Smartlands Platform Celebrates First Anniversary

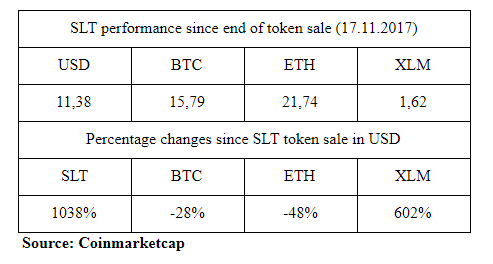

November 17, London, Level39 Building – Smartlands Platform, a global Platform for asset tokenization on the Stellar network, wants to congratulate the community with the First Anniversary of the Smartlands Platform. We want to take this opportunity to reflect on important milestones of Smartlands and share its most significant achievements with everyone who stood by us through thick and thin. Thanks to the vote of confidence from our beloved community, SLT has outperformed all major currencies, and the SLT price in USD grew over the year by whopping 1038%. Pegged against BTC, SLT is 15.8 times more expensive today than it was a year ago. ETH has suffered an even greater defeat from our “little token that could” at 21,7 times. Even XLM, which has also shown outstanding growth during the last 12 months, is slightly behind SLT (1,62).

November 17, London, Level39 Building – Smartlands Platform, a global Platform for asset tokenization on the Stellar network, wants to congratulate the community with the First Anniversary of the Smartlands Platform. We want to take this opportunity to reflect on important milestones of Smartlands and share its most significant achievements with everyone who stood by us through thick and thin. Thanks to the vote of confidence from our beloved community, SLT has outperformed all major currencies, and the SLT price in USD grew over the year by whopping 1038%. Pegged against BTC, SLT is 15.8 times more expensive today than it was a year ago. ETH has suffered an even greater defeat from our “little token that could” at 21,7 times. Even XLM, which has also shown outstanding growth during the last 12 months, is slightly behind SLT (1,62).

Smartlands Platform began its journey as Smartlands a year ago today when we first announced the results of our token sale on Stellar lining up behind almost 1300 of other projects. We had a long road ahead of us but right from the very beginning the idea, which we have successfully crowdfunded, was to create a legal framework and a trading platform for issuing and trading the Token of the Future, securitizing agricultural assets, both residential and commercial real estate, and industrial properties worldwide. With the either non-existent or extremely messy regulatory space, non-existing security token exchanges, the controversial reputation the industry had managed to gain for itself by the end of 2016, and the overwhelming support by our lovely community we’ve had our work cut out for us for months or perhaps even years to come. But it was crystal clear to us from the very beginning of our adventure that security tokens will quickly conquer the online investing space and will continue to have a significant investment potential in the market with high margins and low-risk assets providing expected returns identical to investment in equity. In short, we were on the right track.

In May, the Smartlands Wallet was added to the list of Stellar-based wallets on the official Stellar.org list providing additional capabilities for investors in assets issued on the Stellar decentralized exchange. After a long and grueling testing period, we’ve proved the capabilities and reliability of the Stellar network thanks to the rigorous use of the Smartlands Wallet, which now allows you to manage and trade tokens issued on the Stellar network.

Around the same time, Smartlands released the roadmap for creating a legal framework fully compliant with AML/KYC requirements for issuance of security tokens. This was a crucial step in finalizing the Smartlands business model, and we’re incredibly proud to announce that with the onboarding of one of the largest global law firms, CMS, the legal framework for assets tokenization is in the final stages of completion. The client-centric approach CMS takes to its vision and performance, as well as the firm’s deep immersion in the digital enterprise sector, is recognized by both Smartlands Platform and CMS as the foundational principles of the partnership.

Another major stepping stone of the past year was the Smartlands Platform’s collaboration with a global commercial real estate company, Colliers International – a top-tier global real estate services and investment management company. The goal of the collaboration is to explore the possibilities of the securitizing real estate in a digital world in general and creating a Stellar-based real estate tokenization project based on select properties sourced or managed by Colliers. “The global financial and commercial landscape clearly shows trillions of dollars’ worth of real estate ripe for tokenization and the digital entrepreneurship of the new post-ICO era of security tokens will have a significant impact on redefining wealth creation, investing, fundraising, and a host of other Internet-based commercial activities. Colliers is pleased to cooperate with the Smartlands Platform who appears to have a perfect grasp on asset tokenization on Stellar,” said Ramune Askiniene, CEO of Colliers International Advisors in Lithuania commenting on the collaboration.

