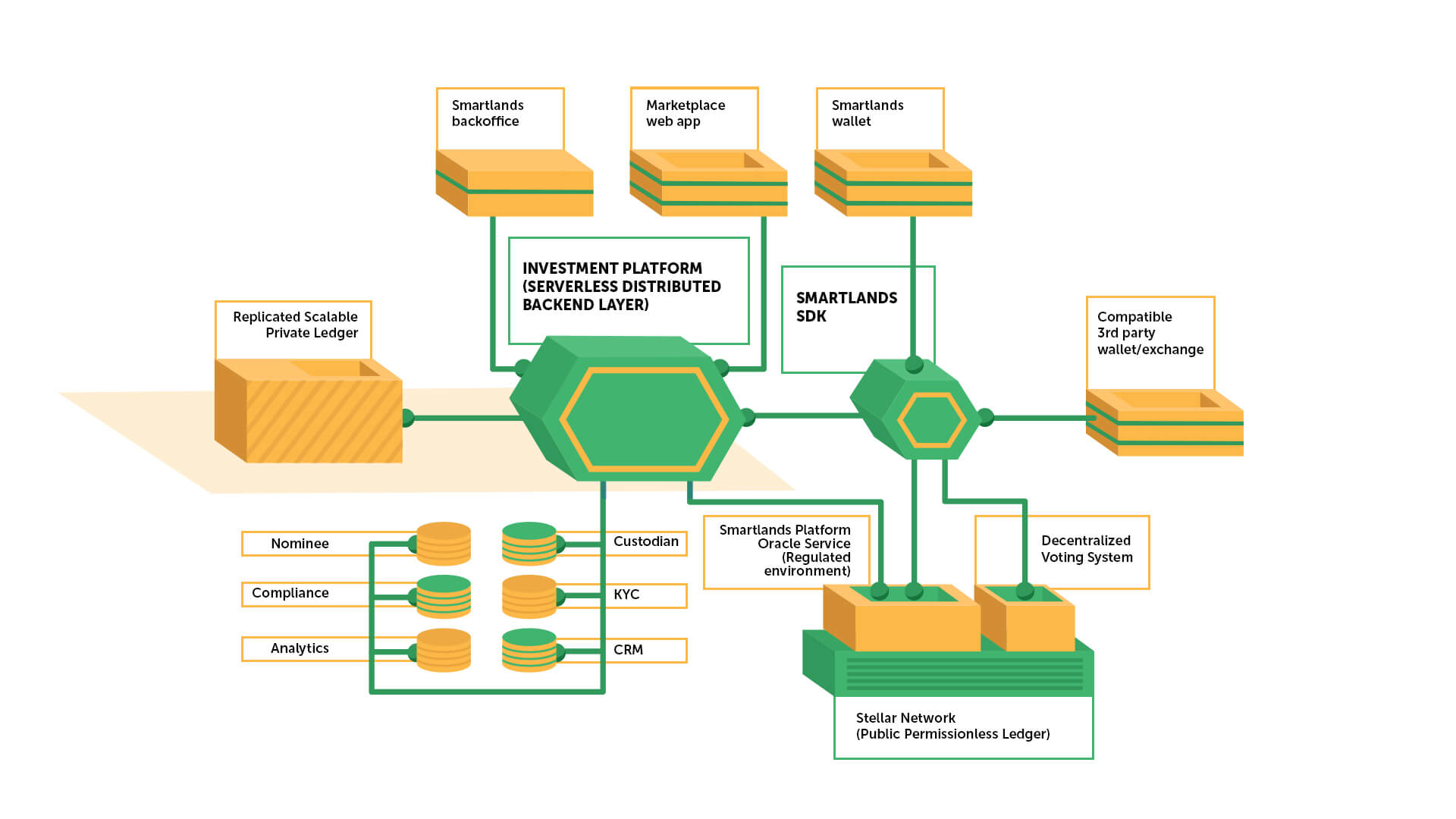

The Smartlands investment platform core (serverless distributed backend layer) is the backbone of the entire system. It interconnects Smartlands private ledger with Stellar public ledger via the multiple programme layers of the Smartlands Platform Oracle service (regulated environment). The process is fully automated and integrated with compliance, nominee, custodian, AML and KYC services, which makes Smartlands a platform uniquely equipped for issuance and management of the complete lifecycle of any type of compliant securities at blistering speeds.

On the forefront, the Platform delivers a comprehensive SDK ‒ an API layer that allows various frontend applications (wallets, web interfaces, back office, on-chain governance, etc.) seamlessly integrate with multiple ledgers and third-party services. By creating an integrated SDK with the built-in programming interface and automated compliance, Smartlands is disrupting the decades-old legacy investing mechanisms facilitating faster onboarding and higher number of investors in all asset classes.

The entire process of transferring ownership is now done in seconds with a single invocation of a particular function from the cloud. Something that used to be very costly and take weeks (sometimes months) is now accomplished hassle-free at negligible costs thanks to Smartlands’ proprietary core technology.

“The majority of issuance platforms are busy creating new blockchains or smart contracts, but we come from the real world where interoperability of security tokens is not as important as the seamless integration and complete automation of legacy finance on the blockchain. In other words, Smartlands with its on-chain regulated segment developed in-house from the ground up is ready to enter the new era of securities issuance; soon our customers won’t even know where the speed, accuracy, and convenience come from. Click – and you, an accredited investor, own a tenth of a square meter of prime London estate, absolutely hassle-free and all compliant with legislation!” says Ilia Obraztsov, Smartlands CTO.

Smartlands is now working towards complete decentralisation of the core platform functions and becoming a fully automated AI-powered decentralised global investment ecosystem, and by 2022, the plan is set to execute. The company intends to launch the Smartlands Chain testnet in H2 2020 and by H1 2021 launch the mainnet with the proof-of-stake consensus mechanism.

By 2022, Smartlands will become technically proficient enough for complete automation of token issuance, audit, underwriting and custody. The ecosystem will have a life of its own, in which Smartlands native token SLT, unlike the bulk of existing cryptocurrencies, is projected to be part of the real economy functioning as settlement vehicle for tangible underlying assets tokenised on the Platform.

“We’ve managed to create a simple program interface and automate an extremely complex mechanism for compliant fractional ownership,” says Arnoldas Nauseda, Smartlands CEO, adding “Today, whether you’re looking to raise capital for your business, invest in real assets or issue equity through a token offering, Smartlands possesses the technical expertise and the means to do it quickly, seamlessly, and on a global scale.”