Smartlands Platform Updates, New Features Ready for Roll-Out

It’s been a vertiginous but awesome ride from the announcement of the Smartlands beta to a fully functional and KYC/AML-compliant platform whose core functions are designed to transform the entire security token landscape. We’ve spent an enormous amount of time polishing up the existing features and adding new ones to address virtually every issue in the security token space. And we’re incredibly proud to announce that the fully functional Smartlands Platform will soon “open its doors” to the first registered users who will be able to touch and feel every shiny new button on the Platform and test its might against their investing needs and wants.

Fully Compliant Securities Trading Platform

In light of the SEC’s latest offensive, the Platform addresses regulatory concerns head-on providing investors with what any investor desires the most: continuous comfort and uncompromised security of doing business.

We at Smartlands Platform think that only full compliance with international regulatory requirements will make our business model sustainable and prosperous. It’s no longer enough to take investors through a generic KYC/AML verification process.

Since the Platform is prohibited from simply collecting cryptocurrencies from investors ICO-style, the actual token sales process prioritizes the safety of investor’s funds and ensures full legal compliance through the engagement of licensed custodians and licensed OTC exchanges. Those entities securely process funds, exchange cryptocurrencies to fiat, and accumulate fiat in an Escrow account to make a timely pay-out to an asset owner upon completion of a transaction.

