Smartlands to Tokenise Investment Fund Focusing on Precious Metals

Even simply listing all endeavours in which we, humanity, still rely on gold, silver, and what’s called PGM – platinum group metals – is going to take a massive effort. Today, as always, it’s all about the diverse functionality of precious metals – from gold’s continuous role as the oldest unit of account in our civilisation to the most advanced hard-to-pronounce industrial applications. Also, let’s not forget the men and women of the world who insist on cherishing the age-old tradition of seeming pretty through self-adornment with multiple types of jewellery.

In other words, if you remember Moor’s law, no matter where we go as a species, we are going to continue to build. We may face a few setbacks along the way, but the need for gold, silver, platinum, iridium, palladium, ruthenium, and rhodium is nowhere near a slow-down.

That’s why investors have always been attracted to this particular commodity. And that’s why Smartlands plans on taking another step in developing its global investment ecosystem by tokenising the Fund that will acquire physical gold or shares of a relevant Exchange-Traded Fund (ETF).

The upcoming project will entail tokenising £5,000,000 equity pool in the UK-based Fund aiming to acquire bullions of precious metals or shares of ETF representing such bullions in the most efficient manner.

The Fund’s return will follow the return of the basket of the precious metals as indicated in the table below, less expense rate. Historically CAGR return over the last 20 years of such basket was 7.4%, though past performance is not indicative of future results.

| Metal | Share |

| Gold | 70% |

| Silver | 20% |

| Platinum group metals | 10% |

Acquisition of shares in the Fund provides an opportunity to benefit from the current standings in the commodities market.

Gold

In the course of human history, one of the most critical roles that gold has played is that of money – a medium of exchange, a store of value and a unit of account. With the advent of modern paper currencies, gold lost is role as a medium of exchange and a unit of account; however, until the collapse of the Bretton Woods fixed exchange rate system, it continued to play a role of a real anchor over which all other monies were valued. Beyond its ornamental and industrial usage today, gold seems to have lost most of its monetary role, only playing the role of a store of value – an investment. However, a careful analysis of the dynamics of gold price points to the fact that, whenever the dominance of the major currencies of the world has been challenged, either by way of geopolitical events, such as wars, mayhem and political turmoil or by the devaluing effects of inflation and balance of payment problems, we have seen a resurgence in the role of gold.

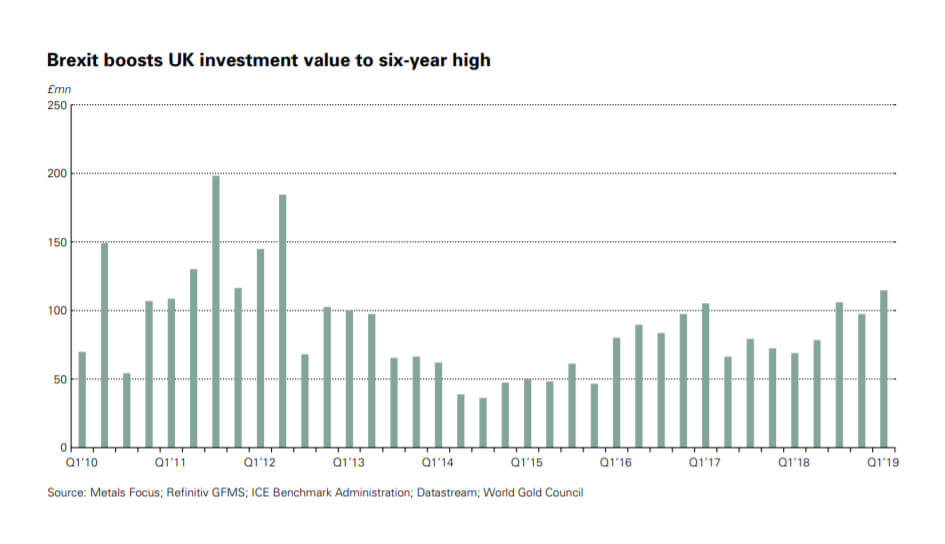

Significant influences on real gold prices come primarily from historical events that either reinforce or challenge the economic dominance of the US and the role of the dollar in the global monetary system. We had witnessed one instance of gold prices rising sharply in 2011 during the debt-ceiling crisis in the US when gold skyrocketed to an all-time high of $1,917.90 an ounce on August 22. The current US-China trade war, Brexit, Hong-Kong protests, Iran sanctions and the occupation of Crimea by Russia are all contributing to the risk of global turmoil resulting in the economic downturn that may fuel the rising demand for gold worldwide. Another long term source of gold demand is discontent with US policies: both Russia and China are stocking up on gold (China has not been buying gold since late 2016 until late 2018, but added almost 100 tons to its reserves since it resumed purchases in December 2018).

Bar and coin demand rose 10% to 44t as investors became increasingly aware of the slow-down in economic growth, a heightened possibility of a recession, and continued political risk.

In terms of consumer and financial markets, the demand for jewellery and a steady demand for gold as a means of long-term investment currently account for roughly 90% of gold consumption worldwide, while the other 10% is allocated for industrial use.

