A Stellar Performance

We are focused on creating equitable access to the financial system by building a global network that delivers services to users regardless of their geography,” – Denelle Dixon, CEO, Stellar Development Foundation.

The team at Smartlands has seen substantial progress in the development of the Stellar network during 2020. As a result, Smartlands has decided to confirm its commitment to running on the Stellar network as the primary ecosystem for all initiatives and business development plans we currently have under development.

With this article, we set out some background to this decision and the benefits we see accruing to the Smartlands community on Stellar. But first, some recent history on key Stellar development milestones.

USDC on Stellar

It was announced in October of 2020 that the USDC, the US Dollar based stablecoin developed by the Centre Consortium, itself a collaboration between Circle Internet Financial and Coinbase, will be adopting Stellar as the third blockchain that supports USDC transactions. As a stablecoin, the USDC tracks the US Dollar on a one to one basis. Each USDC issued is backed 100% by fiat currency kept in “old-world” bank accounts, with the accounts regularly audited by independent third-party auditors to ensure the correlation remains constant. The USDC is thus fully redeemable for the underlying fiat currency at par.

The USDC was originally launched on Ethereum, expanding later to Algorand, and the Centre Consortium has committed itself to offering developers a multi-chain swap service free of charge, such as enabling swaps from USDC_eth to USDC_Stellar.

This is a significant development for Stellar as, at the time of writing, there are 2.8 billion USDC in circulation, which would indicate that with USDC alone, there will be a substantial increase in activity on Stellar as the USDC becomes a low cost and efficient method of settling transactions. It is expected that the USDC on Stellar will become available during February of 2021. USDC_Stellar will thus become a key driver of Stellar’s stated goal to create equitable access to the financial system for all by building a global network that delivers services to users regardless of their geography.

As the Stellar network said at the time of the USDC announcement:

“The addition of USDC to Stellar will allow us to continue to expand our global reach in pursuit of this mission while opening up new avenues for growth and innovation for the developers and businesses building on the network.”

At Smartlands, we have several initiatives underway, including our joint venture with the agricultural trading platform Agroxy. Here, more than 15,000 farmers use the Agroxy system to sell their grains and buy seeds and fertilizers, and they will now be able to settle their transactions in USDC in addition to the Smartlands Token (SLT). As many of Agroxy’s users are situated in East Africa where banking is under-developed and expensive, Stellar’s commitment to providing low-cost access to the financial system where ever in the world the trading parties are located will reduce costs and increase efficiency for the Agroxy client base creating immediate value for both sides of each transaction.

Bankhaus von der Heydt and EURB on Stellar

Bankhaus von der Heydt (BVDH) is not a name that immediately springs to mind when one thinks of banking in 21st Century Germany. The reader should be aware though of the history of BVDH and why this historic German bank has become one of the first in the crypto market to issue its own stablecoin known as EURB and the first financial institution to do so on the Stellar Network.

BVDH can trace its roots back to 1754 when the von der Heydt family ran a successful cloth, linen, and silk trading business in Elberfeld situated in the Wupper Valley; using this as a foundation, they developed a banking institution to handle the financial transactions of the business. The business’s management became so proficient at the financial aspects of their trade that banking became their primary vocation, eventually replacing the trade in cloth and linen. The bank was thus well placed to be a financier of major 19th-century industrial projects in coal, steel, railway construction, and in the textile manufacturing industry, acting as a lender, an equity partner, and as an issuer when a public listing was undertaken. In 1835, for example, one of the first securities issued in Germany was managed by BVDH to finance the Prussian railway network’s expansion.

Bankhaus von der Heydt-Kersten & Sonne, Elberfeld Main office in 1880

Today the von der Heydt group consists of three main pillars being Bankhaus von der Heydt in Munich, a fund management company in Luxembourg, Von der Heydt Invest SA, and a securitization platform von der Heydt Securitisation SA.

It can be seen that BVDH has a history of supporting the development of new technology and its application to the economic landscape. Just as the development of railways and industry brought substantial benefits to all in the 19th century, so Fintech and blockchain-related developments have the potential to bring increased prosperity to a global audience today.

It is no surprise then that 266 years on from its founding, the von der Heydt name is again to be seen embracing new technology for the benefit of its clients with the announcement that BVDH has joined forces with Bitbond, Germany’s leading tokenization and digital asset custody technology provider to create the Euro stablecoin EURB on Stellar. The driving force behind this announcement was a desire to make the securitization platform, von der Heydt Securitisation SA, more efficient by applying distributed ledger technology (DLT) to the business. The Stellar Development Foundation facilitated the creation of EURB and worked closely with BVDH and Bitbond to ensure its successful technical integration.

EURB can be utilized by BVDH’s customers and third-party developers of financial applications to settle digital asset transfers on-chain. With the asset now live on Stellar, Bitbond will integrate it into the platform it built for BVDH to use the stablecoin for securitization, including mechanisms for burning and minting the token. For the Stellar ecosystem, this adds a new access opportunity for the Euro currency on the network. Any user or business looking to connect to EUR through Stellar rails can now do so.

It goes without saying that the EURB gives the von der Heydt group a real advantage over its slower brethren in the German banking market. Given that the necessary infrastructure is now in place through both Bitbond and the Stellar network itself, it can be expected that further Euro related stablecoins will appear on the Stellar network as it can be taken for granted that other European financial institutions will want to embrace the advantages that the Stellar network offers.

