Odesa, BIG-U & Smartlands

On the 25th of September, Smartlands issued a market announcement pertaining to the Regional Development Agency (RDA) of Odesa and BIG-U and how this opens up a significant opportunity for Smartlands with regard to utilizing the Smartlands platform for the funding of Small and Medium Enterprises (SMEs) in that region.

With this article, I intend to provide some background and colour to the agreement and explain why this is a major milestone for Smartlands.

Before I do that, however, it is important to offer a description of each of the agreement participants to see how they all fit together. Let’s start with the oblast (state) of Odesa.

Odesa

Odesa (previous spelling Odessa) refers to the entire oblast, which carries the same name as the principal city of the region. In its current form, the city dates back to 1795, although history shows there has been an important settlement in the region going back to at least the 6th century. The city of Odesa boasts Ukraine’s biggest port with a cargo throughput in excess of 50 mln tonnes pa and 9 km of berths for vessels of every classification and cargo. In addition to the port of Odesa, the oblast is home to a further 7 seaports. Excellent transport links serve the entire area with major motorways, rivers, including the Danube, a comprehensive rail network, and an international airport in addition to the 8 seaports.

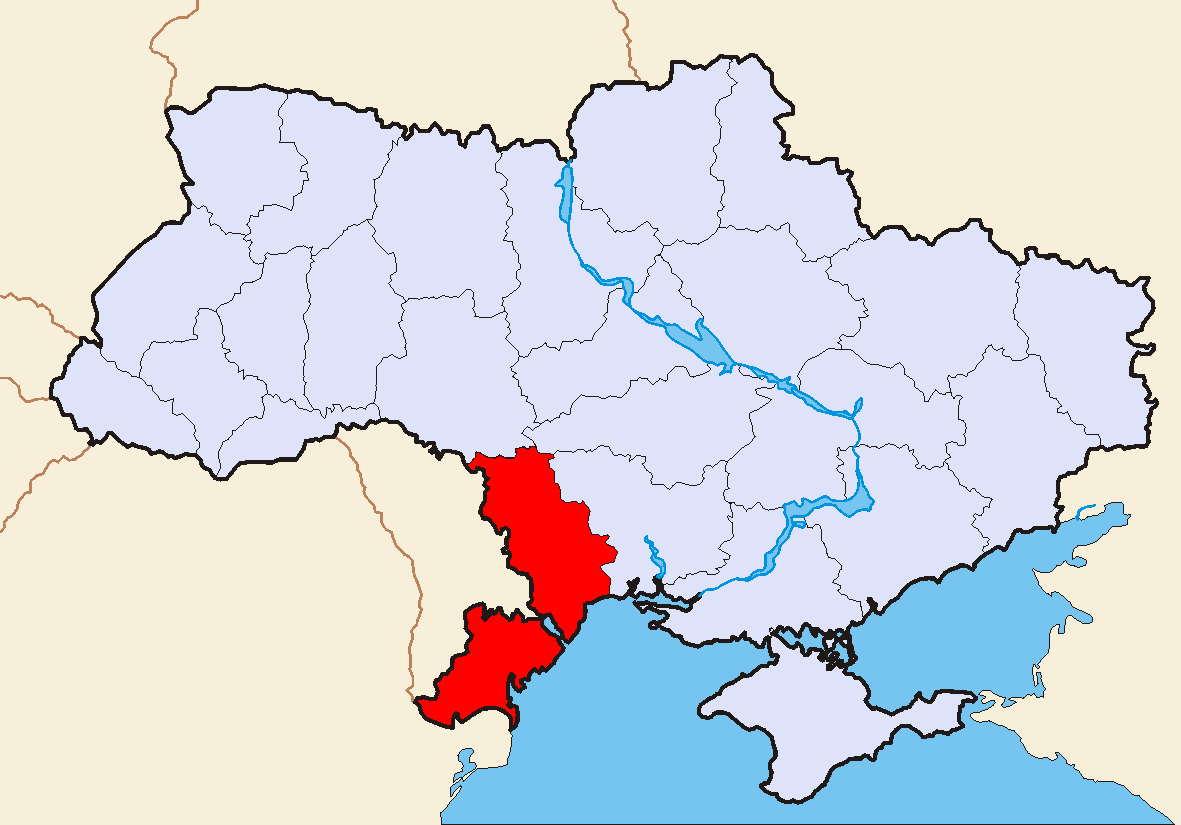

Odesa Oblast in red

Odesa oblast at 33,300 sq km is Ukraine’s biggest oblast by land area and is of a size that makes it larger than the entire country of Belgium. The latest figures from 2020 show a population of approximately 2.4 mln, which puts it at number 6 in the oblast population rankings for the whole country.

