Smartlands Tokenises Disruptive Fund, Invests in Mid-Stage Fintech Startups

Being first and foremost a tech company, Smartlands is out to build a global tech ecosystem. For years, we’ve been in touch with serial entrepreneurs, tech investors, legal specialists, academics, management consultants and technologists who bring innovative new services to the global marketplace. So it should come as no surprise that the next tokenisation project on Smartlands is going to be the Disruptive Fund that invests in mid-stage technology startups.

The fund plans to acquire minority stakes (up to 20%) in companies involved in the target industries, who are on a particular stage of development, and are showing proovable growth potential. With respect to the after-IPO average disruptor’s return of 35% (CAGR) or 350% in total over five years, conservatively, the Fund aims is to achieve 25-30% rate of return on the fund level.

The investee company must be at a stage where it has a commercially viable product, established a client database, and performed first sales. The company’s product or service must address a real need through a uniquely disruptive technology or innovation. Investments will be made to help the company grow faster or launch their product/service globally.

Investing in start-up and scale-up companies is highly risky. Please familiarise yourselves with the associated risks here.

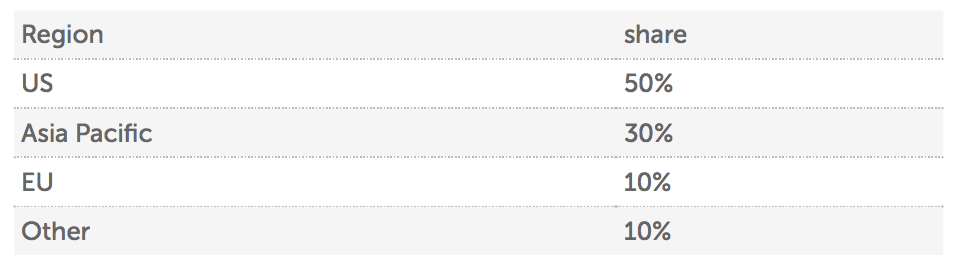

Expected breakdown of investments by region.

The investment strategy for the Disruptive Fund

Fintech

Investors’ appetite for fintech is clear: global fintech funding rose to $111.8B* in 2018, up 120 per cent from $50.8B in 2017, according to KPMG International. This tendency led to rapid expansion in new working styles as collaborative hubs and co-working spaces appear all over the world, new investment strategies using brand new instruments are conceived daily, crowdfunding is winning over more and more investors and asset owners. And above it all, we observe the towering might of Asset Tokenisation as the pathway for fractional ownership of properties in multiple asset classes for all citizens of the world.

The agility of fintech startups, together with their ability to innovate quickly and independently of the global tech institutions and financial markets makes them an ideal target for investment.

Financial technology substitutes thousands of employees that perform mechanical tasks with little to no added value. It also targets multiple intermediaries whose only input is charging fees. Our focus will be on the blockchain technology (DLT), payment processors and crowdfunding platforms, which are designed to unlock potential for innovators to grow and generate revenue.

Disruptive agritech

With Earth’s population reaching 10 bln by 2050, agriculture needs the introduction of disruptive technologies like no other segment of the real economy. To face challenges of decreasing incomes combined with changes in diet due to scarcities, pollution, and climate change, the Fund will invest in companies that have proven technology to radically change the game in all segments of agriculture. Specifically, the Fund is focusing on cultured/substitute meat producers, precise farming, agritech technology providers, and vertical farming.

Robotics and Drones

Manufacturing, Healthcare, Agriculture, Construction, Surveying/Infrastructure Inspections are known to employ advanced robotics and drone technology actively. New horizons are discovered every day in machine learning and AI, which effectively substitute humans in a number of capacities. We no longer have to operate in hazardous environments or work our fingers to the bone doing mechanical labour.

IoT, Big Data and AI

The most reliable way to unlock value in business in the data-driven age of IoT and AI is to create an ecosystem of automation, in which sensor data from multiple sources are instantly uploaded to a cloud and used for the continuous enhancement of AI algorithms while providing useful, actionable information. Once all elements of the ecosystem are in place and synced, the new processes, products, and services will be happening within the constantly self-improving business environment, in which the Fund plans on having significant presence.

The growth potential for the Disruptive Fund that employs this strategy is tremendous. The industries affected by new and wonderful technologies the Fund targets will provide abundant opportunities for creating new markets or penetrating the existing ones with disruptive innovations, new products, and much-needed services.

Important Note

Please note that property and related investments involve risks including loss of capital, illiquidity, default of a borrower and lack of returns. The risks involved will vary by project types, so please make sure you have read and understood the specific risks associated with the investment. Investments made on this website should only be made as part of a diversified investment portfolio. For more details, see the Key Risks. Projections or estimated returns are not a reliable indicator of actual future performance and eventual returns or dividends may be lower than predicted. Information presented on this website is for guidance purposes only and does not constitute financial advice. If you are unsure of the suitability of an investment, please contact your financial adviser for professional advice.

Smartlands Platform Ltd is an appointed representative (FRN: 841597) of Shojin Financial Services Limited which is authorised and regulated by the Financial Conduct Authority (FRN: 716765) (see www.fca.org.uk/register for more information). Investments described in this communication and or on websites operated by Smartlands Platform Ltd are not covered by the Financial Services Compensation Scheme. The investment opportunities listed on websites operated by Smartlands Platform Ltd are not offers to the public and can only be entered into by certain types of investors who have satisfied certain investment criteria.

This document has been approved as a financial promotion for the purposes of section 21 of the Financial Services and Markets Act 2000 by Shojin Financial Services Ltd.

© 2019 Smartlands Platform Ltd. All Rights Reserved.