Smartlands on Stellar

The technical team at Smartlands, led by our CEO, Ilia Obraztcov, has long been at the cutting edge of implementing projects on the Stellar network. Smartlands was the first in the world to issue equity tokens on the public blockchain that were then sold to retail investors. The project in question was a fully let student accommodation block in Nottingham (UK) back in 2019. In other words, the Smartlands technology is “battle-proven” and shown to work extremely efficiently; it is this that was behind the decision of Agroxy to join with Smartlands and run their own system utilizing the Smartlands IP on the Stellar network.

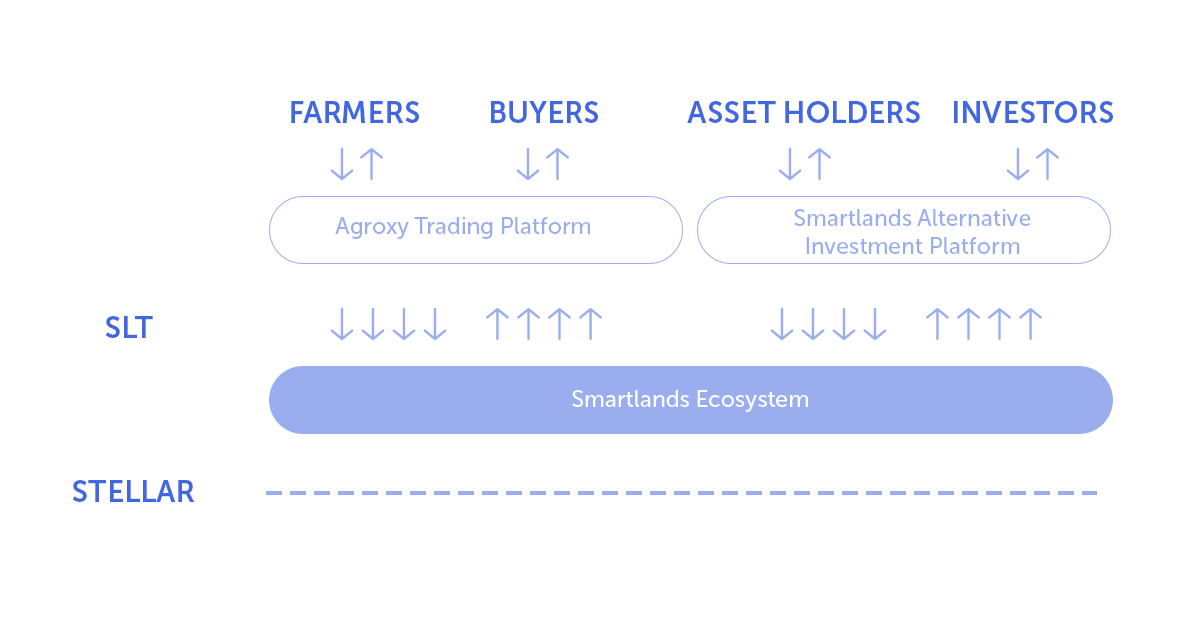

A simple schematic of the Smartlands ecosystem

Smartlands is currently in advanced negotiations with major real estate owners, including a consortium based in Germany that owns more than 1,000 residential apartments, with a view to tokenizing the assets and issuing tokens on the Smartlands network, which will then be quoted in a secondary market on the Smartlands bulletin board. A key consideration for the asset owners is the settlement medium that will apply to transactions, so the creation of USDC and EURB on Stellar is seen as a very positive development by the Smartlands team as it will enable European investors to acquire tokens using Euro and US Dollar stablecoins thus eliminating any investor concerns over exchange rate risk. Transaction fees for each trade in these assets will be payable in the Smartlands Token (SLT), which will also have the effect of increasing demand for the SLT.

Stellar has also made substantial progress in protocol development towards the support of regulated assets and interoperability. Although not all the changes are yet deployed to mainnet, we have an assurance from Stellar Development Foundation that regulated assets are a priority and all the protocol-level features necessary to meet the legislation requirements will be delivered.

At Smartlands, we have been asked by many interested parties how the SLT will be used on the Stellar network since it was our initial plan to develop our own blockchain infrastructure onto which we would apply inflation and fee distribution to qualifying holders of the SLT.

With Smartlands now committed to Stellar and in the process of developing joint ventures, such as the Agroxy JV, that will generate SLT fee income as transaction costs on the platform; we will have the basis to form a fee pool.

It is envisaged that 2/3 of the pool will form operational revenue for the token compliance operator, and the remaining 1/3 will be distributed as an inflation reward to individual SLT holders who hold a minimum qualifying amount of SLT on the Stellar network and indeed on all other networks including the Smartlands network.

Conclusion

Under the watchful eye of the non-profit Stellar Development Foundation, the Stellar network has made a number of very positive steps during 2020, especially concerning the EURB and USDC and a commitment to protocol development in support of regulated assets. We see these developments along with other subsidiary news on multiple stablecoin offerings on Stellar supporting the national currencies of countries as diverse as Nigeria, Brazil, and Argentina being a major positive which will help further elevate the use of Stellar as a major ecosystem as we move into 2021.

Readers who require more background input on how the Smartlands team is developing value on the Stellar network may find the following two articles of interest.

A historical introduction to Crypto the Smartlands way

Farming in a blockchain-enabled world

Martin Birch

Kyiv December 2020

About the Author, Martin serves as the Non-Executive Chairman of the Smartlands Group and is the Managing Partner of Ukrainian investment bank Empire State Capital Partners.