Odesa oblast has a strong and vibrant economy with manufacturing, consumer goods, food processing, vineyards, agriculture, transportation, all supporting the local economy in a major way. In recent years a booming tech sector has taken root in the oblast, with many internationally successful companies starting their life in the Odesa region. All of this, of course, is in addition to the excellent climate which supports a thriving and prosperous tourist economy.

All things considered, there are many advantages to SME owners who choose Odesa as the home for their business.

The Regional Development Agency (RDA) of Odesa

The RDA, as its name implies, is responsible for developing all aspects of the economy of the oblast of Odesa across all industry classifications. The RDA is part of the local government of Odesa Oblast, making all of its personnel state employees. It is worth noting that Ukraine’s governance model is similar to that of the USA, which the reader may be more familiar with. The federal government based in Kyiv is tasked with running the country at the national level. At the same time, the oblast governors and their regional teams are responsible for running each oblast at the local level. In recent years this has been made a lot easier with a larger percentage of locally collected taxes allowed to remain in each region and instead of being instantly remitted to the central government in Kyiv.

The RDA then is a key facilitator of business development and offers all the support it can to all sectors of the local economy based upon local knowledge and understanding of the specific requirements of that economy. It is also responsible for attracting new businesses to the region. For example, suppose a major American tech company wanted to set up a new office in Ukraine. In that case, it is the job of the RDA to sell the benefits of locating in Odesa to the American principals.

One key aspect of RDA work is supporting and nurturing SMEs and creating an environment where these small companies have an accelerated chance of becoming the local champions of tomorrow. Of course, given the broad remit of the RDA, SMEs have to tussle with more established businesses and, in the case of Odesa, tourism to find the support they need to grow and prosper.

Business Incubator Group – Ukraine (BIG-U)

The genesis of BIG-U lies with my Empire State Capital (ESC) Colleague, Alex Bart, who teamed up with Ukrainian social entrepreneur, Alexander Skavskyi, to found the organisation.

On a side note, it is worth noting that Mr. Slavskyi now heads up the State Property Fund for the regions of Odesa and Mykolaiv, where he is responsible for managing state assets and privatization.

After becoming one of the founding partners of ESC, back in 2014, Mr. Bart very quickly realised that Ukraine was not very well served with an SME incubator process, such as is common in Silicon Valley in California, for example, to help boost the success rate of new businesses and SMEs nationally. Taking inspiration from his US counterparts, Mr. Bart mapped out and created BIG-U as a Non-Governmental Organisation (NGO) operating on a clear non-profit basis whose aim was to apply best-in-class business incubation protocols to Ukraine’s SME and new business sector.

In Europe, for example, SMEs are usually defined by the following generally accepted classifications.

| Company category | Staff headcount | Turnover | or | Balance sheet total | |

| Medium-sized | < 250 | ≤ € 50 m | ≤ € 43 m | ||

| Small | < 50 | ≤ € 10 m | ≤ € 10 m | ||

| Micro | < 10 | ≤ € 2 m | ≤ € 2 m | ||

You will see from the above table that SMEs are not just start-ups and tiny companies working from a kitchen table but are, in many cases, established businesses with a growing employee roster returning great value to the local economy.

Across Ukraine, nationally, SMEs make up 98% of all enterprises by number (although not of course by size) and are a major source of employment and tax revenue both from payroll taxes and company taxes. They are also a dynamic and significant force in job creation, which is just as true in Odesa as elsewhere in Ukraine.