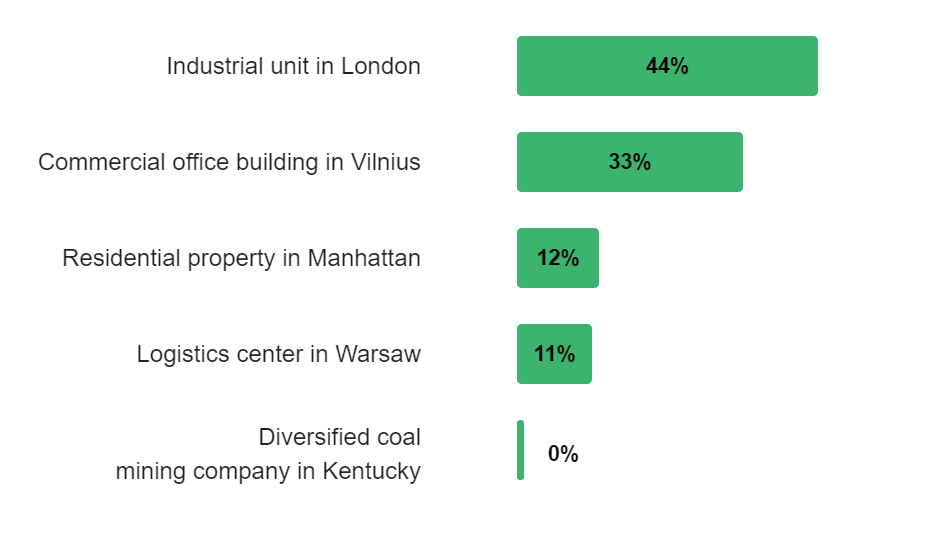

It took us a cool year of sweat and tears, of building partnerships and developing software, losing nerve and finding courage to finally get to the point when on October 31st we were able to stand tall and announce the community vote for the pipeline of five meticulously curated projects ideal for an investment underwriting and a fully KYC/AML-compliant tokenization on the Smartlands Platform. The vote by the community gives us a clear direction, and we’d like to thank you all once again for your participation and confidence in our continuous efforts.

Throughout the first year, Smartlands had managed to open offices in Vilnius and London gathering under its banner a superb team of true-blue technologists and proponents of the blockchain. With their help, we had launched a beta version of the Smartlands Platform creating an ecosystem of partners with expertise relevant to the upcoming first asset tokenization. We’ve introduced a blockchain-based voting system on the Stellar network that will be used for decentralized management of the Smartlands Platform by the SLT holders. The companies issuing their own security tokens on the Smartlands Platform will have their qualified investors vote on pertinent issues. We’ve also developed a majority of modules for regulating the environment on the Stellar network.

We’ve crystalised the legal framework for issuing security tokens on the Smartlands Platform and trading them on the Stellar decentralized exchange with the onboarding of CMS lawyers. The non-binding community vote had followed, and we were able to narrow our focus on two projects suggested to us by the final results of the vote.

The entire year was one never-ending road show, in which our business development team headed by the Smartlands Platform CEO, Arnoldas Nauseda, went around the world participating in dozens of industry events, meetups, accelerators and conferences educating investors on the merits of asset tokenization and the advantages of the Stellar platform. The volume of response is so encouraging that we plan to organize the next Stellar meetup in London on December 7. Expect appearances by the representatives of Colliers International, CMS, Thistle Compliance Specialists, and others.

Our plans for the nearest future

- Within a month, the registration for the first investors in the security token offerings will be opened.

- The revamped version of the Smartlands Platform will be presented before the year’s end. The Platform is designed to be fully compliant with the EU KYC/AML requirements and will feature several new exciting features and services for the convenience of both investors and token issuers.

- We’re at the final stages of selecting a custodial partner and a licensed platform for fiat-crypto-fiat exchange.

- We’re almost at the finish line before the introduction of the renewed legal working mechanism of the Smartlands Platform. Together with our partners, we’re almost done perfecting the processes of issuing and purchasing of tokens in the United Kingdom. Furthermore, considering the upcoming Brexit in terms of innovation and cryptocurrency investments in this new space, we are developing a legal framework in Lithuania for the EU region. This will require some extra push given that the legal frameworks in the UK, the rest of Europe, Asia, and the Americas vary drastically. Nevertheless, the Smartlands Platform team is ready to go the extreme lengths and invest heavily in both time and money to create a workable technological and legal arrangement that will satisfy the authorities in all of our intended markets, hedge the risks for our investors, and launch the platform on time.

- We’re in the process of opening offices in Singapore and New York, USA.