The industrial demand for gold, which comes mainly from dentistry and electronics, has been declining over time. However, the sociocultural factors that sustain the market for jewellery in Asia, primarily in China and India, who enjoy their healthy economic growth, have also ensured a stable demand for physical gold in the world. In fact, China and India lead the rest of the world by far, consuming annually almost a thousand tons each. Notably, China being the largest gold producer on the planet, covers less than 50% of its consumption with its own production.

The demand for gold as an investment has been increasing over time and quite dramatically so from 2002. Investors are mainly interested in gold bars and coins, and since 2003 the gold Exchange Traded Funds (ETFs) have also been a positive contributor. Additionally, low-interest rates for US Treasuries push away investors who resort to buying gold as a safe-haven asset. According to Citigroup Inc, all of the factors mentioned above may very well rally the prices for gold to a record $2,000+ an ounce in the next two years.

Note that historically, gold prices had periods of high volatility, which may have a positive correlation with the price action for other asset classes (stocks, bonds, commodities) during a financial crisis.

Silver

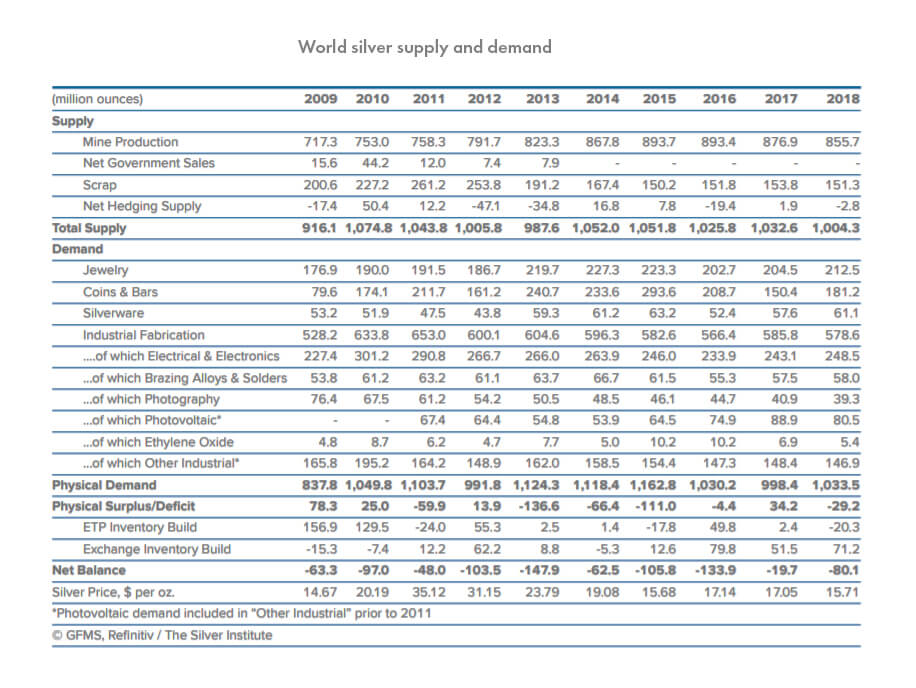

Precious metals prices rose in the first quarter of 2019 due to a pause in interest rate hikes by the US Federal Reserve and an increase in gold and silver demand. Silver prices have moved in line with gold, rising 6.9% in the first quarter. Silver’s heavy discount to gold has led investors to diversify their portfolios, with Indian investment demand rising. Jewellery demand and silverware fabrication also rose moderately. However, industrial demand for silver, which accounts for more than half of total demand, remains weak. Tariffs on solar imports to the United States led to reduced use of silver in solar panels in 2018, and this trend is expected to persist. The use of silver in photovoltaics is expected to decline as it is one of the most expensive components. Silver prices have remained broadly unchanged in 2019.

If we attempt to fence ourselves from the obvious speculations that follow any market research regardless of the purpose, methodology, and the professional credentials of the researcher, three main developments stand out. First, physical demand increased 4% in 2018, propelled by a modest rise in jewellery and silverware fabrication, and a jump in coin and bar demand. Indeed, investment in silver bars and coins grew by an impressive 20% last year, driven by a powerful demand sentiment in the ASEAN countries and India.

Second, Industrial fabrication lost 1% last year, which slightly reduced its market share from 59% to 56%. Following three consecutive years of increases, silver demand from the solar industry took a breather in 2018. That might sound counterintuitively considering the continued commitments from the various governments to increase solar as a part of their energy-generating portfolio. However, silver powder production fell due to continued thrifting and a glut of inventory that first needs to find its way through the system. The drop was countered by a rise of silver demand from the electronics and brazing alloys & solder sectors.

Third, for the third consecutive year, silver mine output fell, declining by 2% last year driven primarily by the lead/zinc sectors. Scrap contracted as well, driven by an 8% decline in the average silver price, with fewer consumers incentivised to return their old jewellery and silverware items, pushing total silver supply for 2018 down 3%. As a result, the physical market balance reached a minor deficit of approximately 3% of annual demand and therefore, give or take, within the boundaries of error considered as a more or less balanced market.

