Smartlands Platform Signs Partnership Agreement with Globacap

London, March 1, 2019 ‒ Smartlands, which is seeking to become a global platform for security token issuance, is pleased to announce a partnership agreement with Globacap, a UK-based blockchain security issuance platform specializing in enterprise-grade custody and administration solutions. Globacap is authorised by the UK’s Financial Conduct Authority (FCA).

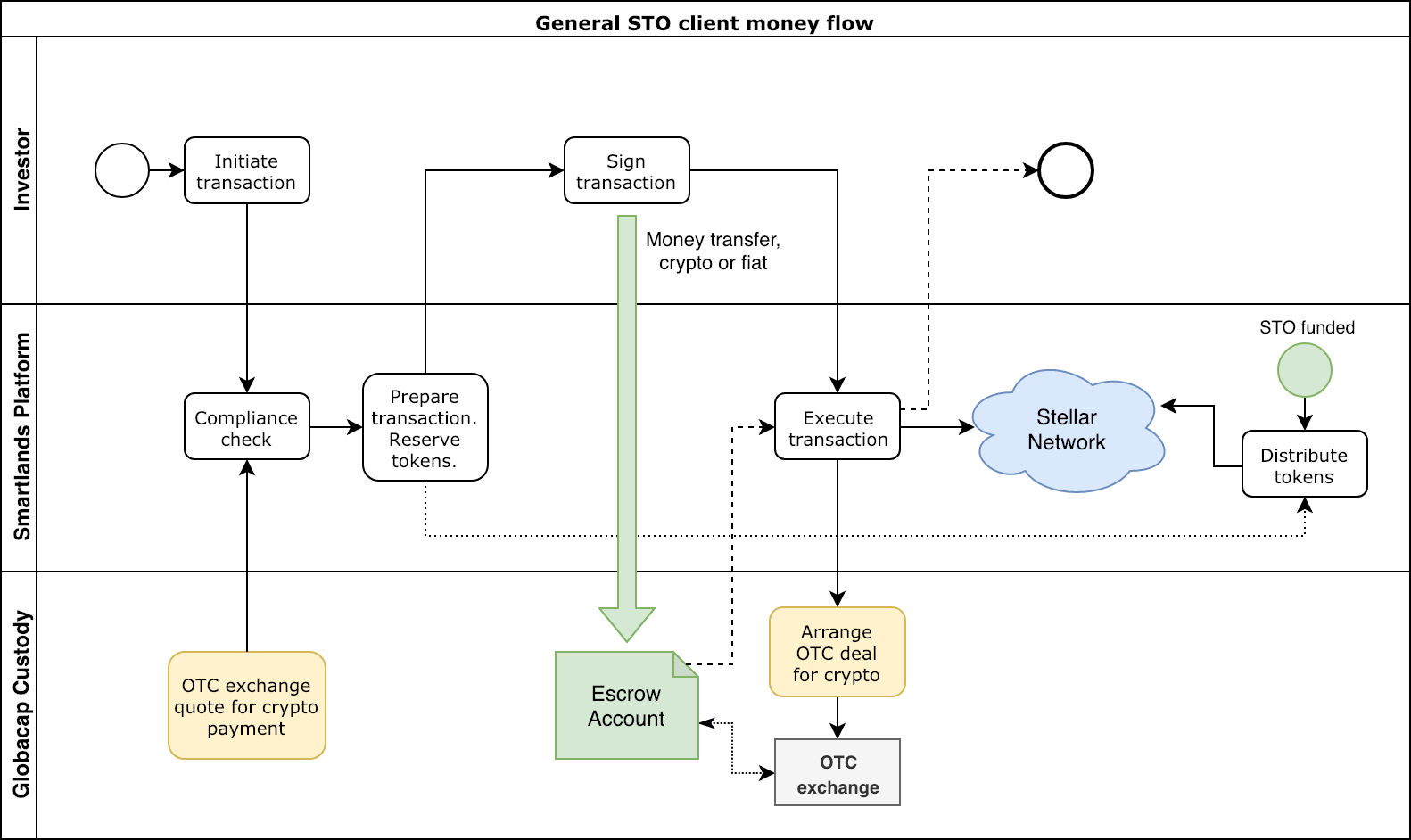

The partnership with Globacap will enable issuers on the Smartlands Platform to meet regulatory transfer agent requirements. Additionally, Globacap will safeguard customers securities/shares, conduct account administration, transaction settlements, distribute dividends and interest payments, and oversee foreign exchange operations on Smartlands platform.

“An essential benefit of the deal is that Globacap has direct access to OTC exchange markets for immediate, fast, and fair crypto-to-fiat conversion regardless of the volume. For instance, if a refund is required, Globacap will seamlessly exchange fiat back to XLM, minimizing cryptocurrency price fluctuation,” comments Smartlands Platform CTO Ilia Obraztcov, adding that “Globacap also offers accounts in multiple fiat currencies protecting global investors from unfair interbank FX rates.”

