Smartlands Collaborated with Queen Mary University of London to Scrutinise Current Investment Market

Earlier this year Smartlands declared that the company focuses on the development of B2B products. In the first place, Smartlands is to release SaaS service for a wide range of businesses such as small enterprises with little or no experience in investment and crowdfunding and companies looking for new optimisation tools to better operational processes and mitigate costs considerably. Owing to the unprecedented COVID-19 situation and the worldwide economic downturn Smartlands took up a project together with the students from Queen Mary University of London (further: QConsult Team). The key goal of the project was to identify the impact of COVID-19 on the investment market and to define further geographical and marketing efforts we should focus on.

Particularly, the project was wrapped up around the following objectives:

- Identify the influence of COVID-19 and lockdown on the investment market and make predictions for the next 1-2 years

- Determine geographies of Smartlands’ potential clients

- Define the optimal marketing channels and materials to reach the aforementioned businesses

In their research, QConsult Team referred to a variety of large-scale surveys conducted by organisations such as PWC and EY which looked at both business and consumer sentiment through their strong connections. The team also used a wide array of articles on the B2B and FinTech space to gain statistics and data on both industries.

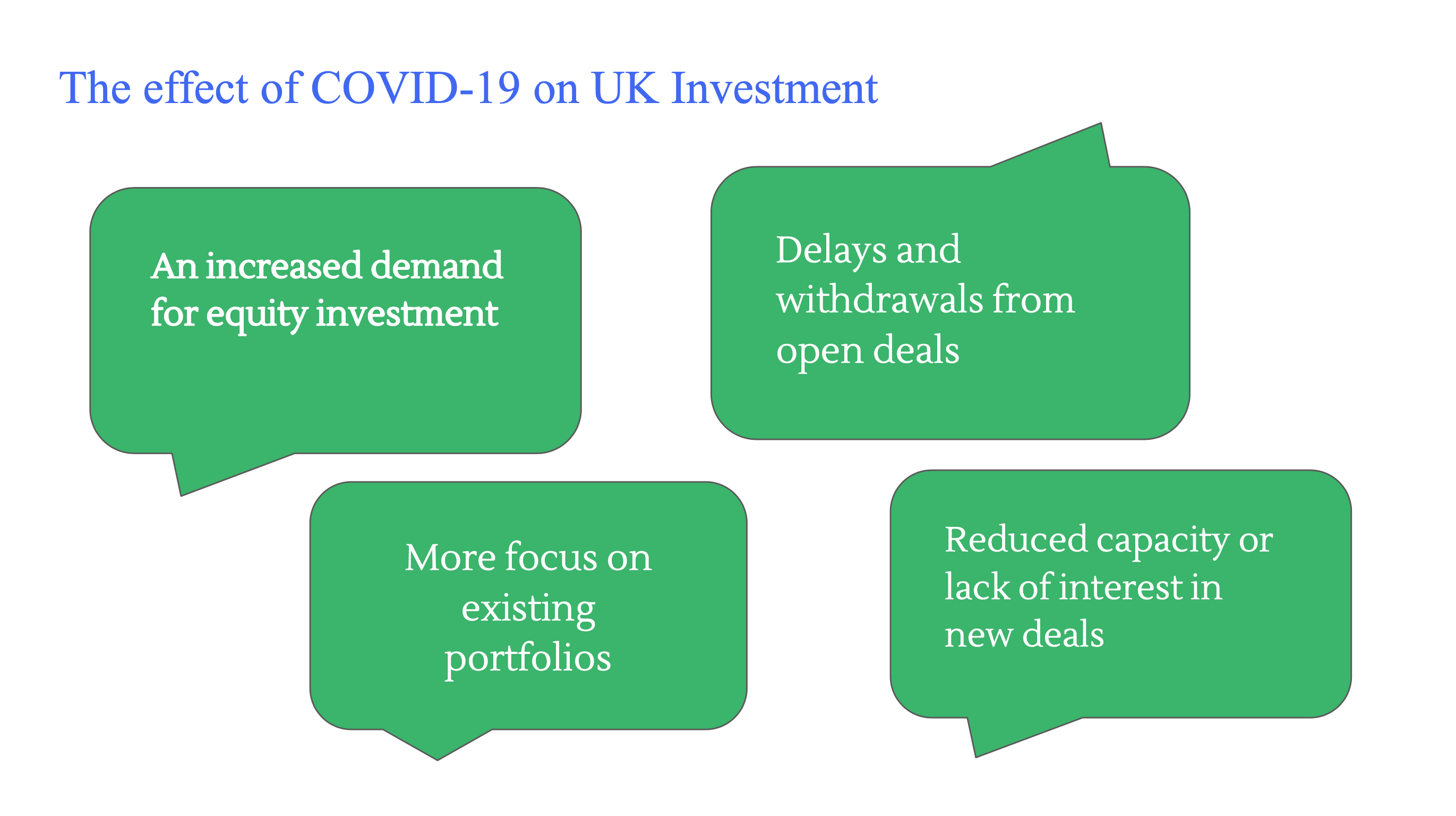

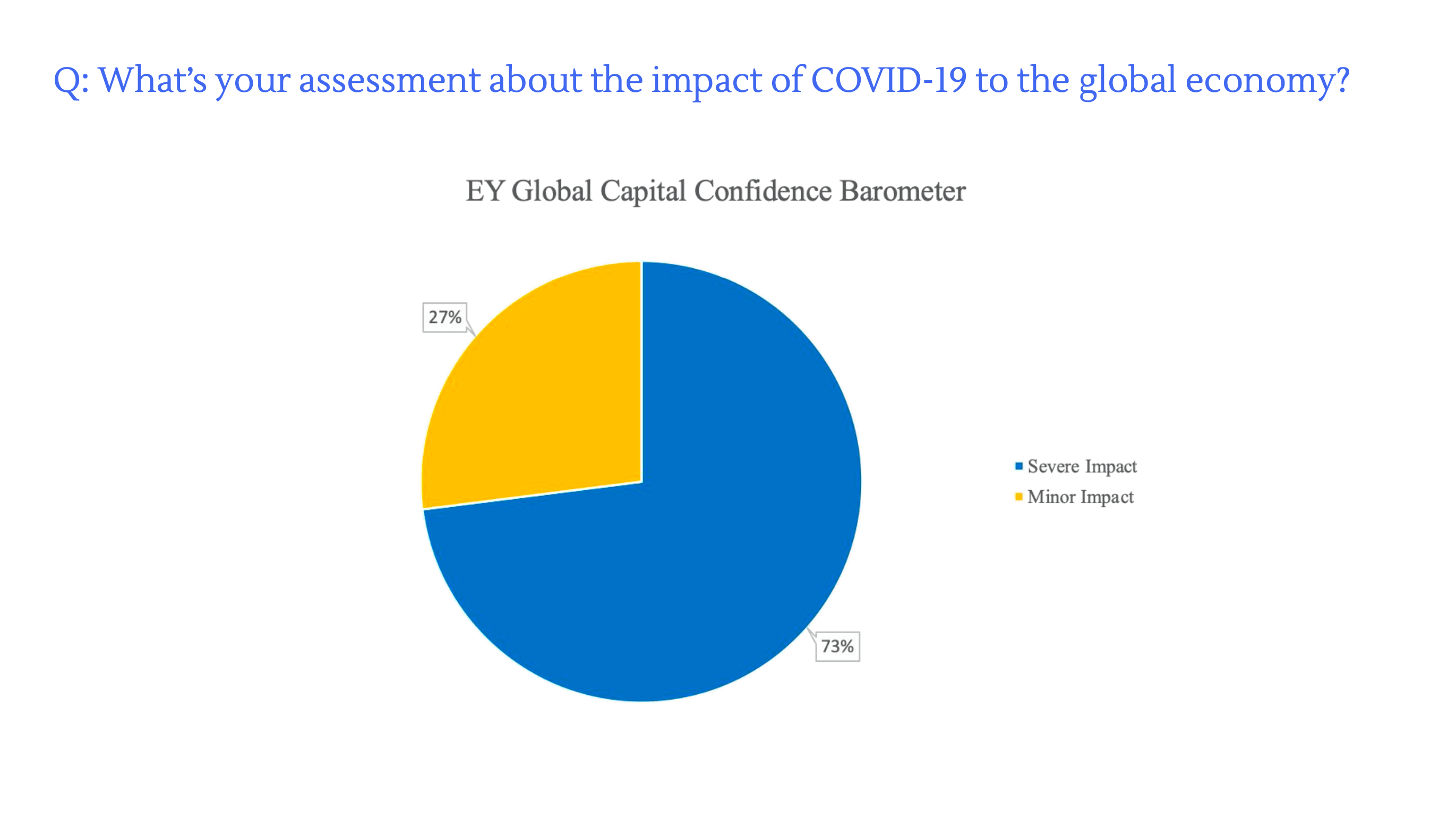

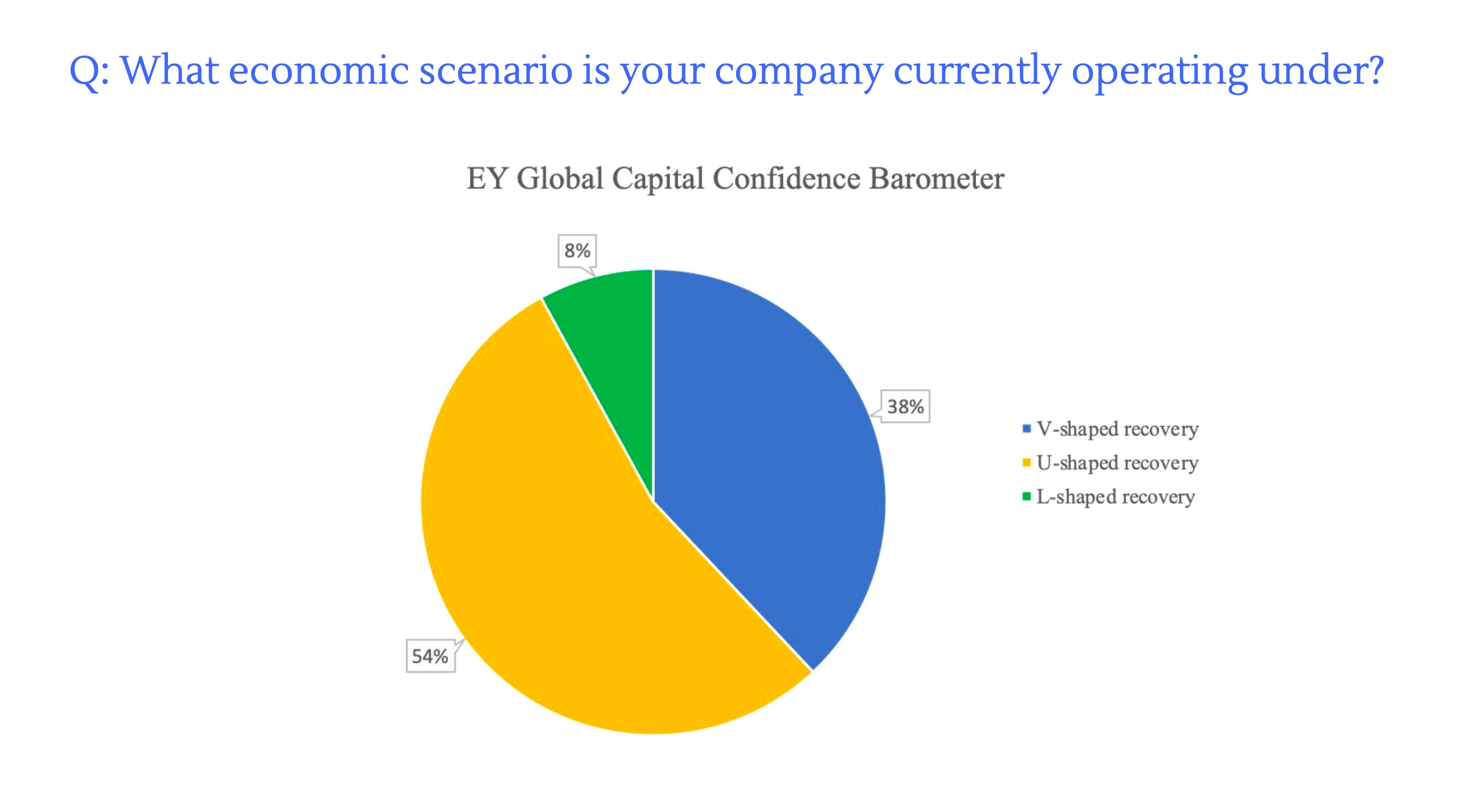

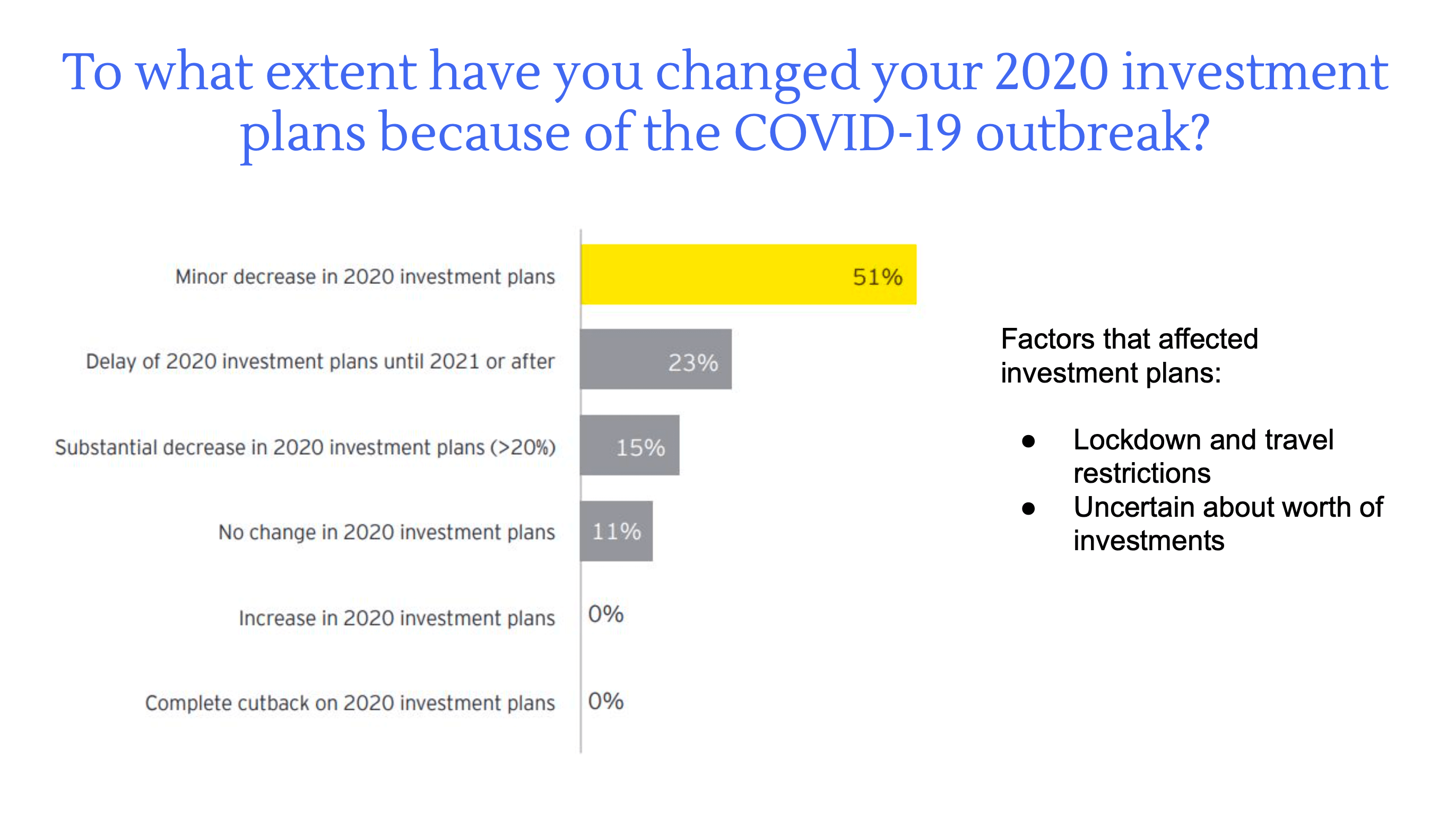

The COVID-19 crisis brings a lot of pain to investors that translates into low investment activity, low valuations and more cautious approach to early stage companies. Such a situation pushes young companies to seek all possible ways to raise funds to finance their operations and development. With this in mind, QConsult Team suggested that Smartlands would want to spend more time on educating clients about the SaaS services if these have to be integrated into a company. At the same time, the results of the Capital Confidence Barometer survey carried out by EY indicated that many global companies continue to plan major transaction programmes and more than half (54%) of executives globally are opting to transform through transactions and plan an acquisition in the next 12 months. When asked about the current economic scenario companies are currently operating under, more than half of respondents expect a U-shaped recovery, with the aftereffects of the initial impact lingering for longer, whereas activity would not reach normal levels until 2021. Additionally, most European leaders believe that COVID-19 has sped up the process of technology adoption, sustainable practices and supply chain reorganization.