SMEs in Ukraine are often at a disadvantage when it comes to access to long-term financing for capital expenditure and certainly are often faced with even bigger problems in finding sources of working capital to support their day-to-day activities. In many cases, the money is there in investors’ accounts, but the mechanism for bringing the SMEs and investors together at the right time to create maximum value for both sides is sorely lacking.

A further issue is an access to impartial and well thought out business advice from business people who have overcome all the obstacles in their path and created their own successful companies. Again, these mentors are potentially available, but the method of bringing them together with SMEs was notable for its absence.

Sensing an opportunity to let loose his keenly developed sense of corporate responsibility and, it must be said, help create the SMEs of tomorrow who would go on to become potential clients of Empire State Capital, Mr. Bart put in place the founding structure of BIG-U and got to work turning it into the reality you see today.

Along the way, Empire State Capital was instrumental in assisting an important Odesa based local bank, in the form of Bank Vostock, to raise US$16 mln from the US government under their Overseas Private Investment Corporation (OPIC) program, which was lent to Bank Vostock for the purpose of lending onto the SME sector with OPIC guaranteeing 80% of the risk of the resultant SME portfolio. For clarity, it is worth pointing out that OPIC has since been renamed to the International Development Finance Corporation (IDFC).

In order to add an international element to the mentoring aspect of BIG-U’s company incubation approach, Mr. Bart forged a strong relationship with the US-based Financial Services Volunteer Corps, which is a US institution in which career business people and entrepreneurs who have achieved impressive corporate and entrepreneurial success agree to travel to foreign countries and offer mentoring, advice and consultancy to companies on a pro-bono basis with only their immediate expenses being covered by the FSVC.

The main aim of the FSVC is to promote economic development by strengthening the financial sectors of developing countries. In addition to promoting the development of capital markets and expanding access to finance and commercial banking, the FSVC believes that supporting SMEs, start-ups and their entrepreneurs is a key driver of job creation and inclusive economic growth, and it is this which will have the most immediate positive impact in the developing world.

The FSVC also assists financial institutions such as banks, investment firms, and securities companies in developing specialized products so that SMEs can grow their businesses. It implements consulting programs that cover a wide range of lending issues, including best practices for credit risk management, portfolio management and loan loss prevention, credit analysis, and loan underwriting, along with strategic planning.

From its inception in the 1990s, the FSVC has worked in 65 countries globally and has been particularly active in Eastern Europe and the nations of the former Soviet Union. Since 2011, the FSVC has supported Ukrainian commercial banks in providing critical loans to small and medium-sized businesses to stimulate economic growth through a partnership with World Business Capital (WBC) and a credit guarantee mechanism through US OPIC and, more recently, the IDFC.

BIG-U has been a partner of the FSVC since 2018 and shares absolutely the goals and aspirations of the FSVC charter. The work of BIG-U is based upon the same principles as FSVC, namely providing pro-bono specialist advice and mentoring in multiple fields, accessing financial resources, and building SMEs to drive economic growth.

Over the past four years, BIG-U has prepared more than 80 Ukrainian SMEs for inward investment and arranged more than 100 ongoing consultancy and mentoring programs from over 50 specialist experts.

It was BIG-U’s impressive track record of work with Odesa-based Bank Vostock, whose chairman sits on the BIG-U supervisory board and international reach with the FSVC that first brought BIG-U into contact with the Odesa RDA. Seeing the difference BIG-U was making in the SME sector in Odesa Oblast and the funding that had been made available through OPIC to Bank Vostock, the RDA came to an agreement with BIG-U whereby all SME development activities in the Odesa region would in future be handled under the BIG-U banner, and the established SME development programs already in place as these have shown consistent and beneficial results that have added immeasurable value to the economy of the Odesa region.

In 2020 Mr. Eugene Barsukov was appointed CEO of BIG-U, and it is his unrelenting efforts as a champion of Ukraine’s SME sector that has made BIG-U the force it is today. Mr. Barsukov was also the driving force of the agreement between BIG-U and the Odesa RDA.

So now you have the background to the main actors, the big question remains.

What does this mean for Smartlands?

