Smartlands Platform STO Fee Structure Explained

The SLT token is a utility or access token created and operated by the Smartlands Platform Foundation incorporated in and subject to the jurisdiction of the Cayman Islands. The Smartlands Platform Foundation is an independent entity from Smartlands Platform Ltd. Smartlands Platform Ltd bears no responsibility or liability for the operation, availability or security of the SLT token.

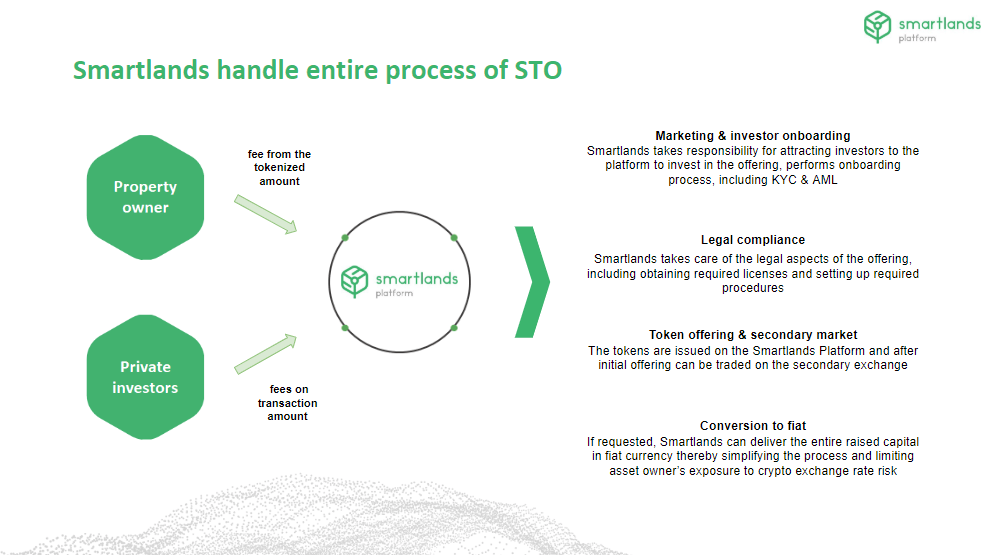

One of the most popular queries in all of our communications channels with our community is how do fees work on the Smartlands Platform. Excellent question. In the past, we’d somehow managed to skip over the part when we explain the fee structure utilized by the Smartlands Platform and now we finally come to our senses and gladly remedy the situation.

Indeed, there’s an informational gap here that needs to be filled for all to understand the role fees are playing on the Platform fully. For instance, it’s still kind of a mystery to many of you what are “investor fees,” who pays whom, and why.

So, instead of sending you off to Google, we’ve put together a special little FAQ to once and for all clear our communal table from those pesky head-scratchers that make our lives so miserable at times. Hopefully, we’ll answer your fee-related questions in one shot and raise your confidence in Smartlands to a new level.

SLT holding requirement (fees reserve)

You will notice in a minute that Investor fees in one way or another tied to SLT. Indeed, the FAQ distinguishes the Smartlands Platform’s native token from almost any other utility token in circulation used for payments or unlocking access to projects or services. But why is it required to hold a certain amount of SLTs? I mean, most of us live in free countries, no?

The function of the SLT holding requirement is essential for the Smartlands Platform because, pure and simple, it guarantees all payments. This certainty begets predictability of the Smartlands Platform’s cash flows, which, in turn, means sustainability of growth. With the SLT holding requirement in play, investors plan their campaigns better, knowing that they can count on the SLT’s well-pronounced liquidity that continuously stimulates the demand for the token and protects both investors and the Platform from market fluctuation. In other words, using SLT for covering all operational costs is a fast, safe and secure way of paying for things on the Smartlands Platform. You’re welcome.

There are three levels of requirements for holding SLTs.

Preserving your SLT balance on the Base level is a requirement. If your account balance drops below Call Level, the Platform will automatically offer to buy more SLTs to reach Base level. The drop below Penalty level will result in a cut-off. You won’t be able to operate on the Platform, and a penalty (requirement to burn a certain number of SLTs) will apply based on the amount due.

Apart from what’s required, holding SLTs do wonders for the token’s price appreciation. Consider: the total holding requirement of SLT is dependent on the total fiat value of security tokens on Smartlands Platform. If a price for SLT decreases, the investors in securities will have no choice but to increase the number of SLTs they hold to balance their accounts (it’s required, remember!), which will drive up demand during downfalls. Should the SLT price appreciate, the investors will be keen on releasing a few tokens into the open market. This framework is designed to protect investors against pump-and-dumpers and other less savory schemes for the SLT price manipulation.

And of course, the cherry on top: investors who hold more SLTs than required are going to enjoy kingly discounted fees on the Smartlands Platform continuously.

Investor Fees

We should point out that the fees mentioned here are not the only ones on the Platform. In fact, the list is long and boring, but it’s crucial to familiarize yourselves with it. However, we feel that it’s the topic for another discussion. Let’s talk about what you as an Investor can relate to the most – investor fees.

Investor Fees are payable in SLTs only (talk about the importance of holding enough SLTs in your wallets to cover all fees of each ongoing offering!). They are calculated as a percentage of the value of shares of each offering you acquire. Naturally, those fees are bundled together and embedded in the code for ease of calculation and transactions but here are the few that we feel we should break down for you today.

STO Access fee

If it is your intention to invest in an STO, you’ll be required to acquire a certain number of SLT tokens. The fee (paid in SLT) of 2% of the value of the acquired shares will be charged. If your account holds sufficient SLT balance, it will be used to pay the fee. Otherwise, the appropriate amount of your payment is spent to buy a corresponding amount of SLT. Now you’re all set to start investing in securities on the Smartlands Platform. And, again, in order to do that, you are required to hold a certain amount of SLTs.

An example of an STO investment transaction depicting application of the STO participation fee and the Base level holding requirement:

You want to buy 10K GBP worth of security tokens during an STO. The SLT price is 5 GBP. STO access fee in GBP: 10 000 x 2% = 200 GBP Fee in SLT: 200/5 = 40 SLT Additionally, you’re obligated to acquire 1% of the amount of the offering in SLTs to remain on the required Base level (10 000 GBP x 1% = 100 GBP, in SLT: 100/5 = 20 SLT) Bottom line: a 10 000 GBP investment in securities will cost you 10 000 + 200 + 100 = 10 300 GBP

Make sure to retain at least a required amount of SLT tokens in your account at all times. The Base level SLT holding requirement is a perch from which you’re going to be evaluating STOs and participating in them with confidence. On the Base level all of the offerings on the Platform are revealed to you in complete detail, the fees are calculated off the amount of SLTs you designate to be involved in an offering; it would be a great disappointment to both you and us to get all of our ducks in a row only to find ourselves in the position to increase the fee amount on the fly causing unnecessary stress to you.

That’s it for now. Hopefully, we didn’t exhaust your brain needlessly, if so, feel free to drop us a scornful line in our Telegram chat or on Twitter.