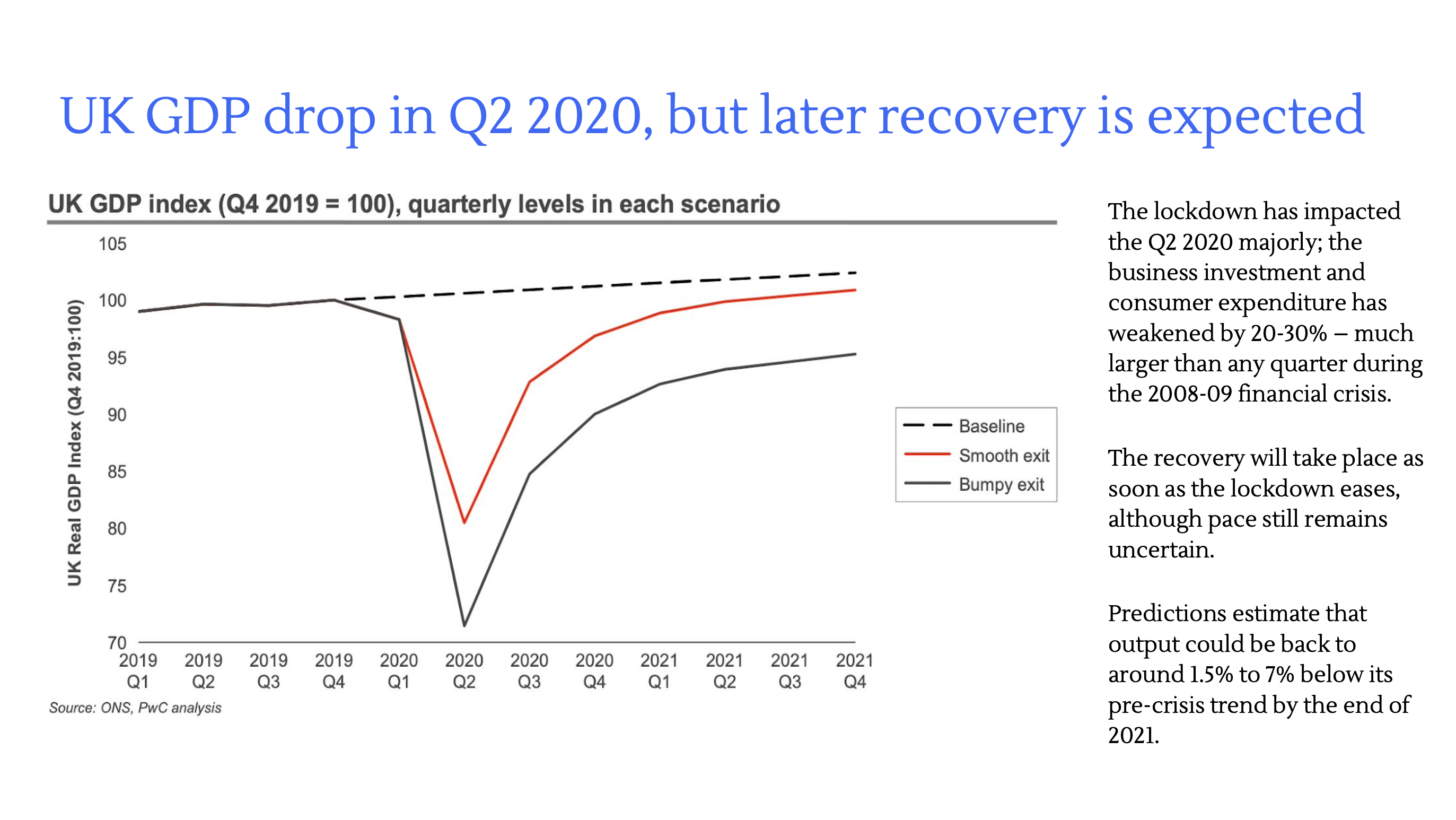

On the contrary, the lockdown in the UK has influenced the Q2 2020 significantly, the business investment and consumer expenditure having weakened by 20-30%. According to ONS, the monthly decline in GDP in April 2020 is three times greater than the fall experienced during the 2008 to 2009 economic downturn where the GDP contracted 6.9% across 13 months. The pace of recovery still remains uncertain.

Having taken a thorough look at Smartlands’ potential clients in the UK where our awareness is the greatest, QConsult Team counsel us to offer the White Label service to global start-ups which are still in need of funding to continue operating and are now more willing to adopt newer tech solutions.

What was discovered further is South America as a highly lucrative place to launch Smartlands’ SaaS services. Even though the political instability and poor financial system in the region usually drive away investors and businesses, QConsult sees opportunity in filling a gap within the market that presently has no major competitors. The recommendation is for Smartlands to align itself with struggling companies that need a new solution to raise finance and rise above these difficult times.

Taking into consideration Smartlands already has a strong presence on social media, QConsult team views Youtube as a top platform to concentrate our efforts on, it being the second biggest social media platform after Facebook and entertaining 2 billion users monthly. Further, it was advised that Smartlands reaches the B2B segment through content marketing and drives traffic to the website with display and bumper ads.

Ultimately, the research conducted shows that COVID-19 has a major hindering impact on the investment market but it hasn’t generated complete cutbacks. Through the research the team established the key markets with high demand for the white-label B2B products, namely the Smartlands Investors Marketplace, would be start-ups, SMEs and established businesses looking for new, efficient solutions for financing. The regions to be highlighted are those of Europe and South America as core markets that have suitable regulations and a corresponding demand.

Below we present some extracts from the presentation made by QConsult Team.

Slide 1

Slide 2

Slide 3

Slide 4

Slide 5

Slide 6

Slide 7