How it works

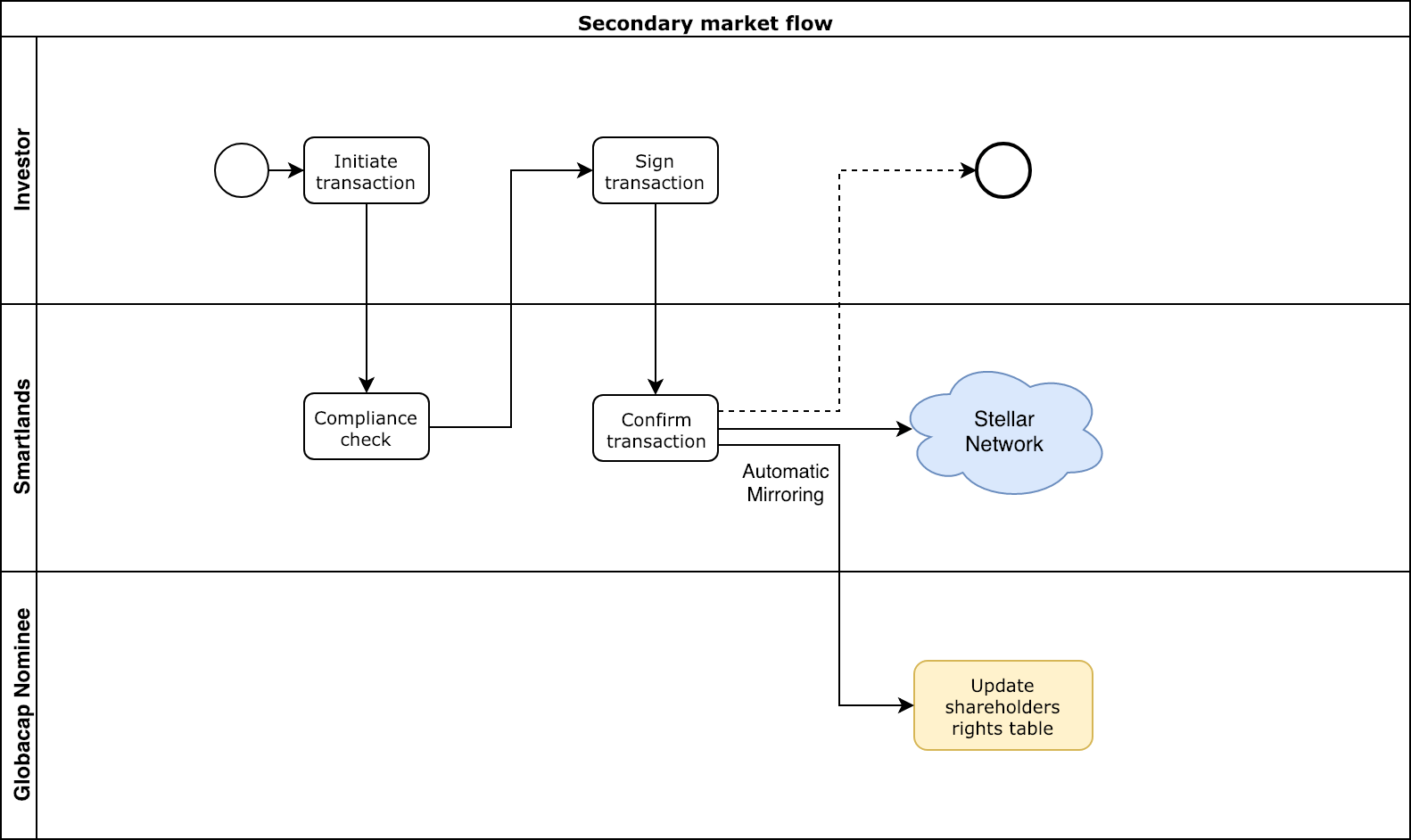

Once an security token offering is concluded and security tokens have been distributed, Globacap as a Nominee on Smartlands Platform will execute shareholder rights following the vote conducted on the Platform during shareholder meetings. In the future, trades executed on the Stellar Network (regulated segment) can be immediately and immutably documented in the shareholder rights table for investors’ legal protection.

“With Globacap, we have put the last piece in place for the big game,” says Arnoldas Nauseda, Smartlands Platform CEO. “Globacap’s blockchain-based innovations and firm grasp on the realities of modern financial markets will help Smartlands focus on our main goal: creating a mechanism for investors the world over to invest in the UK commercial real estate as well as other lucrative asset classes, receiving dividends in stable cryptocurrencies with settlement in seconds, close to negligible fees, and at a future stage easy cross-border transfers.”

Globacap

Globacap is an automated capital markets platform for digital securities, with a focus on administration and custody, and is FCA regulated. Globacap issued the first tokenized equity as a direct shareholding while part of the FCA’s regulatory sandbox in September 2018. The automated platform simplifies and streamlines the administration of securities, including distributions and corporate actions.

Smartlands Platform