Platinum group metals (PMG)

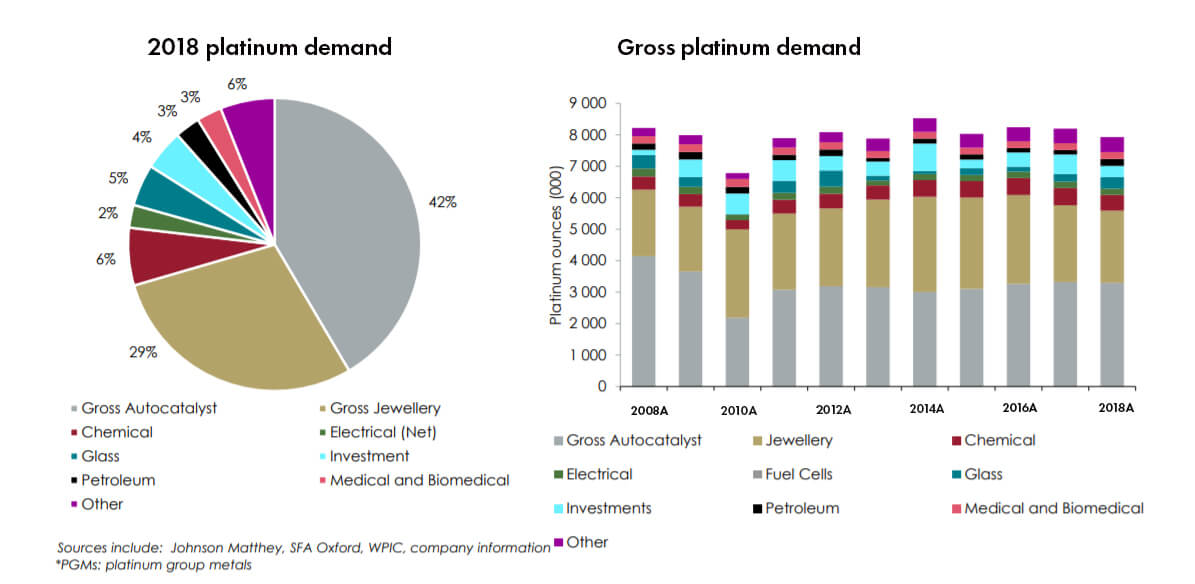

For decades, the platinum group metals have outshone all other elements in their unparalleled range of applications. That range continues to expand, burgeoning within the ‘traditional’ sectors of autocatalyst and jewellery, and to service new demand stimulated by a vast array of more modern industrial and scientific uses – from pacemakers to smartphones to fuel cells.

At the same time, the increased penetration of palladium jewellery throughout China in mid 2010s due to the introduction of the less expensive Pd990 product standard earlier (mid- to late 2000s), led to a strong rise in purchases of palladium metal by Chinese jewellery manufacturers.

The platinum market has been seen historically as a metal that had a ‘balanced’ source of demand from an industrial base – i.e. autocatalysts (considered relatively price-inelastic) on the one hand, and jewellery demand (more price-elastic) on the other. When measured by ounces sold, this has recently shifted more towards a demand picture that is dominated by autocatalyst demand (65% in 2017), while the versatility of PGMs continues to be underlined by a further 25% coming from a widening spectrum of other industrial applications (primarily high-end consumer electronics). At current prices, jewellery demand (mainly from Asia) is down to 30% of total offtake in the wake of the price rises seen during the current commodity cycle.

The jewellery equation is, however, a complex cocktail to interpret, as short-term trends in the dominant Chinese market are affected both by the levels of metal offtake by the manufacturing sector (where margins are eroded in periods of price volatility) and by the levels of offtake at the level of the final consumer. In addition, a different picture emerges when the Chinese jewellery market is measured in dollars sold – while volumes sold were down 13% to 875,000 ounces, the dollar value was down by a smaller 7%, or lower if purchases of recycled jewellery metal are considered.

Important Note

Please note that precious metals and related investments involve risks including loss of capital, illiquidity, default of a borrower and lack of returns. The risks involved will vary by project types, so please make sure you have read and understood the specific risks associated with the investment. Investments made on this website should only be made as part of a diversified investment portfolio. For more details, see the Key Risks. Projections or estimated returns are not a reliable indicator of actual future performance and eventual returns or dividends may be lower than predicted. Information presented on this website is for guidance purposes only and does not constitute financial advice. If you are unsure of the suitability of an investment, please contact your financial adviser for professional advice.

Smartlands Platform Ltd is an appointed representative (FRN: 841597) of Shojin Financial Services Limited which is authorised and regulated by the Financial Conduct Authority (FRN: 716765) (see www.fca.org.uk/register for more information). Investments described in this communication and or on websites operated by Smartlands Platform Ltd are not covered by the Financial Services Compensation Scheme. The investment opportunities listed on websites operated by Smartlands Platform Ltd are not offers to the public and can only be entered into by certain types of investors who have satisfied certain investment criteria.

This document has been approved as a financial promotion for the purposes of section 21 of the Financial Services and Markets Act 2000 by Shojin Financial Services Ltd.

© 2019 Smartlands Platform Ltd. All Rights Reserved.