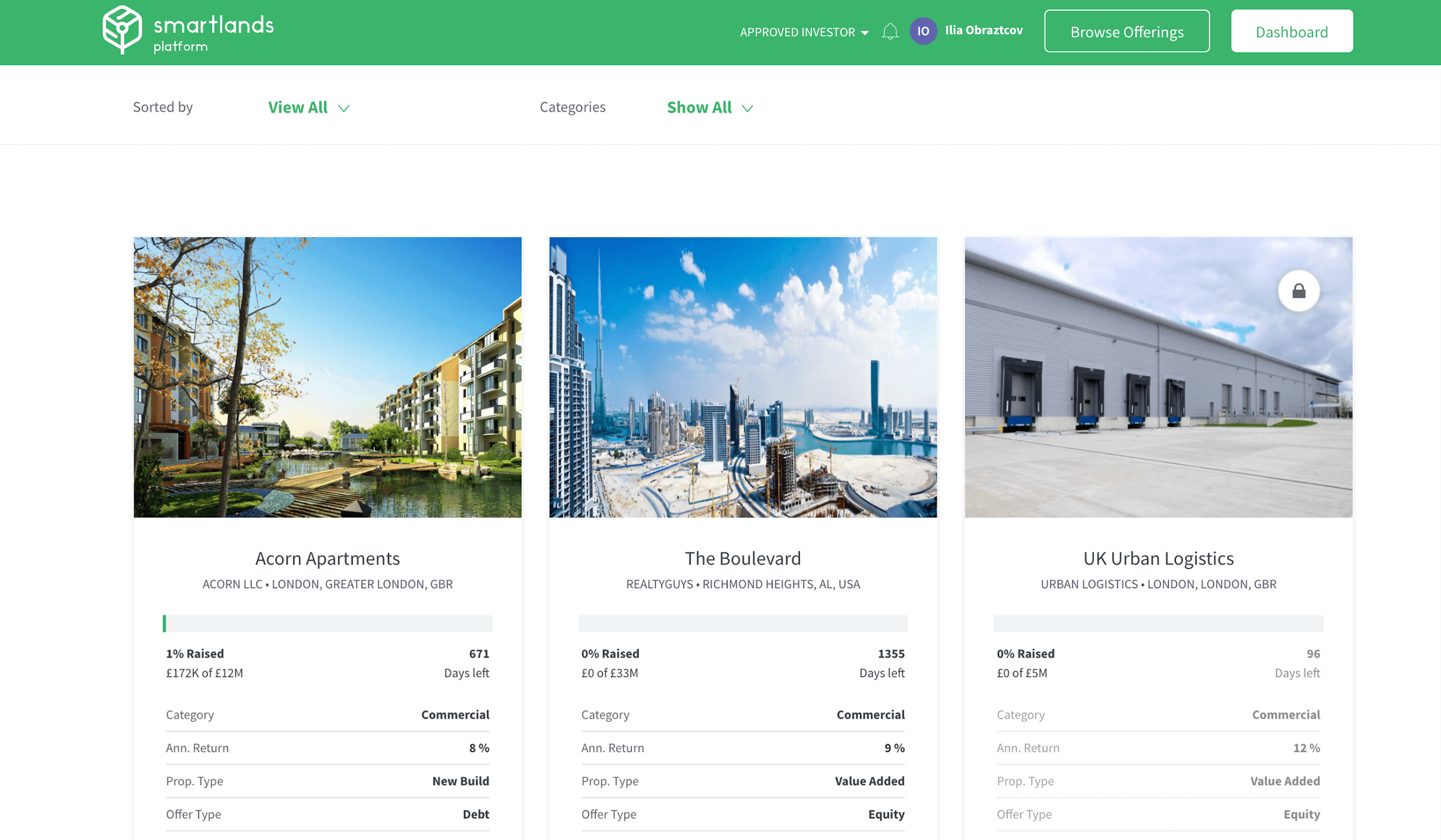

Marketplace

Marketplace interface is an integral part of the Smartlands Platform. It is an informational and business hub where asset owners, asset managers, and investors get together to exchange information, examine current offerings, make investment decisions, activate the tokenization process and create liquidity for their investment targets or manage existing portfolios.

Smartlands Platform combines the industry standard for crowdfunding with our vision for the future of security tokens into a rich, mobile-centric highly customizable UI with investor’s dashboard as a centerpiece. Here investors may select a preferred fiat currency for the future investments and portfolio management and receive all information necessary for making successful and lawful investments.

Document Management

Document management centre will store all the documents pertinent to securities offerings safely and conveniently.

Each security token will have an assigned manager and auditor authorized to upload the audited financial results to the depository and verify the financials of the offering.

Additionally, all audit data will be signed and registered on the Stellar Blockchain to maintain transparency and immutability.

Investor Accreditation Interface

Smartlands Platform invariably prioritizes a smooth and seamless experience for all users. Investor Accreditation Interface is a wizard-styled dashboard designed to guide users through the sophisticated investor verification/classification process in 10 minutes. Our proprietary state-of-the-art KYC/AML-accreditation algorithms will unmistakably verify your identity granting you full access to the marketplace of security offerings and the library of pertinent documents.

Verification/Categorization Interface

Verification/Categorization Interface is developed in strict accordance with the FCA guidelines. VCI is designed to grant global access to legitimate investment opportunities on the Smartlands Platform.