It is important for the ongoing development of the Smartlands asset tokenization platform, as an attractive investment vehicle, that we are able to offer investors as wide a choice of opportunities as possible. In previous articles, we have covered in great detail the attraction of the Smartlands platform to real estate assets while also outlining our plans to include crowdfunding of SMEs with the addition of a market where those SMEs who have undergone ICOs have a quote where those offerings can be traded on the secondary market.

As mentioned in the description above, already more than 80 SMEs have been prepared for investment by the BIG-U program. These deals were, of course, put in place before Smartlands came of age; however, moving forward, SMEs who have successfully completed the entire BIG-U program and who thus meet our acceptance criteria based upon a wide range of metrics will have straight-through access to an ICO on the Smartlands platform. Not all BIG-U clients will be relevant, this is true, but a great majority of them will be. In some cases, we may go for a mixture of direct investment from long term private investors who bring specific value to a particular investment opportunity together with a Smartlands platform ICO, in other cases, it may be more appropriate for a corporate investor whose business interests align with the client’s to take the entire investment with no ICO, but the fact remains it is our intention to use Smartlands in as many cases as possible as it will give the client companies a wide grouping of early-stage investors. In other words, for the very first time, your average small investor will have the chance to participate in investment opportunities that have up until now been the stomping ground of the big end of town, such as Venture Capital investors and High Net Worth Individuals.

There is another major positive here as well. With BIG-U’s agreement with the Odesa RDA and BIG-U’s agreement with Smartlands all now in place, Smartlands, in effect, has inserted itself into the very fabric of SME development activities in the Odesa region at the local government level. Smartlands is not on the outside looking in; we are now on the inside looking out as a key part of local government efforts to develop SMEs. In other words, there is now a seamless link between all parties, with Smartlands being the commercialization partner for the entire process.

So far, we have focused on Odesa and BIG-U, and quite rightly so, but this is only a tiny part of a much bigger picture. The agreements set in place with this latest announcement are in effect a template for future co-operations, not just with other oblasts in Ukraine, but with SME development organisations in other countries altogether. By showing our ability, with BIG-U and Smartlands, to demonstrate value in SME development with absolute proof of concept, it is our belief that as and when other countries advance their digital asset laws to a level we deem operable that Smartlands will be able to use the experience and benefit gained in Odesa to negotiate multiple such agreements anywhere in the world. Indeed BIG-U / Smartlands are already in negotiation with one additional country to roll out the BIG-U program with the letter U replaced with the first letter of that new country. Again we will start off with one state and will then expand it nationally over time. This will have the effect of opening up even more ICOs to Smartlands with the attendant fees being paid for the ICOs and a resultant increase in the monthly fee distribution pool for qualifying SLT token holders.

On a final note, I feel it is appropriate to add a few words from my vantage point as the Managing Partner of Empire State Capital (ESC). ESC has supplied the Non-Executive Chairman of the Smartlands Group, while one of our founding partners, Alex Bart, was responsible for the creation and development of BIG-U. I see ESC as the glue that holds the partnership of BIG-U and Smartlands together; wherever BIG-U goes, Smartlands will go too, anywhere in the world, as the partners of ESC will make it so.

Conclusion

After reviewing the main actors in this story about Odesa and how they all fit together, I hope the reader will now understand the full implications of what this latest announcement means for Smartlands.

This is not just an Odesa-centric opportunity for Smartlands. It is not even just a Ukraine centric opportunity either, but the creation of a seamless, fully structured pathway leading to commercialization via ICOs of SMEs on the Smartlands platform that we can use as a template for proof of concept in almost any country in the world as DeFi and Digital Asset Legislation starts to become the norm on a global basis.

Earlier this month, we shared a photograph with you via our Telegram channel of the CEO of Smartlands, Ilia Obraztcov and I were having a discussion with a globe of planet Earth on the table in front of us. It was humorously labelled as “Martin and Ilia discussing the Smartlands plan for world domination.” After taking on board the content of this latest article, I hope the reader will now see that we were, in fact, not joking.

Martin Birch

Kyiv, September 2021

About the author, Martin serves as the Non-Executive Chairman of the Smartlands Group and is the Managing Partner of the Ukrainian investment bank, Empire State Capital.