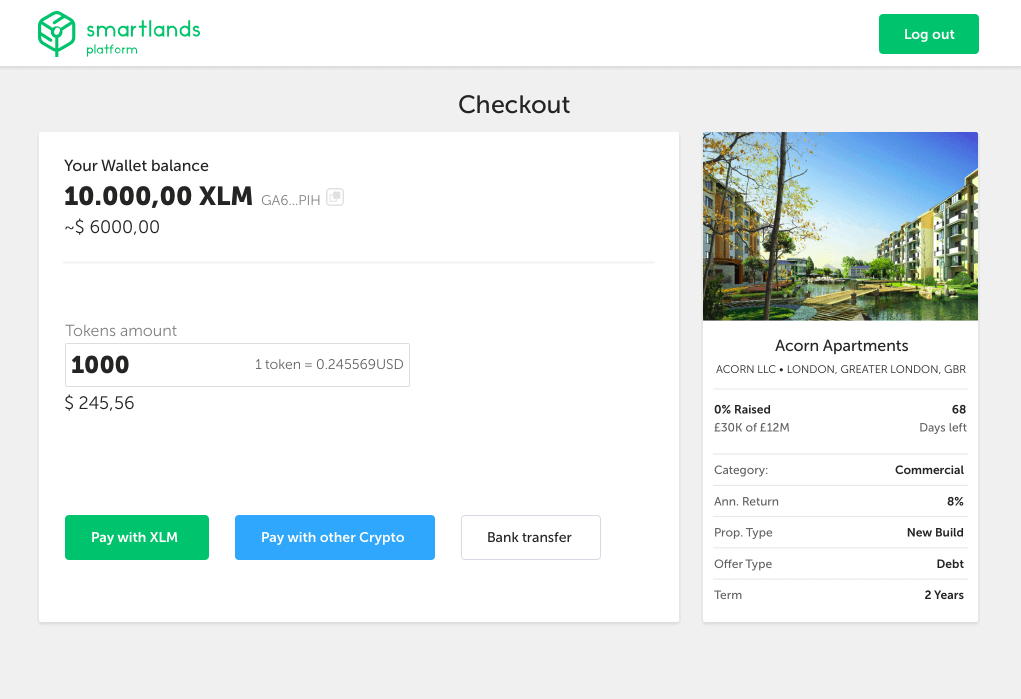

Payments Gateway

Accessibility of the securities market for non-institutional (retail) investors has always been a major issue for those ready and willing to invest online. Smartlands Platform makes a special effort to streamline the process for the community and make the entire sequence – from sign-up to check-out – as pleasant as possible.

Once an investor has selected a security offering in the Marketplace application and compliance rules are passed, several options to purchase are presented: XLM token for instant purchases, fiat bank transfer for institutions or fiat investors or investments in cryptocurrency.

The most important feature of the Smartlands Platform is that all pay-ins go directly to a licensed custodian account, who bears a legal obligation to store and safeguard users’ funds. The funds used for crypto purchases will be transferred through a licensed OTC exchange for instant exchange of the accumulated crypto to fiat.

IMPORTANT: the fiat value of the deposit in crypto will be fixed once the funds intended for investing are deposited into an escrow account turning even an unsuccessful attempt to purchase securities into an investment in a stablecoin (the system charges back the investor’s account with the same amount of fiat it withdrew at the same exchange rate).

Secondary Market

The Secondary Market is the place for investors to buy and sell security tokens from each other.

To maintain compliance with FCA regulations, it will operate as a bulletin board that enables investors to express an interest to sell or buy shares held under the Smartlands Platform Nominee Structure. The Secondary Market application is designed to match the mutual interests of the parties to a transaction and to guide both buyer and seller through the purchasing process.

Dividends Distribution

The timely and fair distribution of dividends and other payouts is a crucial feature of the Smartlands Platform. We also think it is extremely important to be able to distribute dividends in cryptocurrencies to minimize fees and equal the opportunities for investors of all walks of life – large and small, institutional and retail, regardless of the geography.

For distribution of the payouts, Smartlands will utilize a flexible structure of Nominee, Custodian, and OTC-Exchange to ensure the correct amount of the dividend payment less a fraction of a penny in transaction costs. Further, to make the process of dividend distribution even more straightforward, the Smartlands Platform is considering the implementation of fiat tethers.

Stellar Blockchain

The unparalleled flexibility of the Stellar Network allows for seamless cross-border on-chain trades in seconds. This tremendous technology will define the future of investment markets, but with great power comes great responsibility to protect investors from risky operations particularly by maintaining daily/monthly limits for the number of transactions.

Based on the Stellar Smart Contract mechanics, Smartlands Platform established a special “regulated” segment of the Stellar Network where it’s possible to issue and trade securities.

Our cutting-edge technologies ensure that in the regulated segment only fully compliant transactions are allowed — no more scams, wash-trading, pump-and-dump activities. The Smartlands’ proprietary AI-based Compliance Engine is a ready-made solution for monitoring the Platform and approving tens of thousands of operations per second, covering the entire volume of transactions that the Stellar Blockchain is capable of processing in a given period.

What does it mean for investors? The law-abiding investors who are not under international sanctions and are cleared for investing on the Platform through the KYC/AML process are welcome to start trading securities: we will instantly transfer your Stellar wallet into a regulated environment.

For those investors who already happen to hold unregulated tokens, we have implemented a unique mechanism allowing you to have multiple wallets associated with one private key (or a Ledger Nano S device). Now you can conveniently have a wallet for trading on the unregulated Stellar Decentralized Exchange (SDEX) and at the same time be able to login into the regulated environment with the same private key.